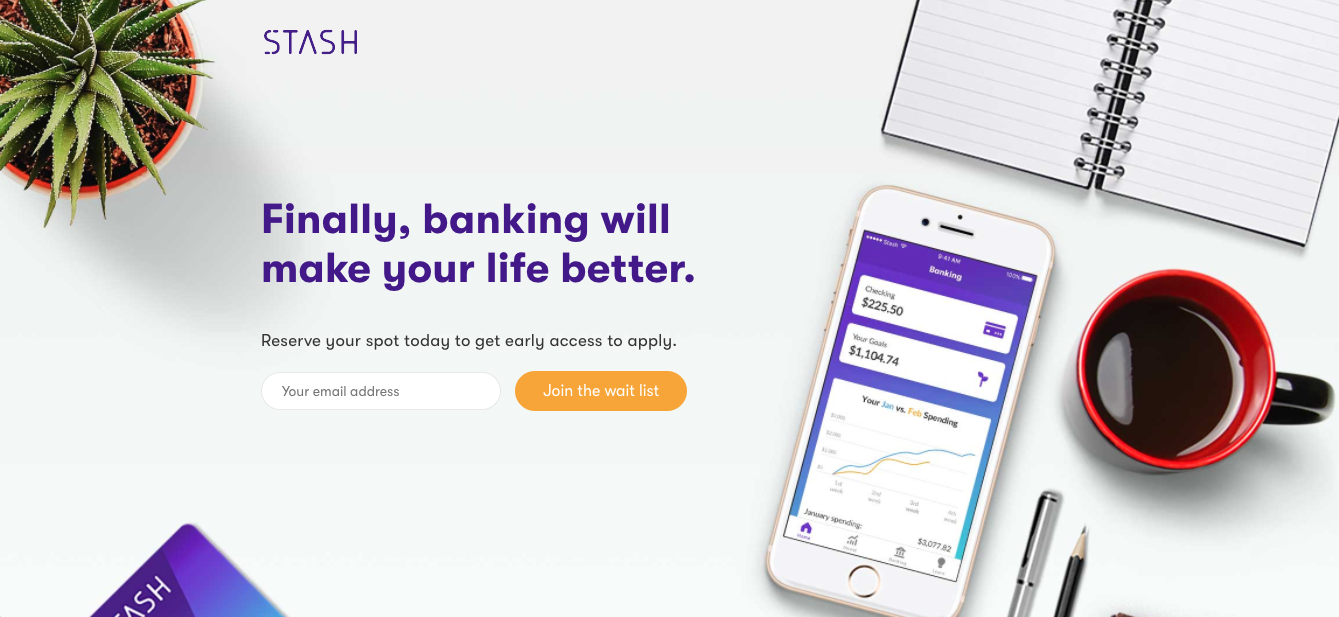

Mobile financial services company Stash first revealed its plans to launch banking services in October of last year, positioning itself as a challenger bank with mobile-centric investment and retirement capabilities. And, as with all U.S.-based challenger banks, Stash will house the funds at a traditional bank. Today, the New York-based company announced it has selected Green Dot and its subsidiary bank, Green Dot Bank, Member FDIC, to keep user’s funds safe.

Through the partnership with Green Dot, Stash will deliver debit cards with no overdraft fees and provide access to a network of free ATMs across the U.S. The app will also share insight into clients’ financial health, with actionable advice on spending, saving, investing, and retirement via Stash Coach. But don’t get too excited– Stash has yet to go live with the banking services and hasn’t hinted at its timeline or anticipated pricing.

In a statement, Brandon Krieg, CEO and cofounder of Stash, said: “Layering Green Dot’s robust Banking as a Service platform with Stash’s full suite of offerings will provide innovative, affordable tools to teach healthy financial habits, relieve financial stress, and help our clients save and invest more money.”

Founded in 1999, Green Dot debuted its own mobile-first banking service, GoBank, at FinovateSpring 2013. The account offers mobile banking, check deposit, and P2P money transfer services.

“Stash is committed to being a true partner and source of support for our clients, and for those who have systematically been left behind,” said Krieg. This sentiment is reflected in Stash’s updated mission which states, “We started Stash to simplify investing, but our true mission runs deeper. Today, your financial products too often fail you. We believe everyone should have access to financial education, technology, and services that help them achieve their life goals.”

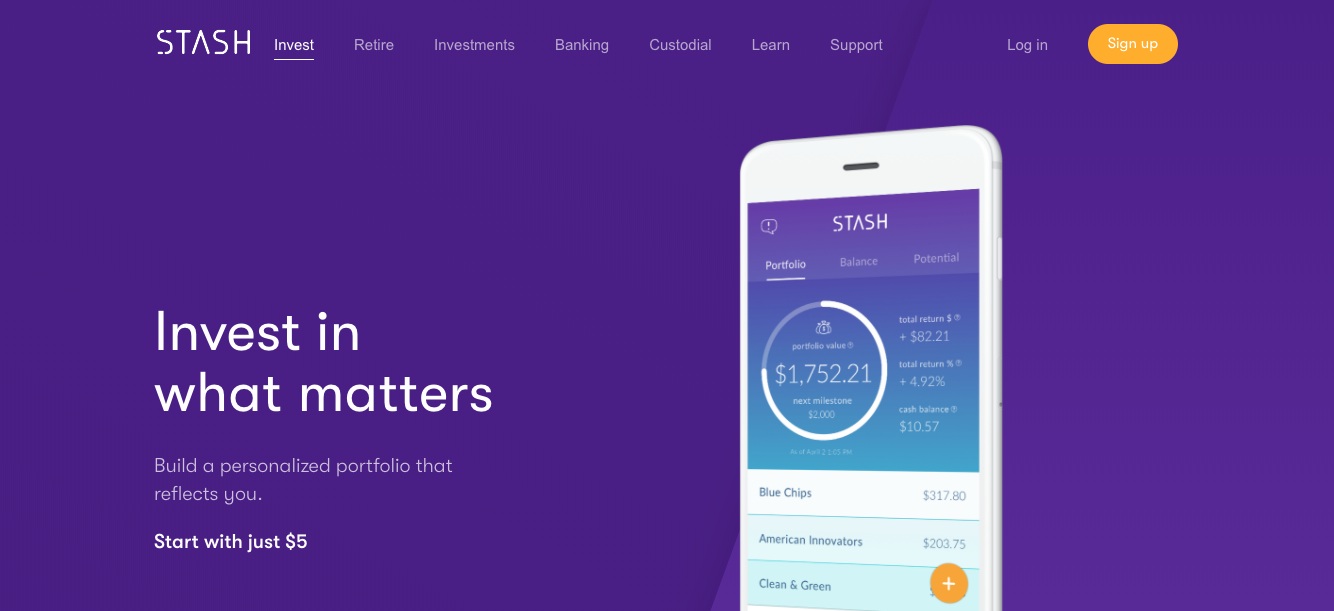

Founded in 2015, Stash serves two million customers on its mobile investment platform, which allows users to choose from a selection of over 40 curated ETFs. The company doesn’t collect add-on commissions or trading fees, and charges $1 per month for accounts under $5,000. Users with portfolios over that threshold pay 0.25% per year. Stash’s growth bodes well for future banking developments– the company currently has 40,000 new clients joining each week.

Krieg debuted Stash Retire at FinovateFall 2017. In November of 2017, KPMG and H2 Ventures named the company on its 2017 Fintech 100 list. In February of this year, Stash raised $37.5 million and unveiled custodial investment accounts to allow Stash clients to open new accounts for minors. This is a smart move from a customer acquisition standpoint. Young users exposed to the Stash app early will be more likely to matriculate as customers of Stash’s investment and (eventually) banking services.