Morningstar-owned HelloWallet launched a new tool today in an effort to help banks and companies encourage their members and employees to focus on their finances. Prompted by requests from users, the Washington, D.C.-based company launched Savings & Debt Guidance to help users achieve their emergency savings, spending, and debt goals.

Saving

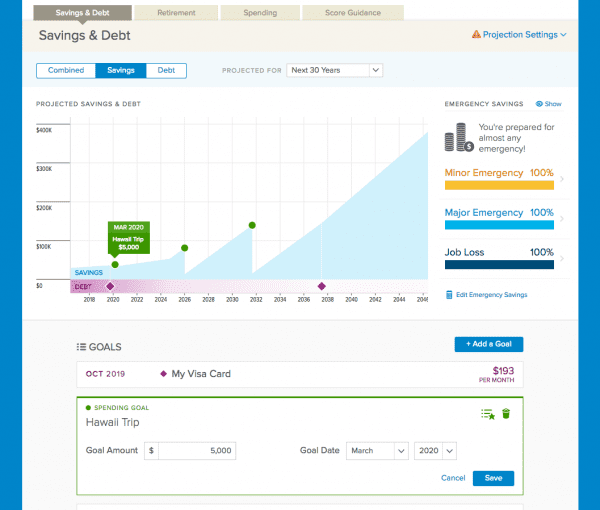

The chart helps users add spending goals and visualize large upcoming purchases. In the column on the right, HelloWallet gauges how prepared the user is for unexpected expenses based on their personalized emergency savings estimate. If a spending goal puts the user’s emergency savings funds at risk, HelloWallet offers suggestions to delay spending, reduce their goal amount, or increase savings contributions to reach their goal on time.

Debt

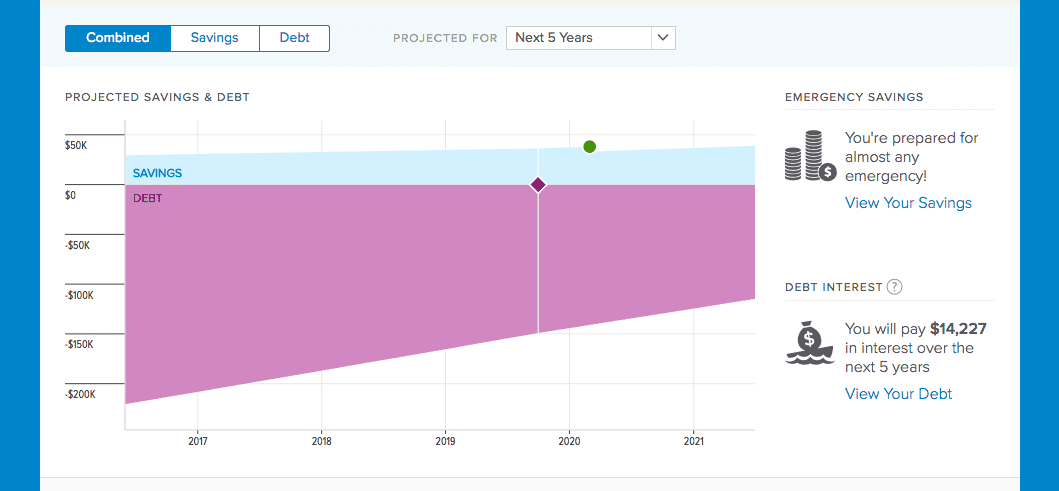

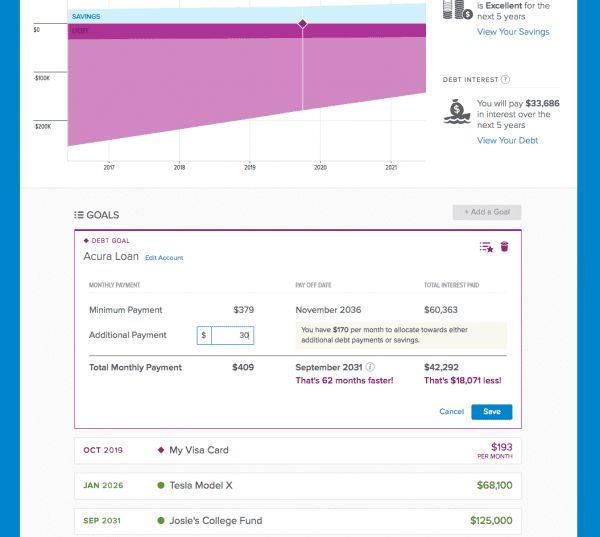

The tools also let users set goals for debt, guiding them to pay down loans with the highest interest rate first. To help motivate, HelloWallet educates the user on how much interest they will pay in the upcoming years and adjusts the number based on their payoff date.

At FinovateFall 2015, the founder of HelloWallet and CIO of Morningstar, Matt Fellowes, gave a Best of Show-winning demonstration in its debut of Retirement Explorer, a planning tool that allows users to model and save retirement scenarios. Fellowes also announced it now allows banks to integrate HelloWallet’s financial wellness programs.

Matt Fellowes, chief innovation officer of Morningstar and the founder of HelloWallet; Andrew Vincent, senior product manager; and Gabe Gorelick-Feldman, software engineer, showcased Retirement Explorer, which won Best of Show at FinovateFall 2015.

Matt Fellowes, chief innovation officer of Morningstar and the founder of HelloWallet; Andrew Vincent, senior product manager; and Gabe Gorelick-Feldman, software engineer, showcased Retirement Explorer, which won Best of Show at FinovateFall 2015.

HelloWallet’s customers include Salesforce, T. Rowe Price, Allstate, Vanguard, and more. Before it was acquired by Morningstar in 2014, the company had raised $15.6 million.