This post is part of our live coverage of FinovateSpring 2015.

![]() Kofax showed how its Mobile Capture Platform onboards customers in real time:

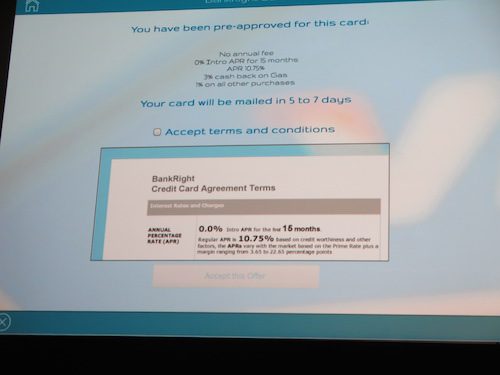

Kofax showed how its Mobile Capture Platform onboards customers in real time:

Kofax is demonstrating how its Mobile Capture Platform can onboard customers with the right product at the right time with the right risk-assessment profile in a completely automated fashion. The mobile account-opening solution incorporates mobile-image capture, authentication, workflow, real-time decisioning, product selection, and digital signature capture to “seal the deal.” Kofax’s platform combines the speed and convenience of mobile to enhance the user experience, with the security and confidentiality of a traditional branch experience. This is the only platform in the market that incorporates all of the critical components needed to make real-time, intelligent and risk-balanced decisions using a mobile device.

Presenters: Diane Morgan, senior business development manager, and Dimitri Snowden, solutions architect

Product Launch: January 2014

Metrics: Subsidiaries in 30 countries; 1,200 employees; 800+ channel partners; products available in 70+ countries; 20,000+ customers; NASDAQ & London Stock Exchange (KFX); $266.3M in revenue; $46.3M adjusted EBITA

Product distribution strategy: Direct to Business (B2B), through financial institutions

HQ: Irvine, California

Founded: January 1985

Website: kofax.com

Twitter: @Kofax