Managing a relationship is stressful enough without introducing unnecessary miscommunications about day-to-day spending. This is one reason why many couples maintain separate spending accounts with pre-defined responsibilities (e.g. you pay the rent, I’ll pay the utilities, etc.). But that doesn’t alleviate the need to communicate, especially when one person has more “discretionary” funds. And separate accounts can lead to more trouble if one person is more of a free spender than the other, or if one has more trouble avoiding overdrafts and/or tapping out accounts well in advance of payday.

Joint accounts have the advantage of keeping funds in a single bucket which is statistically easier to keep above zero compared to stretching funds across two or more accounts. And joint accounts by definition require the couple to work together as a team to manage spending. But many couples, especially early on, aren’t entirely ready to cede “control” over their paychecks. Overall, it’s an area ripe for disagreements and resentment.

That’s why we love Simple’s best-of-both-worlds solution, the Simple Shared plan which offers 3 accounts: an individual spending account for each person, along with a joint account for the pair. While that’s a great foundation, it still doesn’t address the day-to-day communications necessary to keep both partners on the same page.

Enter the newest PFM player, HoneyDue (formerly WalletIQ), currently toiling away in Y Combinator’s summer class (S17). After a stint as one of Apple’s favorite apps in May, the company already has 20,000 registered users, 60% of which are female. The app debuted on Product Hunt two days ago, and was the most popular product of the day (currently 820 upvotes) and so far is fifth highest of the week. You’ll be hearing more about them in two weeks when they officially debut at the incubator’s demo days (Aug 21-23).

Enter the newest PFM player, HoneyDue (formerly WalletIQ), currently toiling away in Y Combinator’s summer class (S17). After a stint as one of Apple’s favorite apps in May, the company already has 20,000 registered users, 60% of which are female. The app debuted on Product Hunt two days ago, and was the most popular product of the day (currently 820 upvotes) and so far is fifth highest of the week. You’ll be hearing more about them in two weeks when they officially debut at the incubator’s demo days (Aug 21-23).

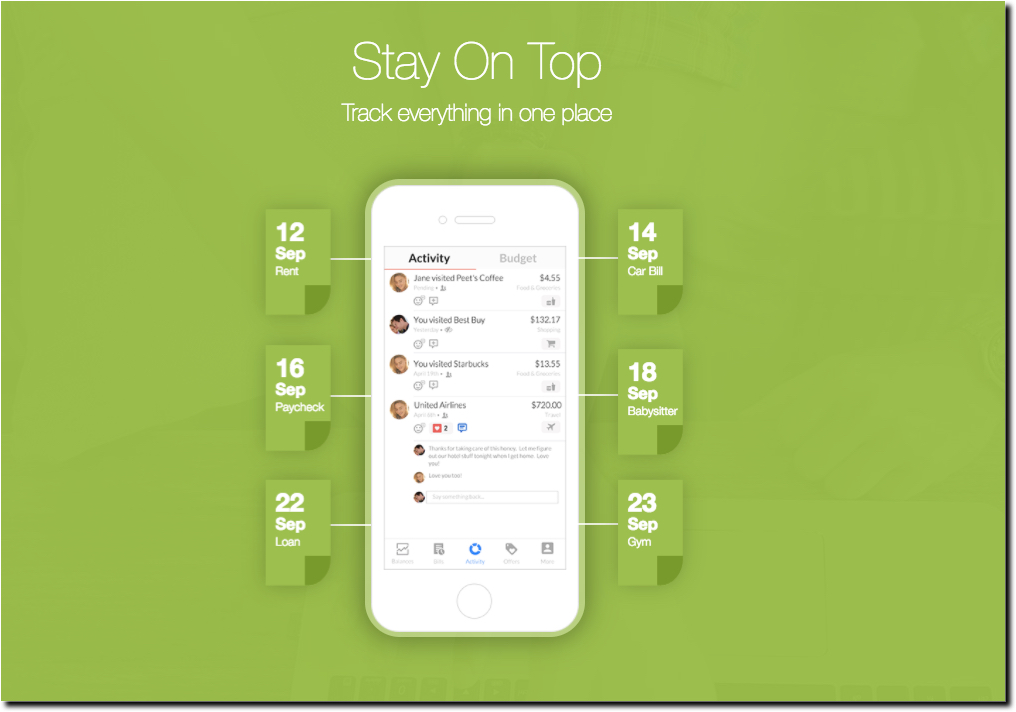

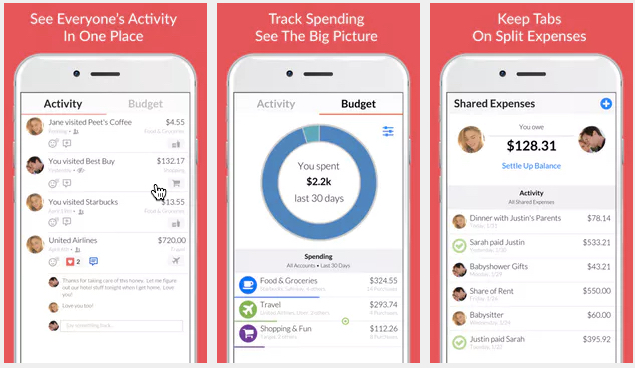

HoneyDue uses Yodlee (probably) to aggregate transaction accounts across multiple FIs into one mobile app. Then it provides tools to make it easy to annotate expenses and communicate with each other about what they were.

Bottom line: Collaborative spending tools are an attractive account management option that absolutely should be offered by every bank, credit union, card issuer and PFM provider. HoneyDue is a good example of how the UI can work. And banks, consider joining the company’s seed round, if only as an R&D effort (strategic seed investing).