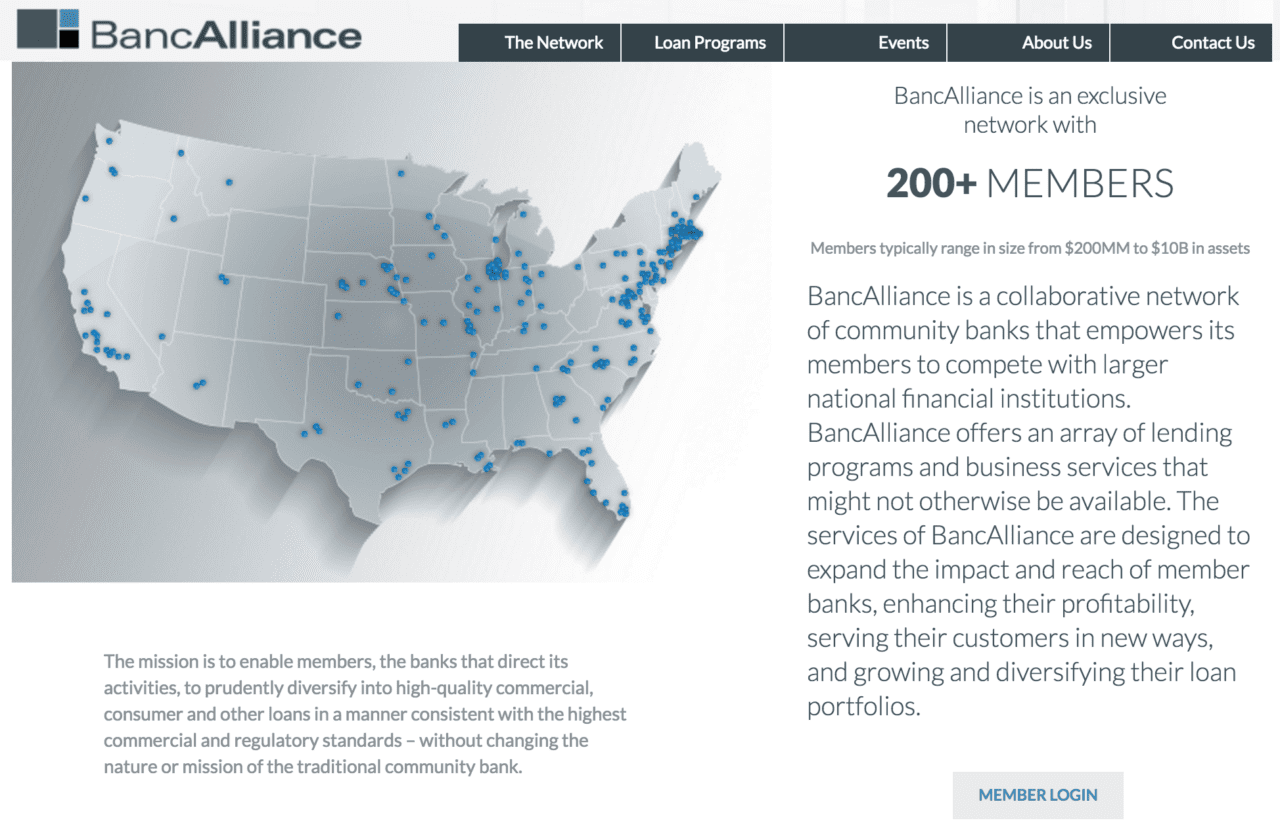

California-based wealth-management platform Personal Capital is partnering with BancAlliance, a vital connection that will give the former access to BancAlliance’s network of 200 community banks.

BancAlliance’s member banks—ranging in size from $200 million to $10 billion AUM across 40 U.S. states—receive access to programs and services that help them compete against larger financial institutions. The member banks can now offer co-branded personal finance and wealth-management tools powered by Personal Capital. In a press release Brian Graham, CEO of BancAlliance, said, “With Personal Capital, we are able to give our members the best tools available today to help their customers plan for their own futures. Moreover, our members will gain an entirely new marketing channel through Personal Capital.”

BancAlliance’s member banks—ranging in size from $200 million to $10 billion AUM across 40 U.S. states—receive access to programs and services that help them compete against larger financial institutions. The member banks can now offer co-branded personal finance and wealth-management tools powered by Personal Capital. In a press release Brian Graham, CEO of BancAlliance, said, “With Personal Capital, we are able to give our members the best tools available today to help their customers plan for their own futures. Moreover, our members will gain an entirely new marketing channel through Personal Capital.”

The aim is to broaden the scope of products and services banks offer their clients and to give clients tools to grow, manage and understand their net worth. Personal Capital CEO Bill Harris says, “Through the partnership with BancAlliance, customers have access to tools and advice that have traditionally been reserved for only the ultra-wealthy.”

Personal Capital has helped its one million registered users track $245 billion and has $2.5 billion AUM. Last month the company hired former Yodlee CFO Mike Armsby as its new CFO. In May, Personal Capital picked up an investment of $50 million, boosting its valuation to $500 million. The company expects to raise another $25 million in 2017.

Personal Capital most recently presented at FinDEVr San Francisco 2015, where the company’s CTO Fritz Robbins talked about data-driven retirement planning. At FinovateSpring 2014, CEO Bill Harris and Chief Product Officer Jim Del Favero debuted One Click Investment Proposals.