Brazilian fintech Nubank announced this week that the company will begin offering digital accounts in addition to its credit card business. The move will provide access to billpay, account-to-account transfers, and the ability to earn more in interest than is available with a regular savings account. “Our real revolution begins today,” Nubank founder and CEO David Velez said. “Now we are offering services to 100 percent of Brazilians.”

ZDNet reports that the new solution, NuConta is currently in beta and is expected to be rolled out to Nubank’s current 2.5 million credit card customers once beta testing is complete. The company hopes to make the accounts available to everyone “from the first quarter of 2018.”

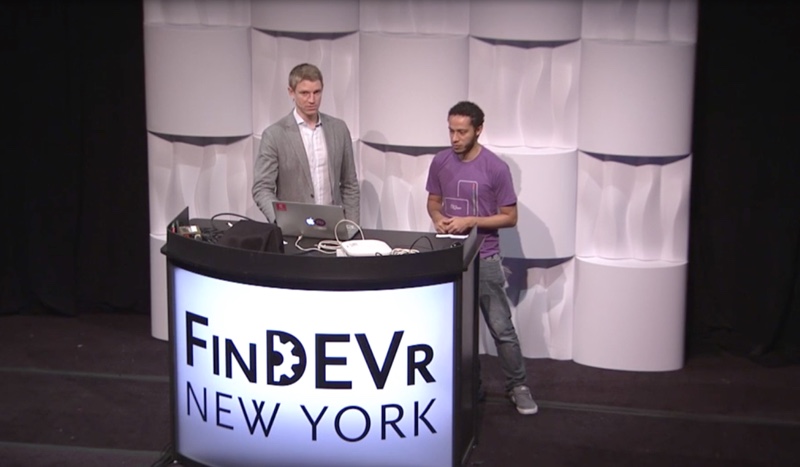

Left to right: Nubank Co-Founder and CTO Edward Wible and Lead Software Engineer Lucas Cavalcanti presenting “Our Money, Our Rulebook” at FinDEVr New York 2016.

The decision helps Nubank bring banking services to the large population of underbanked consumers in Brazil – as many as 60 million without bank accounts. It also could enable the company to narrow the gap between the number of individuals who have applied for Nubank credit cards since the company launched and the 2.5 million who have actually signed on. The NuConta accounts will require neither maintenance fees nor credit checks, and deposits will be tied to interest-bearing government securities. Debit cards and the ability to withdraw cash will not be offered initially, but could be added based on customer demand, Nubank’s Velez said. NuConta accounts will also be mobile-centric, the company said, taking advantage of Brazil’s high rate of mobile internet and smartphone use.

Founded in 2013 and headquartered in Sao Paolo, Brazil, Nubank presented Our Money, Our Rulebook at FinDEVr New York 2016. At the conference, Nubank Co-Founder and CTO Edward Wible and Lead Software Engineer Lucas Cavalcanti showed how building an in-house double accounting system enabled them to gain real-time, customer-level accounting visibility and insight. In August, Nubank raised $139 million in debt financing (R$455 million) from Fortress Investment Group and Goldman Sachs. The company’s last equity round of funding was last December, when Moscow-based venture capital firm DST Global led Nubank’s $80 million Series D.