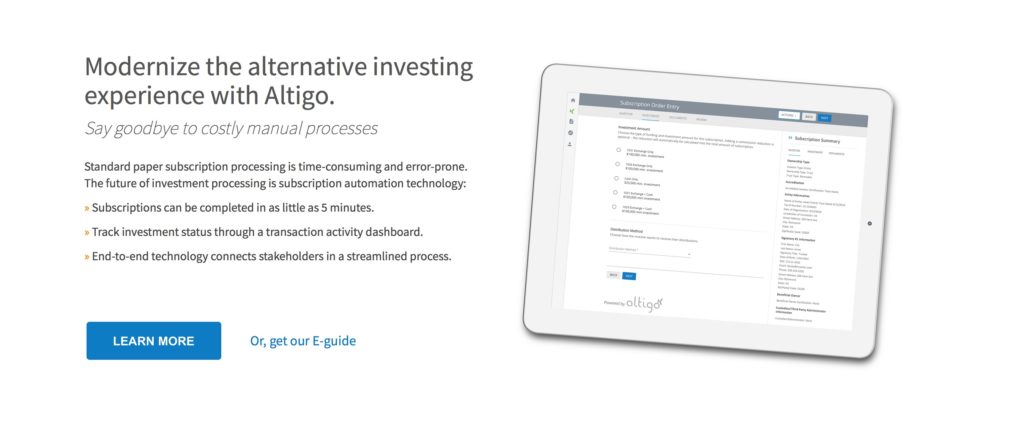

A new straight through processing technology platform for alternative investments from WealthForge will make it easier for advisors and sponsors to manage alternative investment transactions for their clients and partners. The solution, Altigo, leverages automation to improve accuracy and save time in what the company called a typically “lengthy, error-prone, paper-based process.”

WealthForge CEO Bill Robbins cited the “poor experience” most customers face when trying to invest in alternative assets as one reason why interest in alternative investing remains limited among higher net worth clients. “If straight through processing provides a stable foundation for alternative investments, as it has for other asset classes, ” Robbins said, “then we can expect it to expand the pie for everyone involved.”

Errors in alternative investment subscriptions are a major issue. In its statement, WealthForge cited industry analysis that indicated that up to 60% of subscriptions are deemed not-in-good-order (NIGO), and require some correction before the transaction can be processed. This correction process can result in per document costs climbing by as much as 4x, the company noted.

Altigo is being offered to sponsors who then can make the platform available to their distribution partners. WealthForge announced that Cantor Fitzgerald is Altigo’s first major sponsor, and that advisor-focused functionality will be added to the platform later in 2019.

Jay Frank, Head of Distribution at Cantor Fitzgerald Capital, pointed to a variety of ways Altigo will help make operations more efficient for all parties involved. “Consistent with our leadership position in the industry, improving the investor, advisor, and back office experience is a key focus as we continue to scale our unique solution set of real estate and cash management programs,” Frank said.

WealthForge demonstrated its WealthForge Network at FinovateSpring 2016. The Network makes private capital markets more efficient by enabling issuers to display offerings to registered intermediaries, and by providing a branded online investment process for investors. In 2018, WealthForge announced that it has processed more than $500 in capital investments on its platform.

A member of both the WealthTech 100 and the Inc. 5000, WealthForge was founded in 2009 and is headquartered in Richmond, Virginia. The company has raised $5.2 million in funding courtesy of investors including NRV and SenaHill Partners.