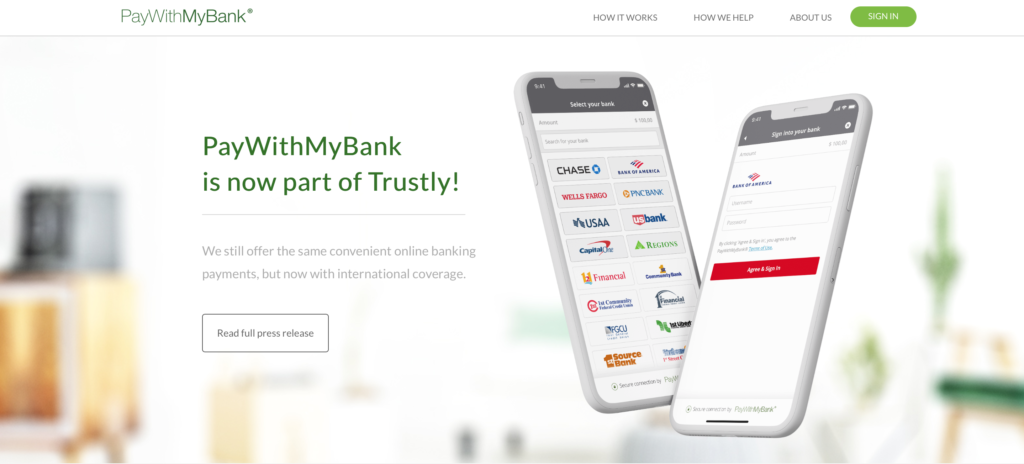

In a marriage between payments innovators from Sweden and Silicon Valley, Trustly has announced that it has agreed to merge with U.S.-based PayWithMyBank. The merger comes a little over a year after Nordic Capital announced taking a majority stake in Stockholm’s online banking payments provider.

“This transformative merger creates the first and only online banking payments network with transatlantic coverage and accelerates our path towards global coverage,” Trustly CEO Oscar Berglund said. He credited PayWithMyBank for being an online banking pioneer going back to 2000. “Together we’re thrilled to be able to offer merchants and billers a unique alternative to card payments,” Berglund said, “allowing them to accept payments from 600 million consumers across Europe and the U.S.”

According to Trustly spokesperson Meredith Popolo, the two companies will continue to operate under their own brands “for now.”

Just this week, we took a look at the rise in M&A activity among fintechs. The news that Trustly and PayWithMyBank will combine into a global payments entity with revenues of more than $120 million (€100 million) in 2018 serves as further evidence of this trend. The merger between payment specialists also supports the trend toward enabling consumers to pay directly from their bank accounts – cutting out the card networks altogether.

Trustly’s straightforward, three-step process makes it easy for consumers to shop and pay directly from their bank accounts. Via the Trustly option during checkout, users select their bank from a drop-down menu and log on as usual. Then they choose the account from which they want to pay, and confirm the payment with the authentication option of their choice. The technology helps merchants improve conversions and reduce churn while providing bank-grade security.

PayWithMyBank CEO Alexandre Gonthier pointed out that the idea to merge with Trustly was in some ways a function of demand. “Our large, U.S.-headquartered customers were all asking us to expand our consumer coverage globally beyond the U.S.,” Gonthier said. “So, joining forces with Trustly, the established leader in our space in Europe, was a natural strategic next step for PayWithMyBank, the emerging leader in the U.S.”

Redwood City, California-based PayWithMyBank was founded in 2012, and provides a high-UX conversion, high-payment authorization, low-cost, no-chargeback alternative to checks as well as other popular payment methods such as Visa, Mastercard, and PayPal. The firm’s client list includes Western Union, First Data, United Way, and a number of social media and telecommunications firms and utility companies.

As a result of the merger, Gonthier will serve as U.S. CEO, where he will oversee the U.S. market and report to Oscar Berglund, who will serve as Group CEO.

Founded in 2008, Trustly demonstrated the Direct Debit feature of its platform at FinovateEurope 2017. Direct Debit enables recurring charges and one-click payments on bank accounts, providing faster, safer transactions for customers and merchants.

More recently, Trustly announced a partnership with Collector Bank to bring instant payments to merchants in the Nordics. Last month, the company introduced its automated invoice payment solution, Pay Your Invoice, for both customers and merchants. With offices in Stockholm, Sliema, London, Orebro, Cologne, Barcelona, and Helsinki, the company celebrated adding its 300th employee this year.