![]() Flipping through a pile of American Bankers on the plane last night, I came across a page one story on The Money Store <themoneystore.com>. If you've been in the business at least ten years, you probably remember the sub-prime lender that created a household name for itself with heavy TV and print advertising featuring baseball great Jim Palmer and others. But shortly after First Union (now Wachovia) paid $2.1 billion for it in 1998, its sub-prime portfolio tanked and the bank shut it down in 2000.

Flipping through a pile of American Bankers on the plane last night, I came across a page one story on The Money Store <themoneystore.com>. If you've been in the business at least ten years, you probably remember the sub-prime lender that created a household name for itself with heavy TV and print advertising featuring baseball great Jim Palmer and others. But shortly after First Union (now Wachovia) paid $2.1 billion for it in 1998, its sub-prime portfolio tanked and the bank shut it down in 2000.

Why First Union/Wachovia didn't use the famous Money Store brand for other lending pursuits is a mystery, but I'd wager that after blowing a couple billion dollars on the acquisition, senior management, and shareholders, didn't want to hear that name ever again.

Fast forward five years. MLD Mortgage, a NJ-based lender founded by former Money Store Vice Chairman Mortan Dear convinced Wachovia to sell him the Money Store brand name. The brand was then repositioned as an online loan exchange along the lines of LendingTree, brokering mortgages for 50 lenders including Washington Mutual, NetBank, and Flagstar Bank.

Analysis

The use of the Money Tree name is good, although they absolutely must secure the <moneytree.com> domain name. The online loan-exchange business model is sound, and its lending partners offer good credibility. However, the company's website execution is deplorable.

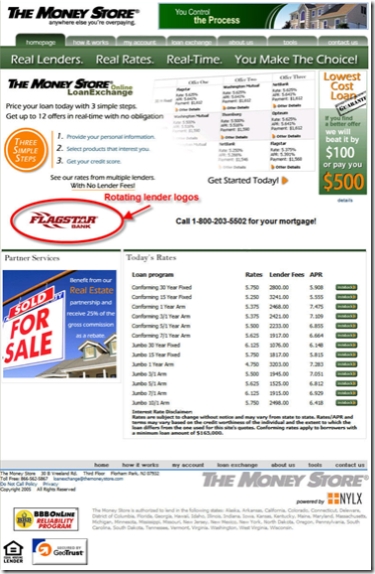

The busy home page doesn't even mention the product it sells (see screenshot below). We could write an entire report on what's wrong with the site, but we'll review just one small section here to give you an idea of the problems.

At first glance, the "three simple steps" graphic in the upper-left looks promising, although the type should be bolder for readability (see inset).

At first glance, the "three simple steps" graphic in the upper-left looks promising, although the type should be bolder for readability (see inset).

As users struggle to understand what the company offers, many will start here due to its location, color, and shape. Unfortunately, most users will become even more confused after reading it due to three significant usability errors:

Mistake #1: Scaring off potential customers. The goal of a financial website is to make users confident in transacting there. Money Tree does the opposite. The very first thing users see is step 1, "Provide your personal information." In today's paranoid times, that's a huge red flag from a relatively unknown website. Before you cause even a smidge of user-apprehension about the application process, you must make visitors want your product. Try starting with a benefit statement such as "lower your mortgage payment" or similar.

Mistake #2: Amateur copywriting with no benefit statements. Always use a professional copywriter, even for bullet points. The Money Store is obviously cutting corners here. For instance, the first line above says "price your loan today." That makes almost no sense to a consumer. It's industry jargon. It should be a benefit statement, like "lower your mortgage rate today" or something similar that can be easily grasped. My fifth-grader could have come up with a better opening line.

Mistake #3: Steps that lead to the wrong product. For the life of me, I can't figure out what the company was thinking with its third step. Here's a synopsis of the three:

1. Provide personal info.

2. Select product

3. Get your credit score

Huh? Are they selling credit scores or saying you need to go somewhere else, find your credit report and then finish the process? Either way, they are going to lose just about anyone that's gotten this far.

Instead, the steps should lead to a recognizable benefit such as:

1. Tell us what you want

2. Compare all the great prices we'll provide

3. Choose the deal that saves you the most money

4. Enjoy your extra cash!!

The Money Store homepage (Oct. 9)