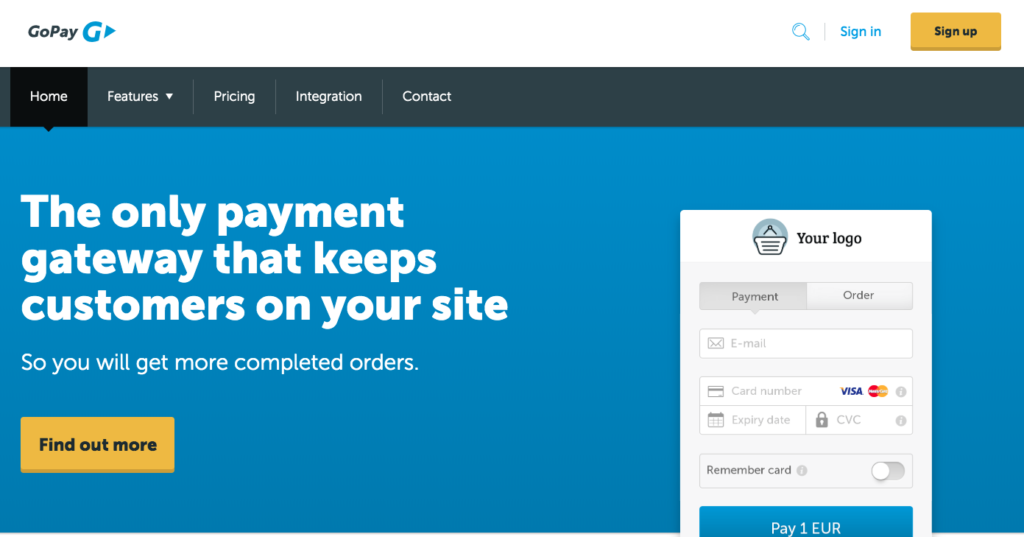

After sealing a transaction which gives it a 70% stake in China-based GoPay, PayPal has taken on a new role in the global payments services scene.

That’s because PayPal not only has controlling interest in GoPay but is also now licensed to offer online payment services in China, making it the first foreign company to be granted such license.

“We are honored to become the first foreign payment platform to be licensed to provide online payment services in China,” said PayPal CEO Dan Schulman. “We look forward to partnering with China’s financial institutions and technology platforms, providing a more comprehensive set of payment solutions to businesses and consumers, both in China and globally.”

The China opportunity represents major growth potential for PayPal. That’s because online payments in China are undergoing a growth spurt of their own. Between 2013 and 2018, online payment transactions in China doubled, topping out at $200 trillion.

The move gives PayPal an advantage over U.S. competitors, which have become not only more prolific but also more competitive since PayPal set up shop in 1998. However, the new territory also pits PayPal against some major new competitors. China-based competitors, Alibaba’s Alipay and Tencent’s WeChat Pay, make up 90% of the region’s mobile payment market.

Financial terms of the deal, which marks PayPal’s 19th acquisition, were not disclosed.

PayPal showcased its Instant Account Creation feature at FinovateFall 2012. The company has a market capitalization of $118 billion.

We highlighted an overview of current stats and trends in the Asian fintech scene in a blog post yesterday. The best way to learn more about fintech in Asia is to attend FinovateAsia, taking place in Singapore October 14 through 15.