Wealth tech player Personal Capital has picked up on the student loan crisis. The company announced today it is adding a new feature to its dashboard to help families plan and prepare for the rising cost of higher education.

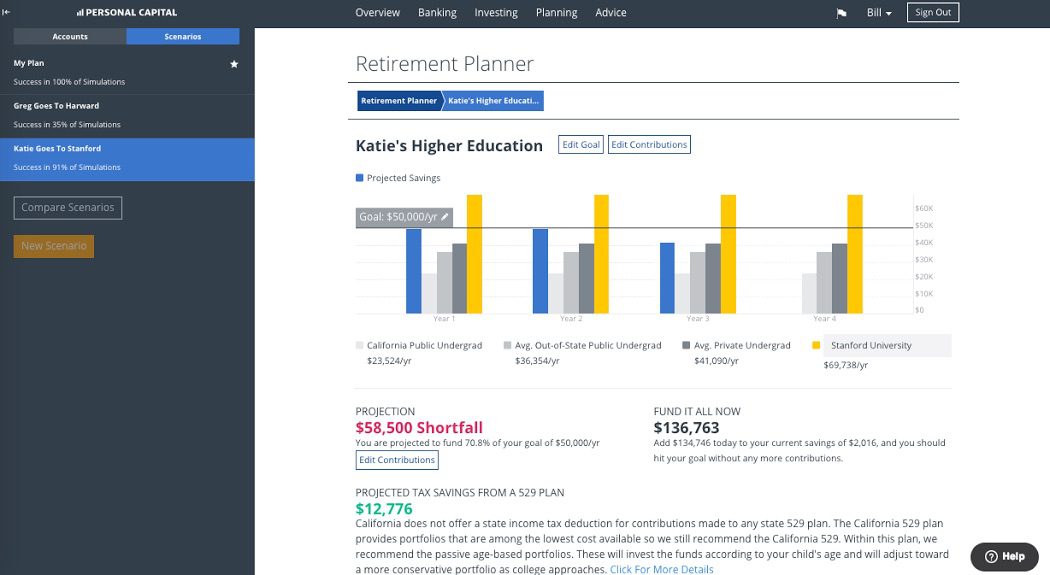

Personal Capital’s Education Planning Tool helps users understand costs of a specific college, compare in-state vs. out-of-state college costs, determine annual savings needs, and track their progress. The differentiating factor in Personal Capital’s new tool is that it allows for what-if scenarios and hypothetical income analyses. For example, users can determine how much more they would need to save if their student took a fifth year to graduate or if they sold their house, received inheritance money, or retired. Users can model multiple potential outcomes and compare the results to their current plan and see the possible effects on their overall portfolio and retirement readiness.

When starting a new education goal, users enter information about their student, planned education costs, and current savings. The planner accounts for inflation or deflation and calculates how much the user needs to save per month or per year to stay on track. Users can see the projections, edit their contribution amounts, and select specific schools to determine potential changes.

Founded in 2009, Personal Capital debuted its One-Click Investment Proposals at FinovateSpring 2014. At FinDEVr Silicon Valley 2016, the company’s Ehsan Lavassani, Founding Engineer & Chief Engineering Officer, and Ravi Gundlapalli, Director of Frontend Engineering, gave a presentation titled, Data-Driven Account Opening. Personal Capital was recently named in CB Insights’ Fintech 250 List. Earlier this year, the company extended its Series E funding round by $40 million, bringing its total capital to $215 million. In late August, Personal Capital reached $5 million in assets under management. Jay Shah is CEO.