U.S. peer-to-peer lending company Prosper launched a mobile app for investors on its platform this week called Prosper Invest.

The new app, which allows investors to manage their portfolios, offers a visually-rich view of their investments, allows them to transfer to and from their bank account, and shows a clean breakdown of their portfolio and annualized returns.

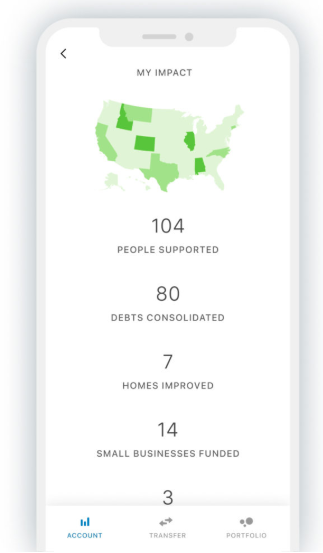

Unique to the app is an impact map that details how many borrowers the investor has funded. This feel-good feature also shows a high-level geographical view of investments and breaks down the total by each borrower’s stated loan purpose. Adding a more personal touch, the app shares individuals’ stories from Prosper’s #MyProsperStory contests. Held from 2014 to 2017, the annual contest encouraged users to share how the loan has impacted their lives.

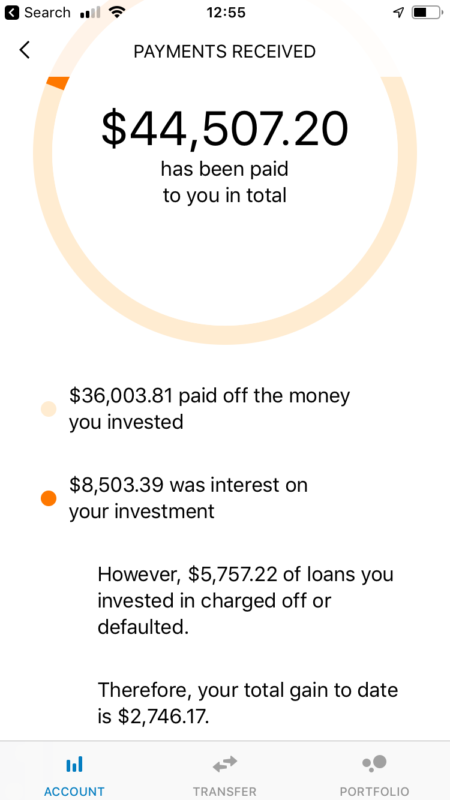

In my opinion, the most useful feature of the app details return on investment. The tool shows how much the investor has received in payments over the lifetime of their account and breaks it down by their principal and interest received. It even shows the default/chargeoff amount and net gain.

The native app, available on both Android and iOS, is quite a step up from the web-based app the company launched in 2012. Until this week, the web-based version of the site served as the only way for investors to manage their investments on-the-go.

Today’s app launch comes well after the brief existence of Prosper Daily, a borrower-focused mobile app that was born out of Prosper’s purchase of BillGuard for $30 million in 2015. Launched in 2016, the app was only available for a year before it shuttered in 2017. The launch of an investor-focused mobile app in the absence of a borrower-facing one may indicate Prosper currently has a higher balance of borrowers than investors. Peer-to-peer lending sites have often wrestled with the chicken and egg issue– they can’t get borrowers without enough lenders and they can’t attract lenders without enough borrowers.

Today’s launch isn’t the only release from Prosper we expect to see this year. In November of last year the company disclosed plans to unveil a Home Equity Line of Credit (HELOC) product that will streamline the application process and offer rates competitive to banks’ offerings.

Prosper presented at FinovateSpring 2009 as well as the inaugural Finovate in 2007. The company has raised a total of $410 million and is valued at $550 million.