Foreign currency-exchange platform TransferWise today announced it has released a new segment out of beta. The London-based company launched TransferWise for Business to the public, offering businesses access to international money transfers.

The beta test of the new offering began in May, just after the company closed a $26 million round. Since then, after working “closely with businesses to create a product that meets their needs,” TransferWise has helped business customers transfer more than $1.3 billion using the platform. According to the website: “Businesses can now use TransferWise to pay suppliers or employees overseas, request payments from customers, and transfer funds between their own accounts in different countries.”

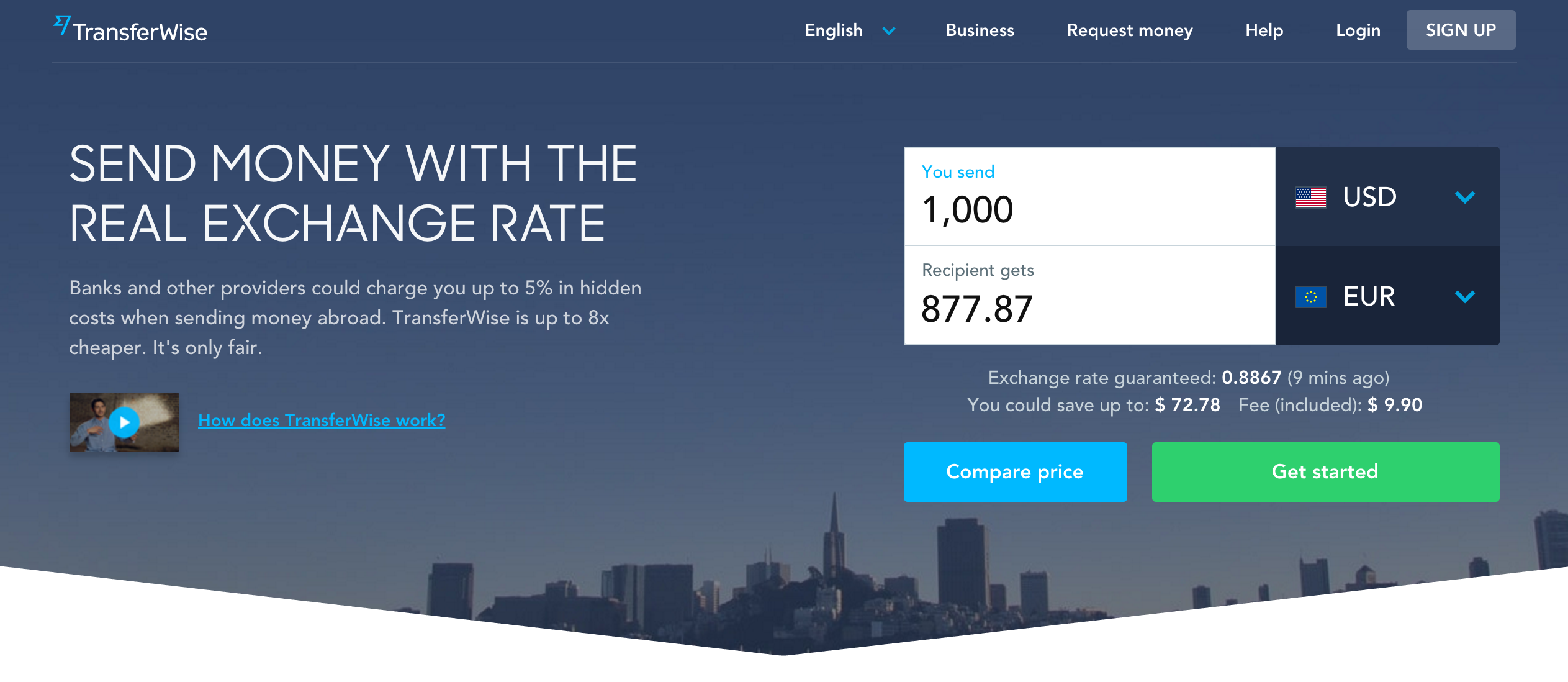

Following its ethos, TransferWise does not charge businesses to sign up and there are no monthly fees. By leveraging the ability to transfer money within its network of banks, the company makes sending money abroad up to 7x cheaper than using a business bank account. For bulk overseas payments, TransferWise launched Mass Pay (not to be confused with Dwolla’s MassPay), a batch-payment solution that lets businesses send and track large numbers of payments. Mass Pay is available as an API or on the web interface, which allows for one-by-one or bulk file uploads via CSV.

TransferWise demoed at FinovateEurope 2013. The company, founded in 2010, now boasts 1 million customers and more than $116 million in funding.