With the support of PayU and Microsoft’s venture capital division M12, digital assets startup Bakkt has picked up a whopping $300 million in Series B funding. The round, which closed last Friday, also featured participation from Boston Consulting Group, Goldfinch Partners, CMT Digital, Pantera Capital, and Intercontinental Exchange (ICE), Bakkt’s parent company.

“Bakkt launched two years ago with the vision of building trust in and unlocking the value of digital assets for institutions and consumers alike,” company CEO Mike Blandina wrote in a blog post earlier this week. He pointed to the company’s launch last year of its end-to-end regulated market for bitcoin, as well as its institutional bitcoin custody offering, as examples of how the Atlanta, Georgia-based startup has been “focused on delivering that vision.”

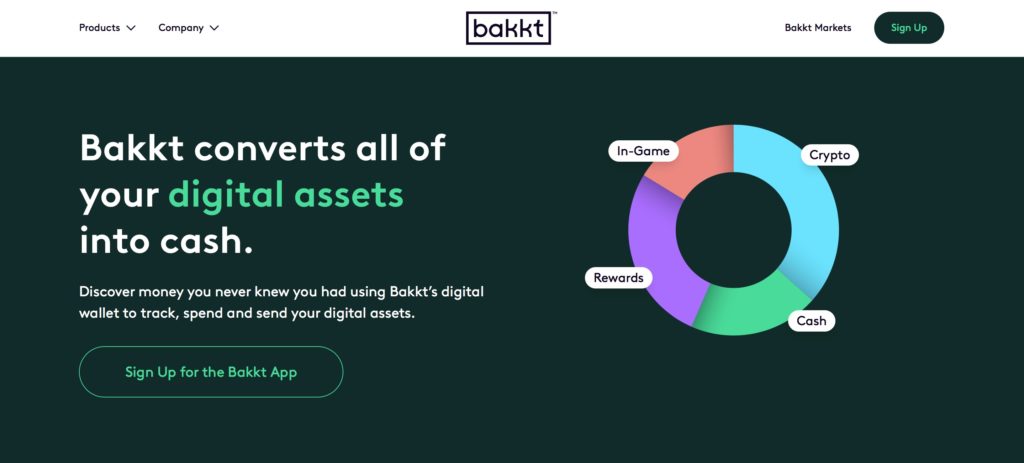

These examples will soon also include a new app, slated for a summer launch, that will enable users to maximize the value of a widening variety of digital assets – from loyalty and rewards points to cryptocurrencies.

“Bakkt gives users control over their digital assets,” Blandina wrote. “Whether it’s miles from your favorite airline, loyalty points from the local grocery store, or bitcoin you’ve purchased, the Bakkt app enables you to aggregate all of these assets into a single digital wallet.”

The funding takes the company’s total capital to more than $482 million, and adds to its more than $1 billion valuation. Proceeds from the Series B will be used to help fund parent company ICE’s acquisition of loyalty solutions provider Bridge2 Solutions. Bakkt will leverage Bridge2 Solutions’ partnership network, and its Loyalty Pay offering, to help build and launch products of its own.

Powering more than 4,500 loyalty and incentive programs, including programs for seven out of the top ten financial institutions and two of the largest U.S. airlines, Bakkt was founded in 2018.