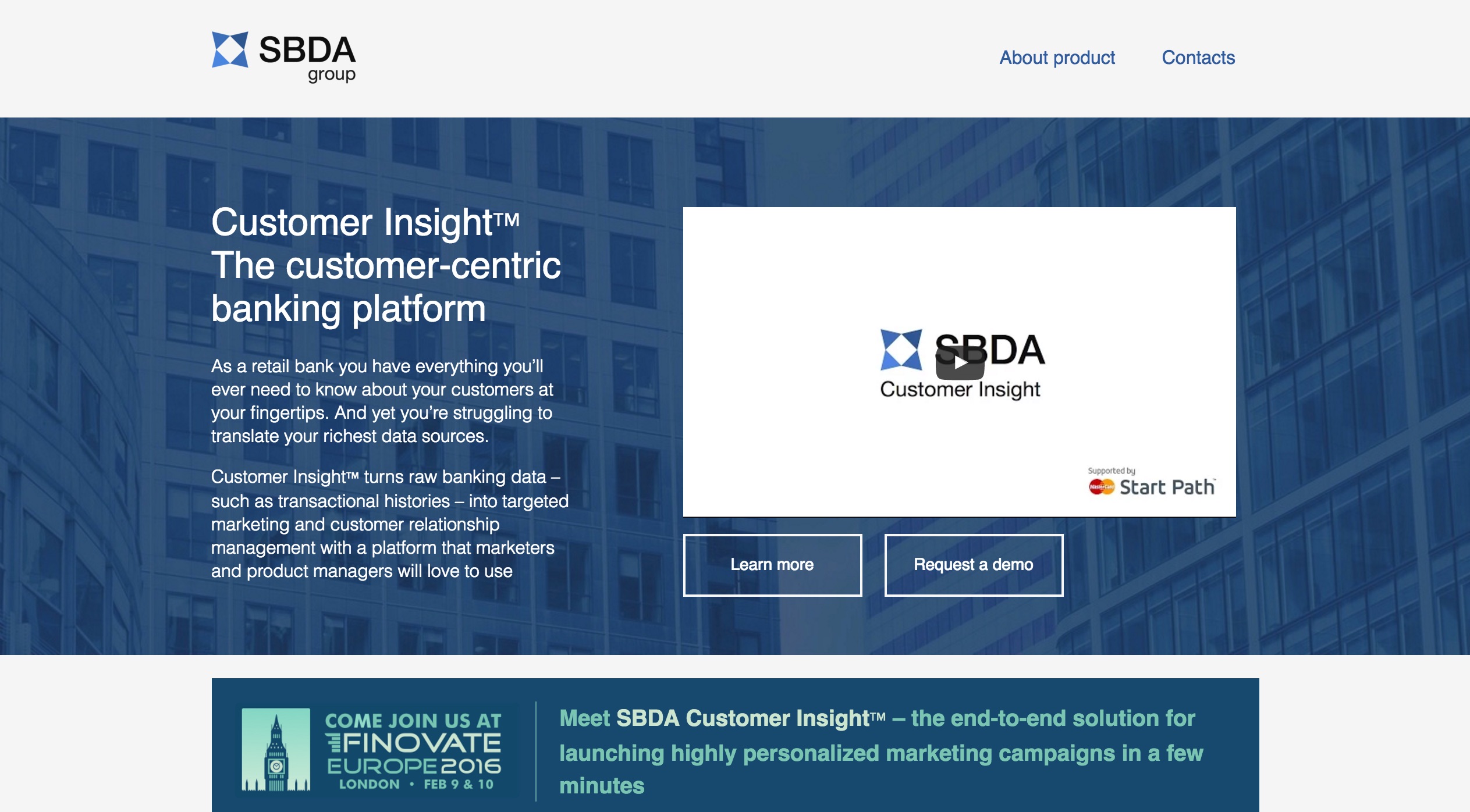

SBDA Group began from the realization that banks are not making use of most customer data. The London-based company helps banks leverage the data to create a more personalized banking experience through machine learning and data science.

The founders originally started SBDA Group as a consultancy. After working with a large European bank and gaining insight into its data problems, it was decided to productize the offering. The result was SBDA Customer Insight.

SBDA Customer Insight helps banks launch a campaign to target customers by using observations from internal data, such as transaction history, and external data, such as social network activity, to determine which customers to include in each campaign. After the customer segment is defined, the bank uses a step-by-step campaign widget to tailor and launch the campaign.

Company facts:

- Founded in 2014

- Headquartered in London

- Self-funded

- Profitable

- Its algorithms cover 70+ million customer profiles

CEO Nikita Blinov, Chief Data Scientist Alexander Fonarev, and Project Manager Anna Laskovaya presented at FinovateEurope 2016 in London.

CEO Nikita Blinov, Chief Data Scientist Alexander Fonarev, and Project Manager Anna Laskovaya presented at FinovateEurope 2016 in London.

At FinovateEurope 2016, we interviewed Nikita Blinov (LinkedIn), the company’s CEO. Blinov holds a masters degree in mathematics. Prior to founding SBDA Group he served in a variety of positions at Yandex over the course of five years. Most recently, he served as Head of Yandex’s Local Search.

At FinovateEurope 2016, we interviewed Nikita Blinov (LinkedIn), the company’s CEO. Blinov holds a masters degree in mathematics. Prior to founding SBDA Group he served in a variety of positions at Yandex over the course of five years. Most recently, he served as Head of Yandex’s Local Search.

Finovate: What problem does SBDA Group solve?

Blinov: The problem that we solve is lack of personalized communications in retail banking. Banks have huge amounts of customers’ real-life data, but in general don’t use this data to make their communications as personalized as it could be. It happens because the process of launching a campaign is quite complicated and involves a huge number of teams. And one of the longest steps is analytics. As a result, it takes months just to launch one campaign and it’s obviously too expensive to be done on a regular basis.

Finovate: Who are your primary customers?

Blinov: Top-tier retail banks and financial services.

Finovate: How does SBDA Group solve the problem better?

Blinov: Using data science methods, SBDA Customer Insight turns raw banking data – such as transactional histories – into targeted marketing and customer relationship management with a platform that portfolio and product managers will love to use. It enables them to select customers by their real-world activities to make a bank’s campaigns highly personalized. And after that, Customer Insight provides an end-to-end solution for coordinating the campaign with other specialists and for launching it in a few minutes. As a result, it saves months of work from the bank’s developers, marketing managers and analysts and sets up an efficient, targeted-offers creation-process based on real-life events of bank customers.

Finovate: Tell us about your favorite implementation of your solution.

Blinov: The most interesting one is Alfa-Sense, which was launched at Finovate Fall 2015. That’s Alfa-Bank’s new generation mobile banking app working preventively. It predicts why each particular customer at each particular time might want to use the app and comes to him preventively with a push-notification offering a solution.

Finovate: What in your background gave you the confidence to tackle this challenge?

Blinov: Previously, our executive team worked together at Yandex, the largest European search engine, on various services such as heads of services, technical leads, and data scientists. So we realized pretty well what a big impact personalization can bring to the business. That’s why we decided to move to the financial services sphere which has such a great potential from that point of view.

Finovate: What are some upcoming initiatives from SBDA Group that we can look forward to over the next few months?

Blinov: We are actively working on other applications of our core technology, for example using AI, conversational commerce and other directions. Stay tuned and join us at future Finovate events to know the details!

Finovate: Where do you see SBDA Group a year or two from now?

Blinov: In the long term the main aim of SBDA technologies is helping banks move from a utilitarian tool to a personal financial assistant. To become a service that understands the client’s financial situation better than anyone else and preventively and proactively help him solve his everyday tasks related with finance. So the bank could solve his client’s everyday personal financial tasks and become highly personalized. And we are eager to provide banks a platform for that.