If you skipped FinovateFall last week, you missed out! Fortunately, I’ve compiled a written highlight reel to bring you up to speed.

Demos

With 66 demos on stage, the audience took in a variety of fintech solutions. There was one underlying, enabling technology that fueled the majority of the products and services. That enabling technology, AI, pulsed throughout not just the demos, but the entire event.

At FinovateFall 2024, there were eight demo companies crowned Best of Show winners, as voted by the audience. Winners include Bancography, CardLift, Credit Mountain, Delfi Labs, Eko Investments, Illuma, Nest Bank & Efigence, and Themis.

On-stage thought leadership themes

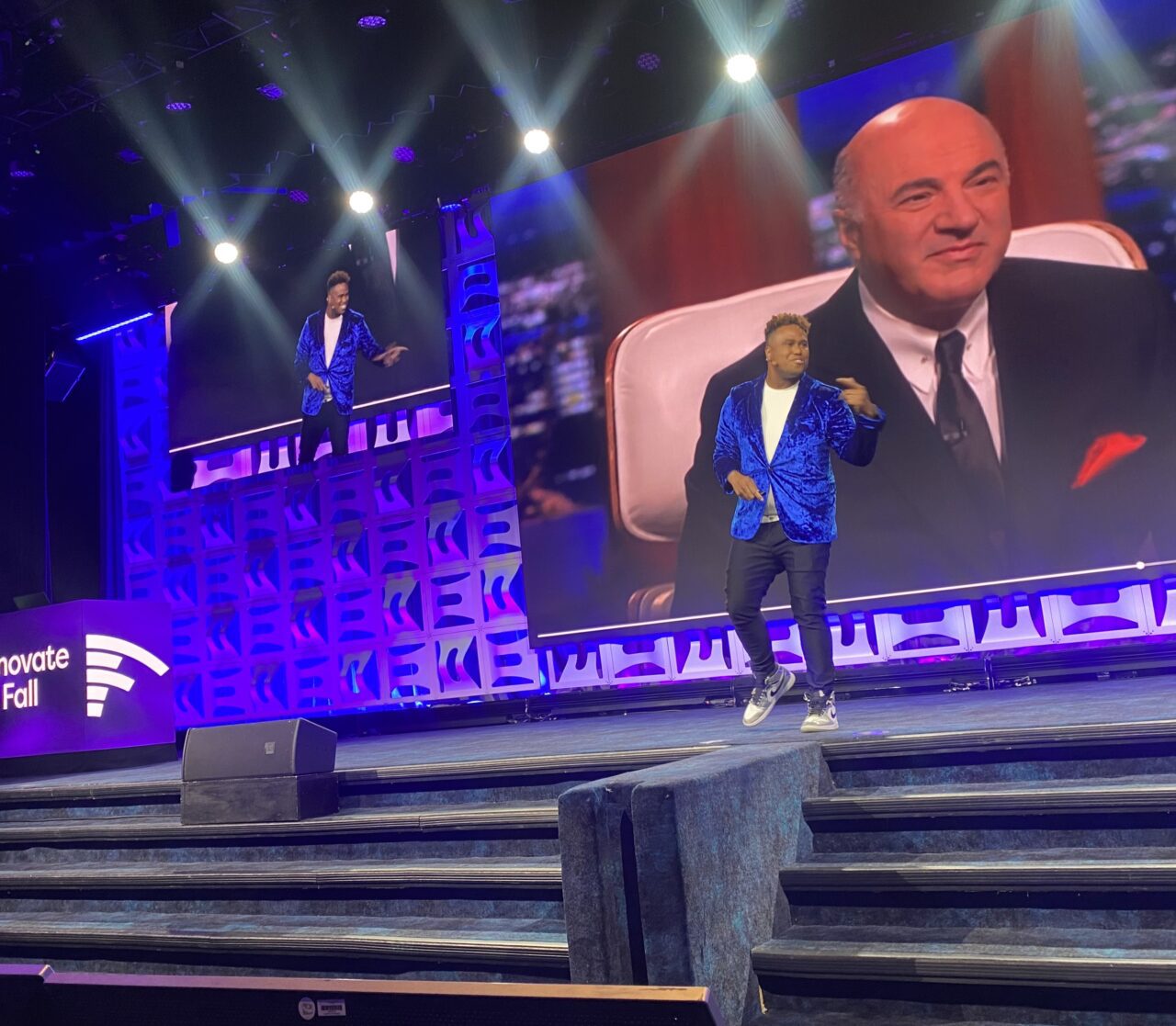

There were a wide variety of thought leaders on the Finovate stage last week. Among my favorites were Akeem Shannon, Founder and CEO of Flipstik, who not only brought a massive amount of energy to the stage, but also brought the story of how he launched his product. Perhaps not surprisingly, Akeem’s message centered around the importance of your brand or company’s story. During his presentation, Akeem shared both why crafting a story around your brand is so important, as well as how to build your own compelling story.

As always, I also loved the coverage from the Analyst All Star session, which featured seven-minute presentations from Tiffani Montez, Principal Analyst at EMARKETER; Philip Benton, Senior Analyst- Financial Services at Omdia; and Suraya Randawa, Head of Omnichannel Experience at Curinos.

Tiffani covered the growth of retail media networks in financial services. In addition to Chase Media Services and PayPal’s media arm, Tiffani covered others in the space and explained that financial media networks such as these are superior to retail media networks in that they have cross-merchant data. For his presentation, Philip highlighted the increase in SaaS adoption for banks and explained the implications of leveraging third party technologies. Suraya offered her presentation on how banks can deliver a better customer experience. Notably, she explained that there is no singular, happy path for customers. This variability is perhaps the factor that makes achieving a perfect user experience so difficult.

The conversations

My favorite part of every conference is the networking. This event was no different. I saw plenty of familiar faces and met multiple new ones. Many of my conversations centered around AI–specifically the regulation of AI in financial services.

I spoke with Katie Quilligan, Investor at BankTech Ventures, who sat on a panel discussion I led on creating value in leveraging AI. During our conversation, Katie remarked that all banks need to have a strategy around AI, even if they are not planning on using it directly. She added that banks don’t have the option to ignore the AI revolution, because not only are they falling behind by not leveraging the new technology, but also because their employees are using the technology, regardless of whether or not there is a formal policy around using it.

In a separate conversation with Jim Perry, Senior Strategist at Market Insights, Jim commented that he spoke with a bank recently that said that even though they put up a firewall blocking ChatGPT, one of their bank marketing employees felt they needed to leverage GenAI and was able to get around the firewall by walking across the street to Starbucks on their lunch break so that they could use Starbuck’s wifi to access ChatGPT and generate marketing copy.

The point of both of these conversations makes one thing clear– GenAI has arrived, and at this point ignoring it is not an option.