This is a continuation of Friday’s post about using apartment rent-and-chore-tracking app HomeSlice to attract younger customers. The app is a classic Trojan Horse tactic, though not a nefarious one. The thing is, once you get customers digitally locked-in to your platform, they may never leave. And while this works on any age group, the younger set is more attractive in many ways, because they are not already set in their financial ways, and they have massive revenue potential if you are able to hold onto them through the next few decades.

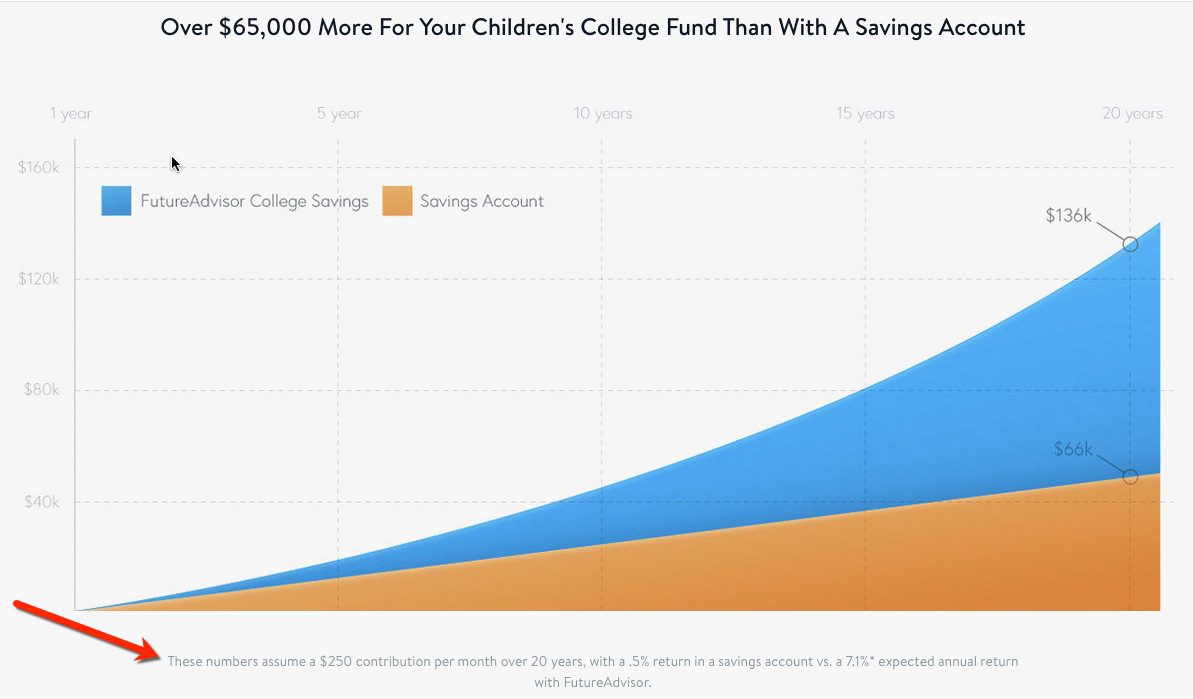

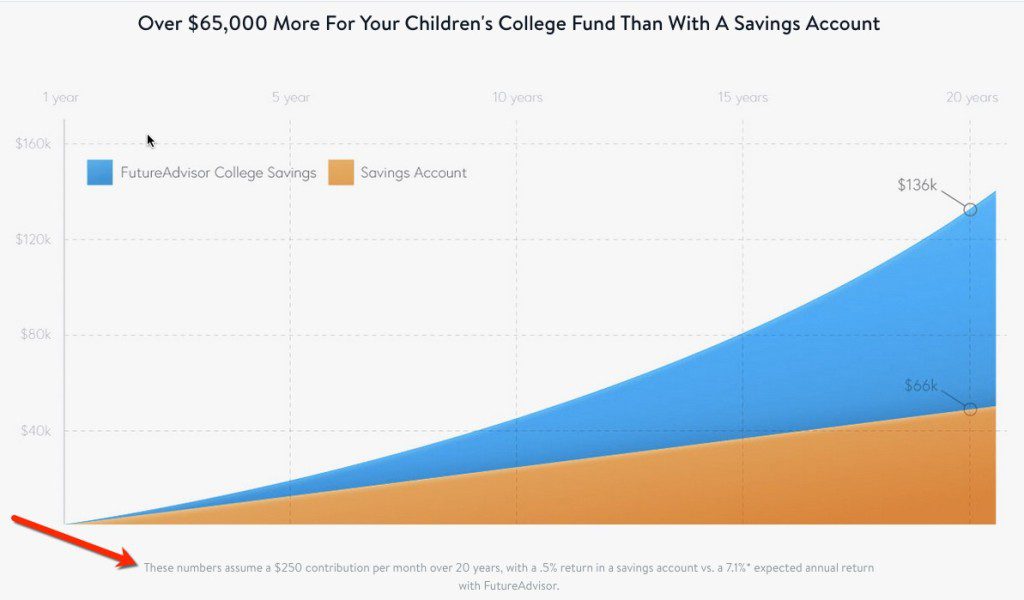

Today, automated investment management platform, aka a robo-adviser, FutureAdvisor launched its own youth play, but targeted it to the parents of the kids it hopes to serve for the next 70 years. The service, dubbed FutureAdvisor College Savings, aims to get funds earmarked for college into its managed savings plan. The startup is forgoing its usual 0.5% wrap fee and is offering the account at zero cost. An impressive graph (inset) charts the savings growth in its plan (optimistically predicted at a 7.1% annual return) vs. a bank savings account (pessimistically pegged at 0.5%) over 2o years. Even though the spread is likely to be less dramatic than the indicated 6.6%, the benefits are large.

Today, automated investment management platform, aka a robo-adviser, FutureAdvisor launched its own youth play, but targeted it to the parents of the kids it hopes to serve for the next 70 years. The service, dubbed FutureAdvisor College Savings, aims to get funds earmarked for college into its managed savings plan. The startup is forgoing its usual 0.5% wrap fee and is offering the account at zero cost. An impressive graph (inset) charts the savings growth in its plan (optimistically predicted at a 7.1% annual return) vs. a bank savings account (pessimistically pegged at 0.5%) over 2o years. Even though the spread is likely to be less dramatic than the indicated 6.6%, the benefits are large.

Bottom line: For most financial institutions, the parents are probably the easier path to landing the under-21 crowd. So financial services companies should consider similar offerings whether it be student-loan management, regular savings accounts, starter credit, apartment loans, first-car loans, and so on (for more ideas, see previous posts).