U.S. challenger bank Point, which offers a consumer banking app and pledges to provide a “credit card experience” to debit cardholders, announced that it has raised $10.5 million in Series A funding. The round was led by Valar Ventures, and featured participation from Y Combinator, Kindred Ventures, Finventure Studio and “business angels.” Company CEO and co-founder Patrick Mrozowski said the challenger bank has raised a total of $12.7 million.

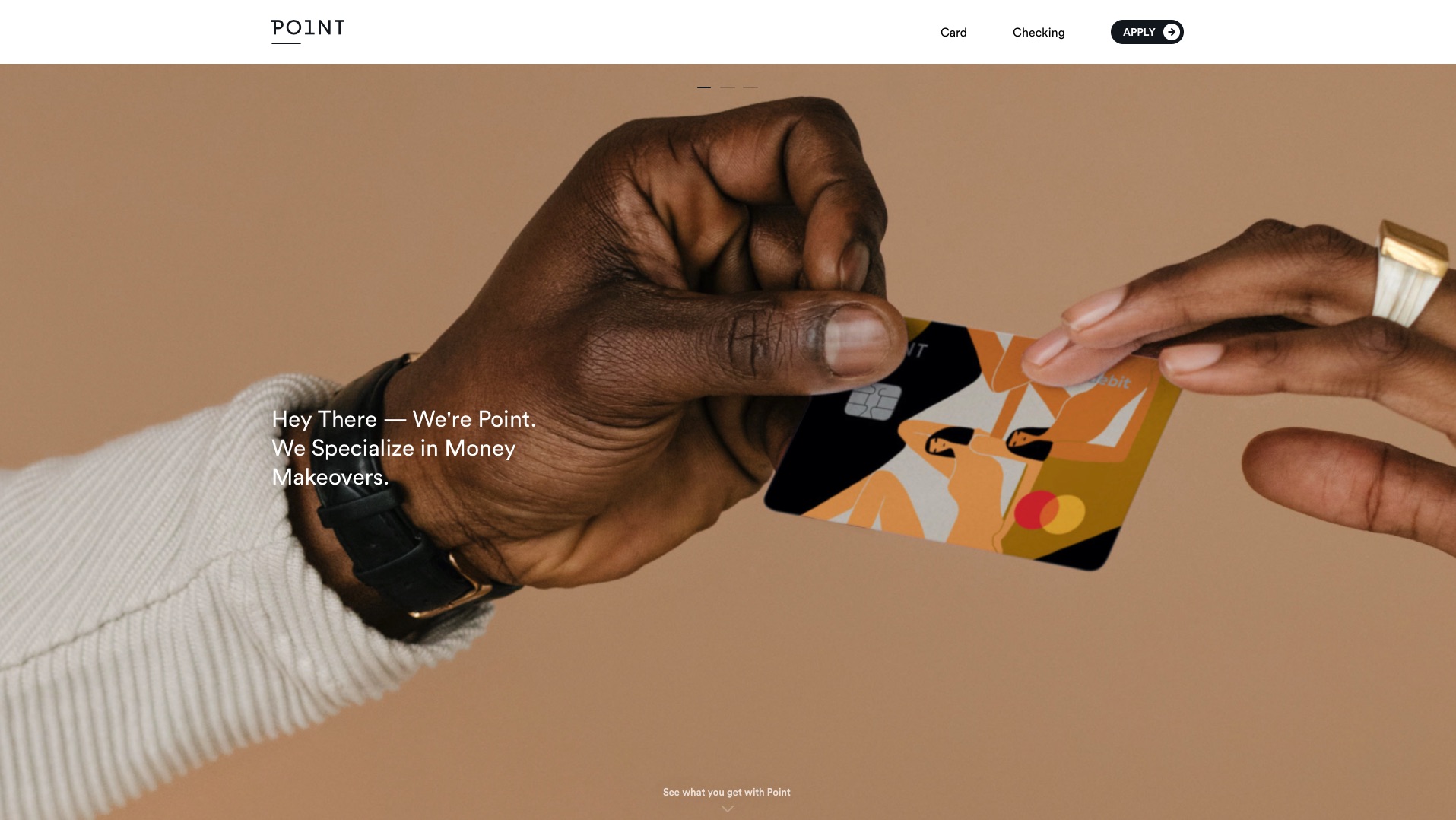

The San Francisco, California-based company has been in private beta “for the past year” plans to launch a major new version of its technology later this year, according to reporting in TechCrunch. In addition to its Point Card debit product – available as both a physical and virtual card – the company offers a Point Checking mobile savings account. The account is backed by FDIC-insured, Point partner Radius Bank, and the challenger bank leverages technology from Finovate alum Plaid in order to link accounts on its platform to a third-party bank account. Point does not charge foreign transaction fees for international transactions, and relies on Mastercard’s exchange rate for overseas transactions.

Users of the Point Card earn points when shopping with popular merchants including Airbnb, Uber, and Starbucks where cardholders can pick up 2x, 3x, and 4x in points respectively for each dollar they spend. Seamless integration between the Card and the app ensure a holistic consumer experience with features including purchase notifications, in-app card management, and rewards tracking.

Previous to his co-founding of Point, Mrozowski founded and ran Crumbs, a micro-investing platform for cryptocurrencies and digital assets that was acquired by Metal Pay two years ago.