Robo advisor technology provider Munnypot inked a deal with Denmark’s Jyske Bank. This marks Munnypot’s first European white label partnership.

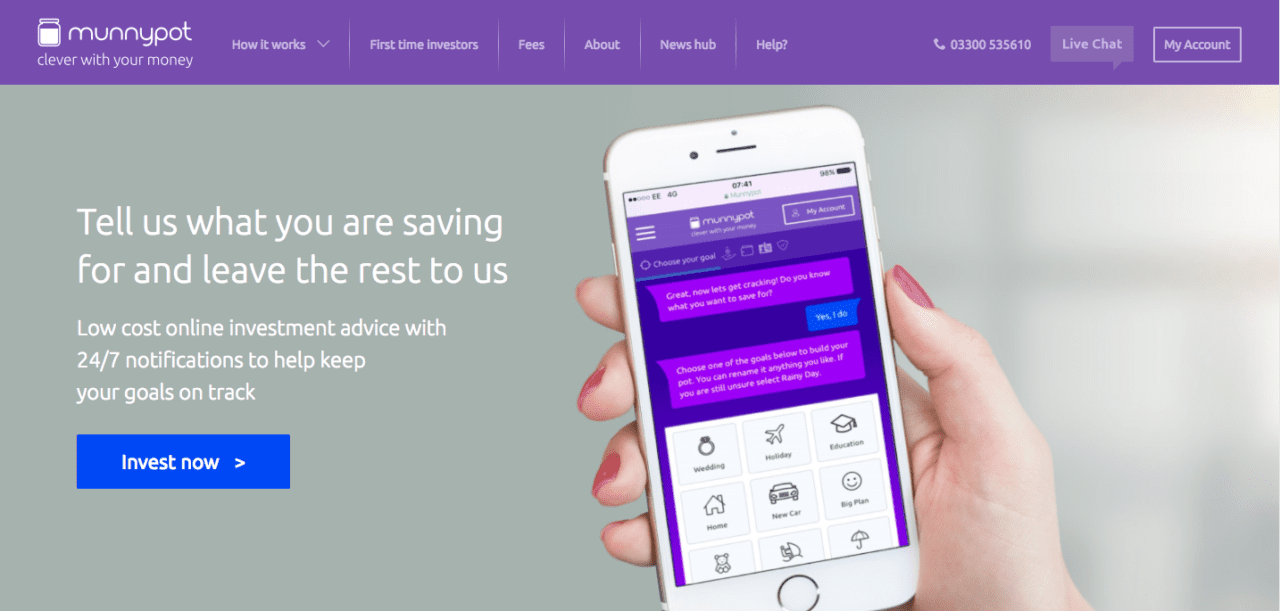

As part of the agreement, Munnypot will work with Jyske Bank to give clients a new solution, Jyske Munnypot, that provides online investment advice. The new tool will offer clients regulated investment advice along with monitoring and notifications of their investment performance. The goal-based solution will be available to Jyske Bank clients in the first half of this year.

In a press release CEO and co-founder of Munnypot, Andrew Fay, described the value of the partnership.”We’re delighted to partner with Jyske Bank and bring the Munnypot service to one of the most prestigious banks in Europe,” he said. “We know, first hand, the time and resources required to build a robust online investment advice proposition and that for most firms, partnering is the best and most efficient route to developing an innovative, client-engaging service.”

René Schjøtt Brogaard, Jyske Bank’s Head of Investment Solutions, said that the two partners share a goal to “help people make the right investment decisions by building an innovative, engaging and customer-focused proposition.”

Founded in 2015, Munnypot allows users to begin investing with as little as £25 per month and/or a £250 single payment into an individual savings account (ISA), junior ISA (JISA), general investment account (GIA), or pension fund. The company is headquartered in Crawley, England.

Munnypot is among the dozens of companies that will demo its newest technologies on stage at FinovateMiddleEast next week at the Madinat Jumeirah Conference and Events Centere in Dubai, U.A.E. There’s still time to register so book now to save your seat.