Swedish-born PFM app Tink has landed $16.5 million today for its personal financial management app and packaged APIs. The funds come from SEB, Nordea, Nordnet, ABN Amro, Creades and Sunstone and brings the company’s total funding to $30.5 million.

“This latest funding will allow us to put great focus on the European market, scale our offer, and help banks to keep pace with the expectations of their customers,” said Daniel Kjellén, co-founder and CEO of Tink. “We see this need continuing to grow as customers exert their rights to access their financial information and take control of their money.”

In addition to expanding its pocketbook, the company has also broadened its horizons. Not only has Tink signed licensing agreements with Nordea, Nordnet, and Klarna, it also announced plans to further its European expansion. Today’s partnerships add to the company’s existing agreements with Sweden-based SEB and Dutch-based ABN Amro who teamed up with Tink last year. Through the partnerships, Nordea, Nordnet, and Klarna can integrate Tink’s aggregation, payment initiation technology, and PFM platform into their existing customer channels. Klarna, a bank focused on the online payment experience, demoed its flagship payment technology at FinovateSpring 2012.

Kjellén announced that the company will be live in 10 European countries at the beginning of 2018. He said that Tink’s technology “transforms the industry” by assisting banks to build a customer experience that helps clients understand their finances, make smarter choices, and “ultimately brings them financial happiness.” Kjellén continued, “We see today’s announcement as evidence of a new generation of bank and fintech partnerships. By working together, we are paving the way for a new era of banking in Europe – unlocking the market to create greater choice and a better deal for consumers.”

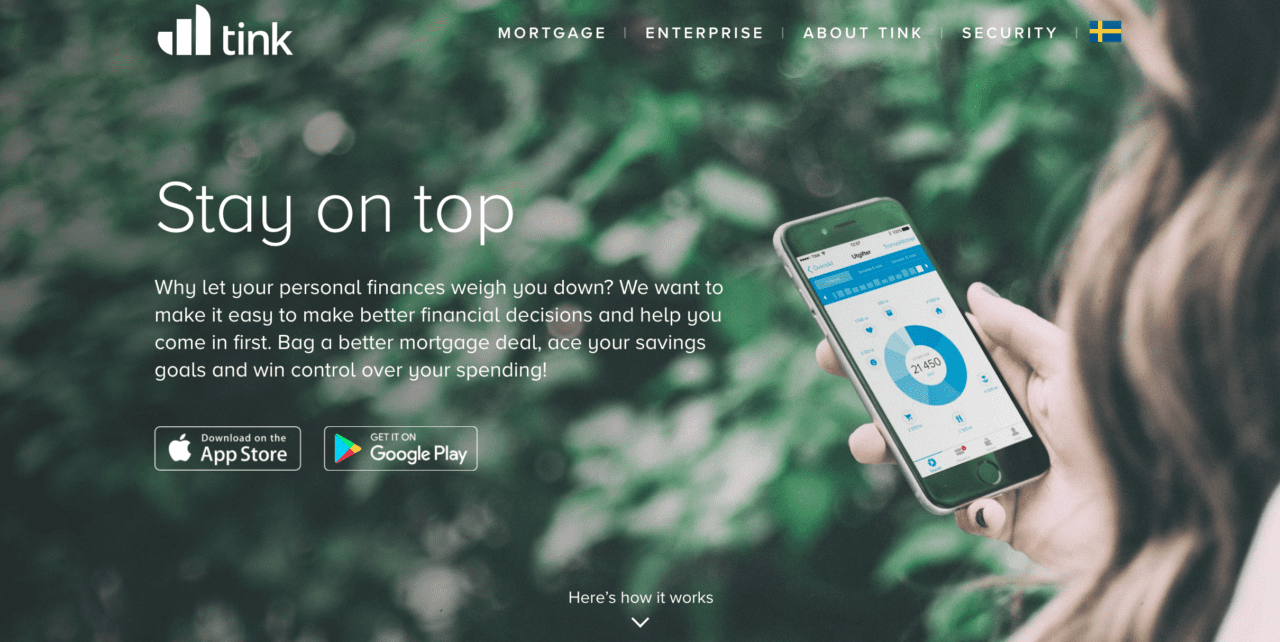

Tink is an active supporter of the European Union’s proposed PSD2 legislation and has campaigned for greater consumer access to their financial data. The company’s APIs enable banks to plug-and-play account aggregation, payment initiation, PFM, and product recommendation technology in a single platform.

Tink has 50 employees and was founded in 2012. The Tink app has more than 400,000 users in Sweden. This summer the company earned a place on CB Insights’ Fintech 250 list., Kjellén, along with the company’s Commercial Director Tashi Sylten, took home a Best of Show win for their demo of Tink at FinovateEurope 2017 in London. Three years earlier, at FinovateEurope 2014, the company won Best of Show for its debut of the Tink platform.