We recently shared the news that restrictions on the ability of banks in India to work with cryptocurrency exchanges was overturned by the country’s Supreme Court.

With this in mind, and given the growing interest in India as a fintech power, we spoke with Neeraj Khandelwal, co-founder of CoinDCX, a cryptocurrency trading platform and liquidity aggregator in India. The company, founded in 2018 and based in Singapore, recently won the Excellence in Finance – Companies award by FiNext. Last month, CoinDCX launched its cryptocurrency derivative trading platform, DCXfutures. Bain Capital Ventures is among the firm’s investors.

Finovate: The biggest news in India in terms of the cryptocurrency market has to be the Supreme Court’s overturning of the Central Bank’s ban on cryptocurrencies. What can you tell us about the impact of the ban and the effect of the ruling striking it down?

Neeraj Khandelwal: The banking ban was related to the suspension of banking relationships with individuals or businesses dealing with cryptocurrencies, but crypto businesses were still free to operate on their own. In response, CoinDCX innovated and offered peer-to-peer services for the buying and selling crypto through INR.

After the verdict, banking relations have resumed once again. CoinDCX became the first cryptocurrency platform in India to integrate bank account transfers, just six hours after the Supreme Court’s ruling. Today, we are seeing 10x growth in signups on a day-to-day basis. Our product, Insta, which allows customers to buy crypto with INR, has also seen high hits. Overall, the market is in an upswing.

Finovate: What is the potential of the cryptocurrency market in India? How widespread are cryptocurrencies now and what factors are driving growth in adoption in India?

Khandelwal: Less than five million people currently hold cryptocurrencies in India today. However, listing websites like exchangewar.info have shown that the highest volumes are coming from India, so there is indeed great potential here. With a population of over one billion, India stands to contribute significantly to a large part of the global crypto volume and the industry as a whole.

In India, there is a growing number of cryptocurrency exchanges and startups that are constantly innovating to strengthen and expand the industry. In addition, India holds many favourable advantages for cryptocurrency adoption—for instance, with an average age of 27 years, India has a huge working population with disposable income on the rise.

Finovate: Many of us outside of India are fascinated by the country’s cashless experiment. At this time, what has been learned from that experience and what is the future of cashlessness in India?

Khandelwal: The writing on the wall is crystal clear that cashlessness is the way to go. This was first witnessed on an extremely large scale during the time of demonetization in late 2016. The National Payments Corporation of India (NPCI), which is the umbrella body for retail payments and settlements in India, revealed that the value of UPI transactions for December 2019 was INR 2.02 Lakh Cr. This figure is expected to grow as cashlessness brings greater convenience and faster transactions.

As cryptocurrencies are entirely digital, it promotes greater benefits for cashlessness in comparison to fiat currencies. I believe that in the coming years, the Indian economy will be built on the foundation of a cashless society, with both digital fiat and cryptocurrencies working in parallel.

Finovate: You are part of the founding team of CoinDCX. Can you tell us a little about the company, the market it serves, and the role it plays in helping pave the way for broader adoption of cashless technologies?

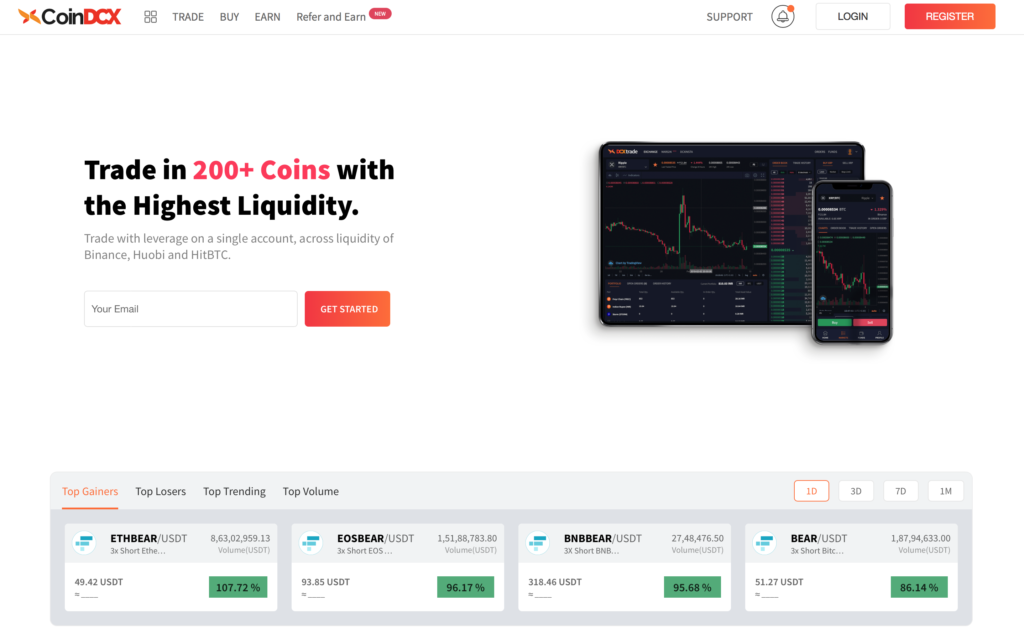

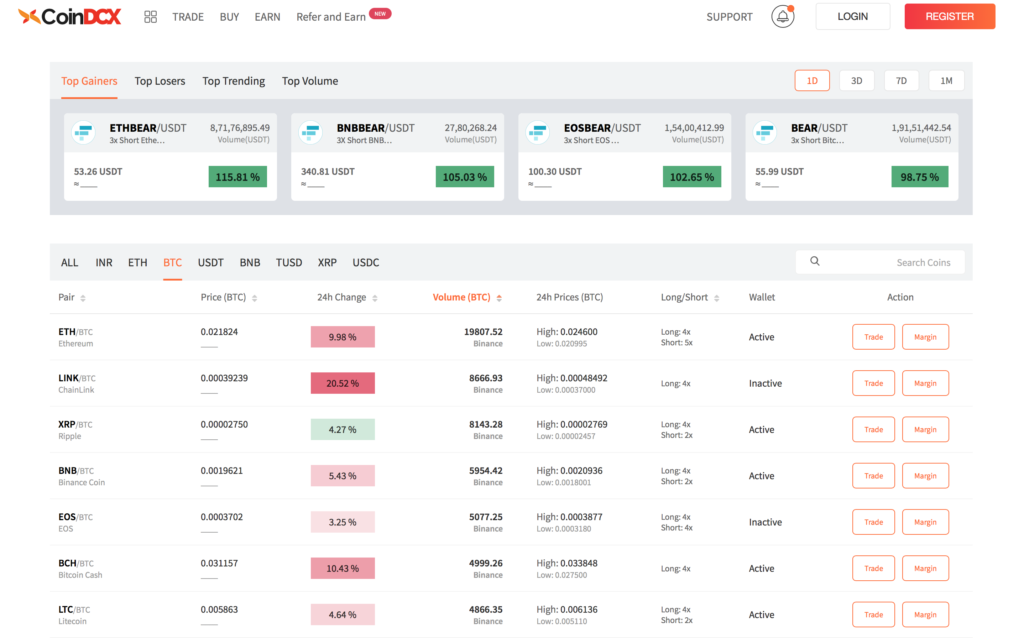

Khandelwal: CoinDCX specializes in crypto-enabled fintech services. Sumit Gupta and I founded CoinDCX in 2018, with a mission to connect billions of people to global financial markets. Today, CoinDCX is reputed to be India’s most trustworthy cryptocurrency trading platform and remains one of the strongest products in our service offerings. CoinDCX has empowered its traders with a bouquet of industry-first crypto-based products to trade better using liquidity from the world’s leading exchanges like Binance, Huobi Global and OKEx.

By bringing all crypto-trading products under a single roof, our products are designed to cater to all types of traders, keeping their experience, risk tolerance, and frequency of trading into consideration.

Our users have found the platform to be simple and effortless. Anyone can trade in 500+ markets with DCXtrade, convert their INR to cryptocurrencies and vice versa on DCXInsta, earn by lending their holdings with DCXlend, and leverage their trades up to 6X in 250+ Altcoins using DCXmargin.

Here is our weekly look at fintech around the world.

Asia-Pacific

- Alipay to encourage 40 million merchants and service providers to use its mini programs as competition with WeChat intensifies.

- Hong Kong will soon have a new challenger bank as Standard Chartered’s Mox Bank opens for business later this year.

- Southeast Asian ride-hailing firm turned super app company Grab to use Wirecard for payment processing.

Sub-Saharan Africa

- Visa and Nigeria-based mobile money platform Paga forge strategic partnership to bring more security and convenience to mobile payments.

- South African cloud platform builder Jini Guru teams up with product engineering firm Azilen Technologies to build fintech solutions for emerging markets.

- Modern Ghana features WorldRemit Country Manager Gbenga Okejimi on the country’s fintech industry.

Central and Eastern Europe

- Total Croatia News features Microblink in its look at Croatian companies making the Financial Times’ 100 Fastest Growing Companies in Europe roster.

- International Banker profiles Poland’s digital banking leader mBank.

- Hamburg, Germany-based lender Kreditech rebrands as Monedo

Middle East and Northern Africa

- Saudi Arabia Monetary Authority (SAMA) hires payments technology company HPS to provide a QR-based payments system.

- Orange Money goes live in Morocco after receiving authorization from the Bank Al Maghrib.

- Business Chief Middle East looks at the top 10 fintech startups in the Middle East and UAE.

Central and Southern Asia

- FamPay, a Bengaluru, India-based fintech that is building a payments network for teens, picks up $4.7 million in seed funding.

- Bloomberg Quint looks at the controversy over the Reserve Bank of India’s moratorium on Yes Bank and its impact on fintech companies in the country.

- My Republica asks whether or not India’s cashless revolution can be extended to Nepal.