Continental challenger banks like N26 may be pulling away from the U.K. market. But that is only creating room for newcomers like London’s social payments app B-Social which has raised $10 million (£7.8 million) en route to its transformation into Kroo, a fully-licensed bank.

The funding, part of a seed round, brings the company’s total capital to more than $17.8 million (£13.25 million). Participating in the round was Karlani Capital’s Rudy Karsan, along with additional undisclosed investors.

“Our seed 2 funding round is another key milestone towards building the greatest social bank on the planet and changing the relationship people have with money for good,” B-Social CEO Nazim Valimahomed wrote on the company’s blog. He noted that B-Social has signed up more than 9,000 users and will soon introduce functionality to enable account funding via bank transfer. Valimahomed also added that the company plans to double the size of its team at its headquarters in Holborn.

Most significantly, the investment will help B-Social as it transitions into becoming a bank, to be called Kroo. Valimahomed said that the company is currently in the final, pre-application phase for obtaining a U.K. banking license and hopes to finish the application process “in the very near future.” He referred to the rebrand as a change to an “exciting new brand that fully embodies who we are – intuitive, talented, empowering, social, and collaborative.”

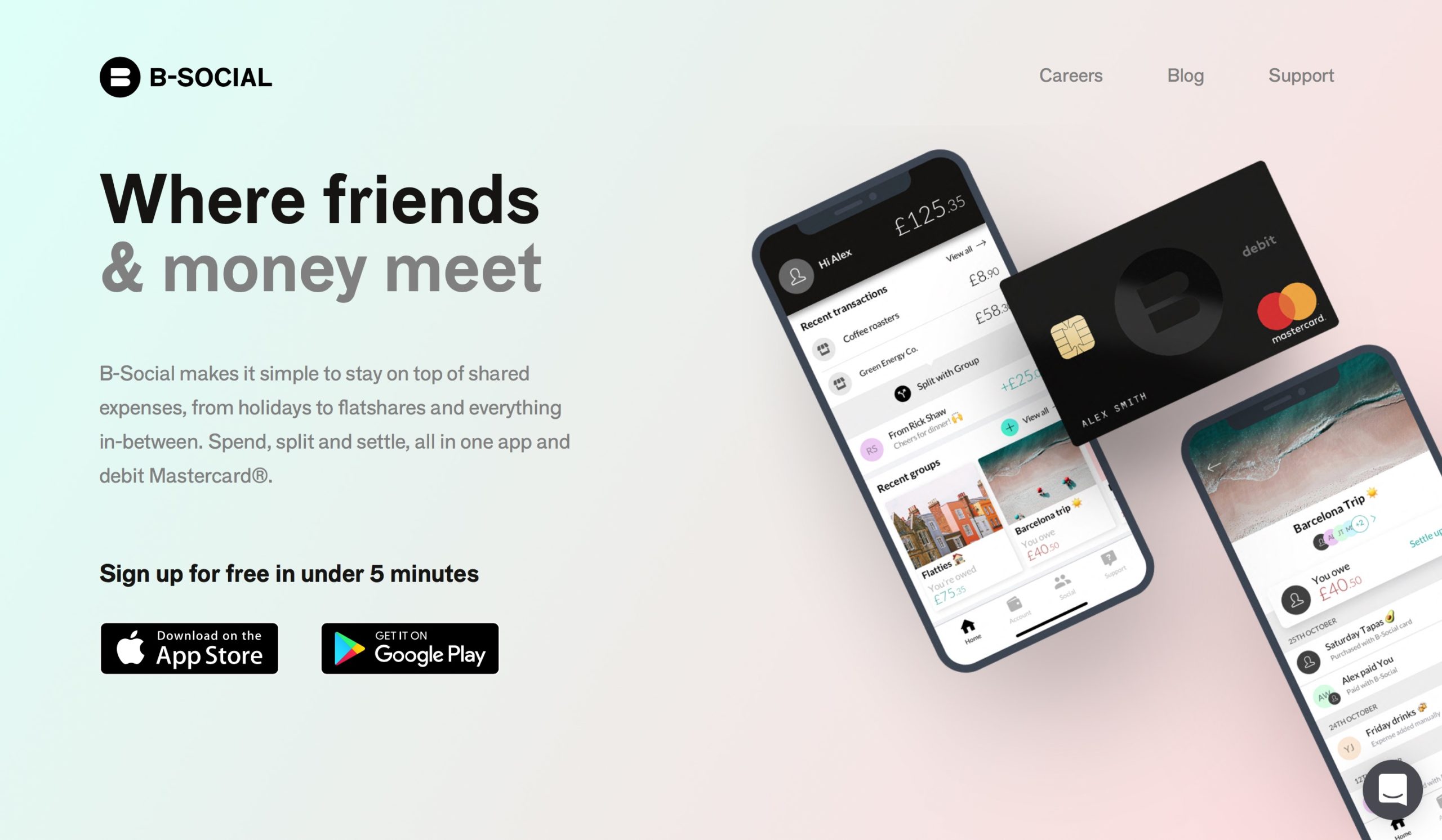

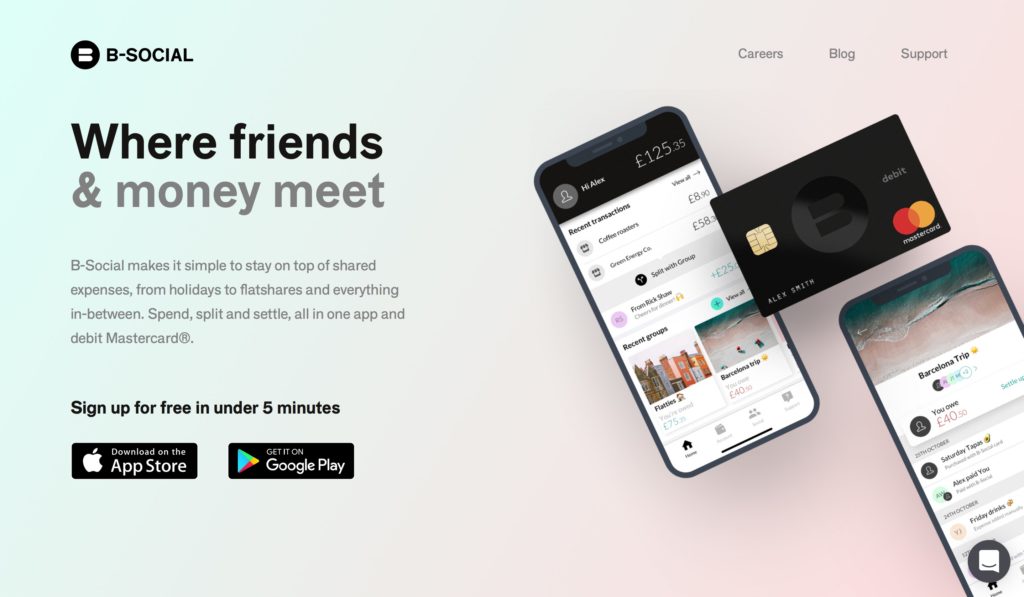

Founded in 2016, B-Social helps users manage shared expenses. The company’s app, available in both iOS and Android, supports bill splitting and group expense tracking, and instant payments between B-Social account holders. The solution also comes with a contactless debit Mastercard that can be used, fee free, both at home and abroad wherever Mastercard is accepted.