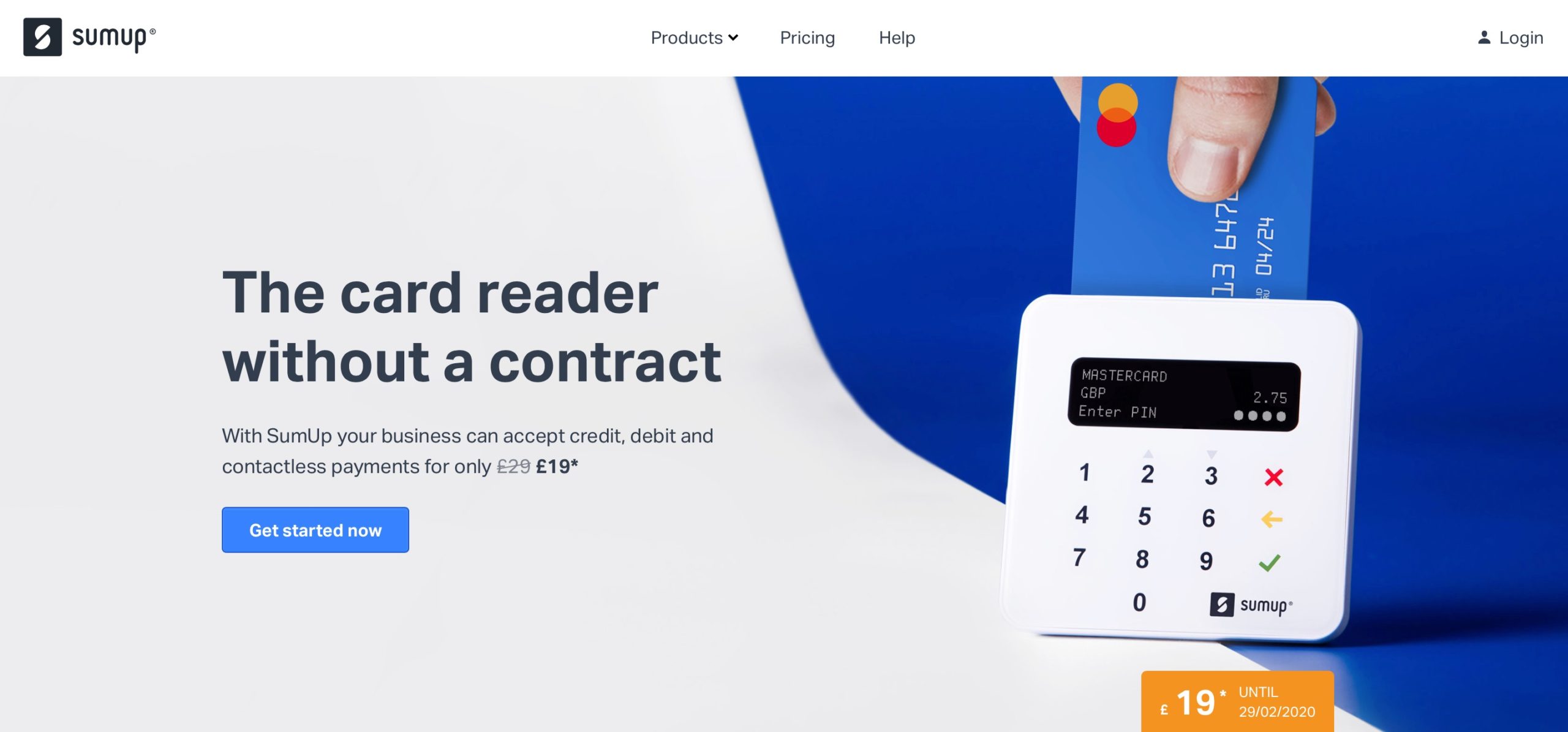

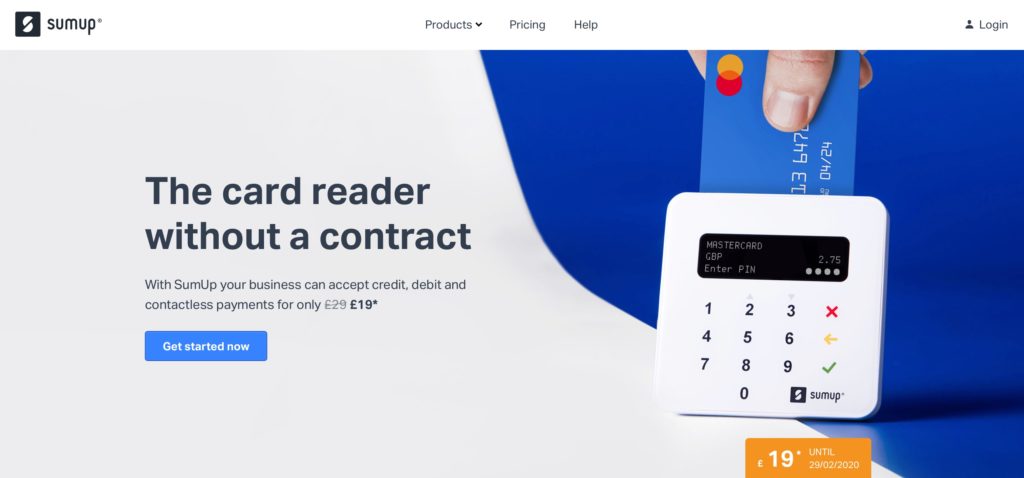

The company that has helped bring fintech innovation to e-commerce with its mobile point-of-sale (mPOS), card reading solutions now offers merchants a card of their own.

SumUp announced this week the launch of the new SumUp Card. In partnership with Mastercard, the new card will make business payments easier for merchants, giving them both faster access to their funds, as well as enhance their ability to monitor their accounts.

When merchant cardholders accept payments via their SumUp readers, the payments will now flow directly to their SumUp Card. The card guarantees next-day payouts including on weekends, has no upfront cost or monthly fee, and offers free overseas payments. Available initially in the U.K., Italy, Germany, and France, the SumUp Card will be expanded to other markets over the course of the year.

The card comes in the wake of consultations with the company’s SME partners, as well as a successful beta-test with more than 25,000 merchants. The partnership with Mastercard reprises a collaboration the two firms undertook last summer which was designed to boost the number of electronic payment acceptance locations in 27 markets in Europe. The company noted in its statement that the card makes SumUp a more comprehensive solution for SMEs by facilitating “both the making and taking of payments.”

“Since launching our first reader, we have been dedicated to empowering merchants so they can focus on making their business as successful as possible,” SumUp co-founder Marc-Alexander Christ said. “We had this in mind when we designed our latest product, with the SumUp Card being a smart solution so we can continue being the driving force behind small businesses across the globe.” He referred to the new offering as “a small card for big ideas.”

SumUp was founded in 2001. The small business payments facilitator offers a variety of solutions that provide merchants with inexpensive payment acceptance options wherever their business is. The U.K.-based company has raised more than $425 million in total funding, most recently securing €330 million ($356 million) in debt financing. An alumni of FinovateEurope 2013, SumUp forged a partnership with German challenger bank Penta in December, and collaborated with U.K. challenger bank Starling Bank in July.

Read more about challenger banks in Europe in our recent features on top challenger banks in Germany and how venture capital is impacting the growth of the industry across the continent.