It’s about this time every year that someone tells me there just isn’t that much new going on, at least not like the “old days” (which could be last year, 2007, or 1997). Usually, they want me to change their mind, offer up some crazy examples of how the world of financial services is about to be turned on its head.

But things just don’t move that fast in the world of money, nor should they. In the past 50 years, there’s been a banking technology game-changer every 10 years or so:

- 1960s: Credit cards move unsecured consumer lending outside the branch

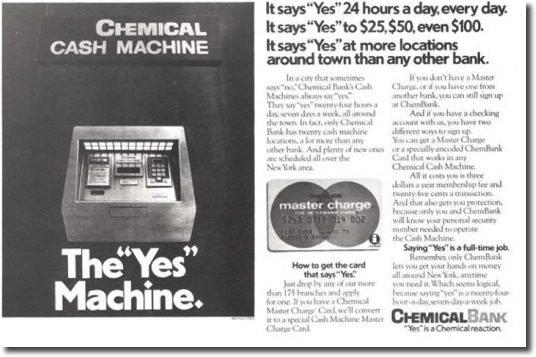

- 1970s: ATMs moved cash withdrawals out of the branch

- 1980s: Call centers moved customer service and account queries out of the branch

- Late 1990s: The internet moved account queries away from the telephone, mail and ATM

- Late 2000s: Mobile moved account queries away from the (desktop) web, and check deposits out of the branch

- Late 2010s: ????

We are still hard at work on the mobile phase which started very late in the last decade. Apple didn’t allow outside apps until mid-2008, and it wasn’t really until 2009/2010 that mobile banking came into its own. And the Great Regulation push after the Great Recession, has stifled innovation somewhat.

However, halfway through the 2010s, I’m still unsure what history will show as the groundbreaking change of the decade. Here are three contenders:

- Wearable computing: That’s just a workaround before less cumbersome technology comes along

- Bitcoin/blockchain/crypto technology: It may be on the chart in the next decade, but I don’t think it gains dramatic traction in the next four or five years (at least not in countries with stable fiat currencies)

- Crowdfunded/marketplace lending: While initially commercialized by Zopa, Prosper, Lending Club in the 2005-2007 period, it really didn’t get going until after the worst of the financial crisis had run its course in 2010/2011 (and after the SEC shut down the U.S. companies for half-a-year in 2008/2009).

My prediction: All three contenders are interesting and potentially huge. But I don’t think wearables or crypto will gain enough traction in the next four or five years to be considered the game-changers of this decade. But I do believe history will show that direct investor-to-customer lending (aka P2P lending or crowdfunding) begin to take hold in the mid-to-late 2010s.

Last year, total worldwide volume in crowdfunded loans was just $11 billion. That’s just 1% the size of a Chase, BofA or Citibank. So clearly, there is a long, long way to go before we start considering crowdfunded lending to be a disruption. But I believe it will begin to take measurable deposits and loans away from banks, credit unions and credit card issuers by 2018/2019.

We are due for a new game-changer, and I doubt we will be wearing it on our wrists.

——–

Picture credit: PixGood