Faster payments for freelance workers? That’s the goal of the new partnership between freelance career platform UnderPinned and payments platform Banked. The two companies are now offering a commission-free service that reduces the amount of time it takes to process a freelancer’s invoice from more than three minutes to less than 30 seconds.

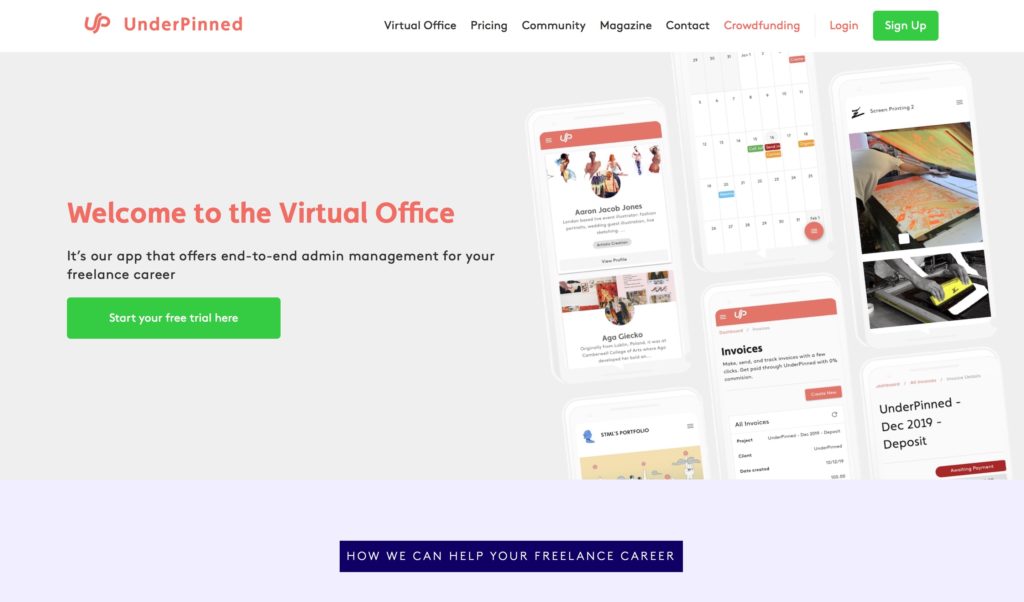

The service works via UnderPinned’s Virtual Office platform, which leverages open banking to retrieve data from invoices and automatically generate bank transfers that can be readily authorized by any U.K. banking provider.

“The number of people choosing freelance work has grown rapidly in recent years, but the infrastructure that supports this type of employment has failed to keep pace with the trend,” said Albert Azis-Clauson, UnderPinned founder and CEO. He highlighted payments as a major pain point. “The traditional process of paying an invoice for a freelancer is extremely clunky and time-consuming,” he said, “and that’s (why) we’ve decided to launch this new service.”

UnderPinned’s Virtual Office provides freelancers and gig economy workers with resources they need to make their jobs easier. The cloud-based hub helps freelancers manage portfolios and projects, invoices, contracts, and more. The Virtual Office also features educational tools and support resources to give freelancers additional assistance with things like finding work spaces to securing insurance. Founded in 2018, and launching its technology earlier this year, UnderPinned already has more than 2,200 users on its platform. The company, which is headquartered in London’s Bethnal Green, is in the final few weeks of its crowdfunding campaign, having raised 93% of its £500,000 ($614,000) target.

In working with Banked, UnderPinned has partnered with a firm that, since its founding in 2017 and launch early last year, has been dedicated to improving the payments process. Banked offers an API platform that fully leverages open banking by connecting to banks to enable payments and authentication of user information with their third party solutions. Based in London, the company includes account top-ups for e-money, trading, and gaming businesses, and payment linking for charities, marketplaces, and crowdfunding platforms among the use cases for its technology.

“We started Banked because we wanted to build a platform that allowed businesses and consumers to do more with their financial lives,” Banked CEO and founder Brad Goodall said. “Our new partnership with Underpinned delivers on this, helping freelancers and businesses save a huge amount of time and ultimately money. It provides a new way of paying invoices that will transform the freelancer experience.”