Pure-play loyalty and rewards startups face a challenging battle: the need to please two masters, banks and merchants.

Location-based, loyalty platform Larky has been up to the challenge since its founding in 2012. The startup recently expanded its client base to include three additional credit unions:

- Wisconson-based Summit CU

- Maine Savings FCU

- Utah-based Goldenwest CU

The inclusion of Maine Savings FCU is a significant benchmark for Larky as it now reaches coast-to-coast across North America. Company co-founder Gregg Hammerman says Larky recently signed its first client in Canada and anticipates further international expansion. He notes the momentum being gained with financial institutions across North America, and reports that over the past year, Larky has made dozens of meaningful product improvements to meet the needs of credit unions that want to boost member loyalty and retention.

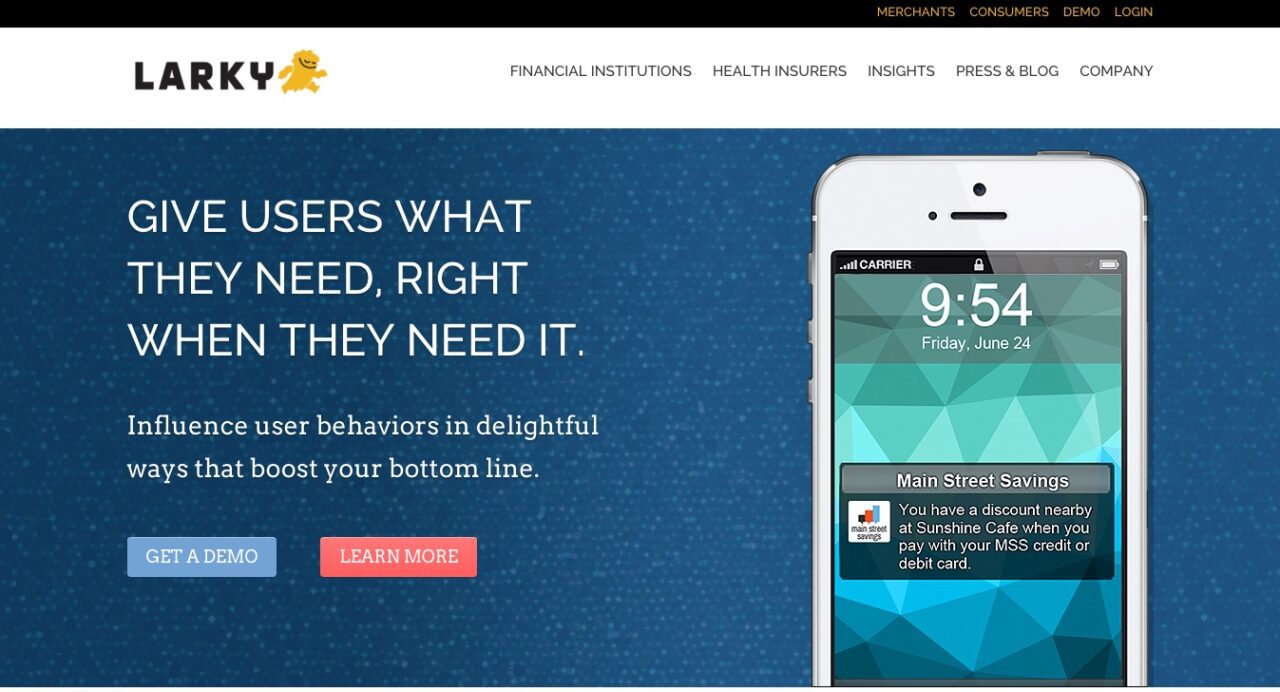

The Ann Arbor-based company’s web-and-mobile loyalty platform offers users discounts at the point of sale of both local and national merchants. The location-based, bank-branded alerts help banks stay top-of-wallet while offering users instant savings without changing their purchasing behavior.

When asked about the company’s plans for 2016, Hammerman noted Larky’s focus on refining how it serves up location-based notifications, and to further hone the company’s niche in customizable notifications.

Larky’s co-founders Andrew Bank and Gregg Hammerman demoed at FinovateFall 2014 in New York.

Larky’s co-founders Andrew Bank and Gregg Hammerman demoed at FinovateFall 2014 in New York.

Since its appearance at FinovateFall 2014, Larky has expanded the types of industries it serves, adding paid pilots with publishers, health insurance providers, and other verticals.