In the financial services sector, artificial intelligence (AI) is often heralded as a transformative force capable of revolutionizing everything from customer engagement to fraud detection. However, as the excitement around AI continues to grow, so do the challenges associated with its implementation. According to the latest McKinsey Global Survey on AI, AI adoption is accelerating, with 72% of organizations using AI in at least one business function in 2024, up from 50% in previous years. However, the challenges of achieving tangible business value remain substantial. The survey highlights that organizations need to focus on aligning AI projects with strategic business goals to achieve success (McKinsey, “The State of AI in Early 2024”).

The journey to successful AI implementation in financial services is not about jumping on the latest technology bandwagon; it is about identifying core business challenges, choosing the right AI strategy, and following a robust engagement methodology. Here’s how financial institutions can move beyond the AI hype and achieve real, measurable business value.

1. Start with the business challenge, not the technology

The key to successful AI deployment begins with a comprehensive understanding of the specific business problems that need to be addressed. Too often, organizations are drawn to AI’s potential without a clear roadmap for its application, leading to projects that flounder in development or fail to deliver a return on investment (ROI). McKinsey notes that “the business goal must be paramount,” emphasizing the importance of identifying the most promising business opportunities and working backward to potential AI applications rather than pursuing tech for tech’s sake (McKinsey, “The State of AI in Early 2024”).

For financial institutions, this means asking critical questions: What are the pain points that, if resolved, would yield the most significant benefits? Whether it’s enhancing customer engagement, improving fraud detection, or optimizing operational efficiency, defining the challenge upfront ensures that AI initiatives are grounded in strategic business needs rather than technological fascination.

2. Evaluate: build, buy, or partner

Once the business challenge is identified, the next step is to determine the most effective strategy for deploying AI. This involves a critical decision: whether to build a custom solution, buy an existing one, or partner with an AI expert.

- Build: Custom solutions offer the highest degree of specificity and alignment with unique business processes, but they require significant time, resources, and in-house expertise. For institutions with complex, industry-specific needs, building an AI solution may be the most effective approach, but it also carries the highest risk.

- Buy: Off-the-shelf solutions provide a faster route to deployment and can be cost-effective for common challenges. However, they may not offer the flexibility needed to adapt to specific business environments. McKinsey’s latest research shows that while 50% of organizations are using off-the-shelf generative AI models, the high performers are increasingly moving toward significant customization or developing proprietary models to meet specific needs (McKinsey, “The State of AI in Early 2024″).

- Partner: Partnering with a specialized AI consultancy, like Intelygenz, allows organizations to leverage deep technical expertise and experience while focusing on rapid implementation. A trusted partner can guide institutions through the complexities of AI deployment, ensuring that the solution is tailored to deliver the maximum business impact. This approach combines the benefits of both build and buy strategies, mitigating risks and accelerating time to value.

3. Implement with a proven engagement methodology

The pathway from AI concept to value realization is rarely linear. To navigate this complexity, financial institutions need a structured, end-to-end engagement methodology that enables rapid development and deployment while ensuring alignment with strategic objectives. Accenture’s “Tech Vision 2024” report emphasizes that adopting an agile, iterative approach to AI deployment enables organizations to see faster returns on investment and adjust quickly to evolving business needs (Accenture, “Tech Vision 2024″).

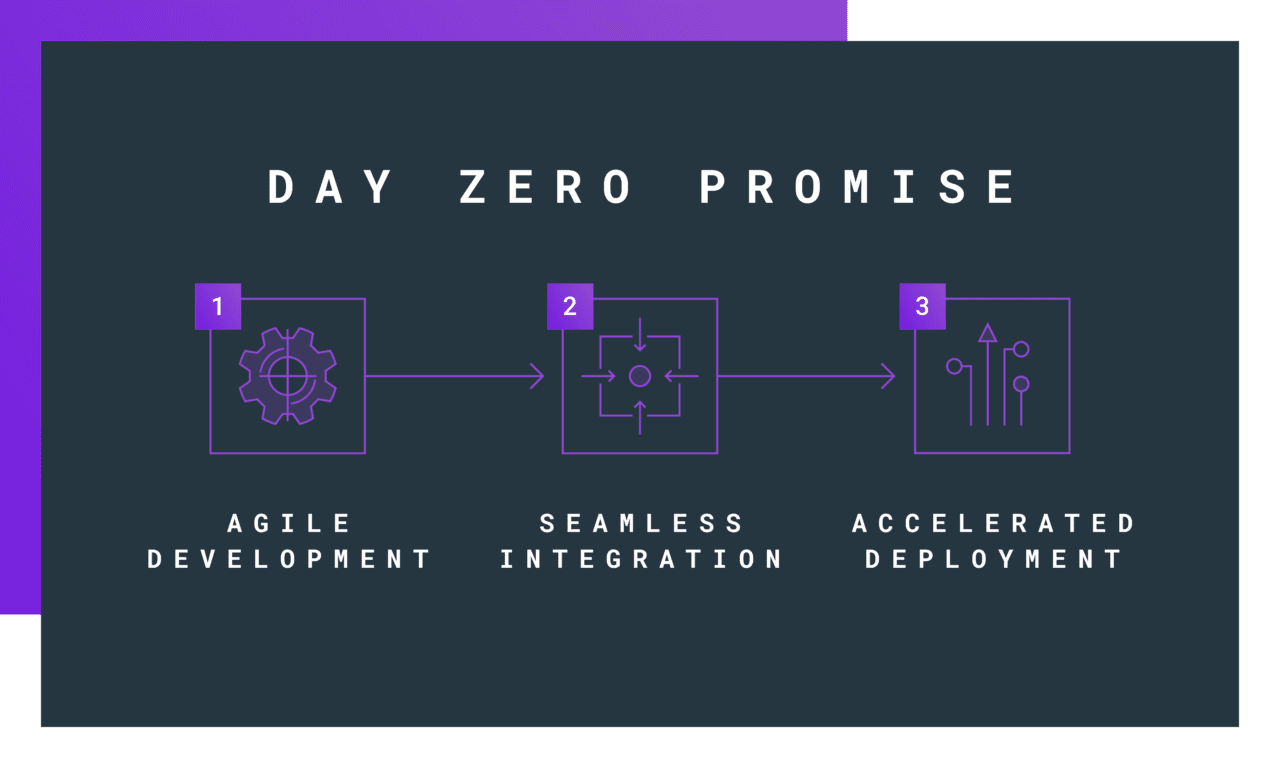

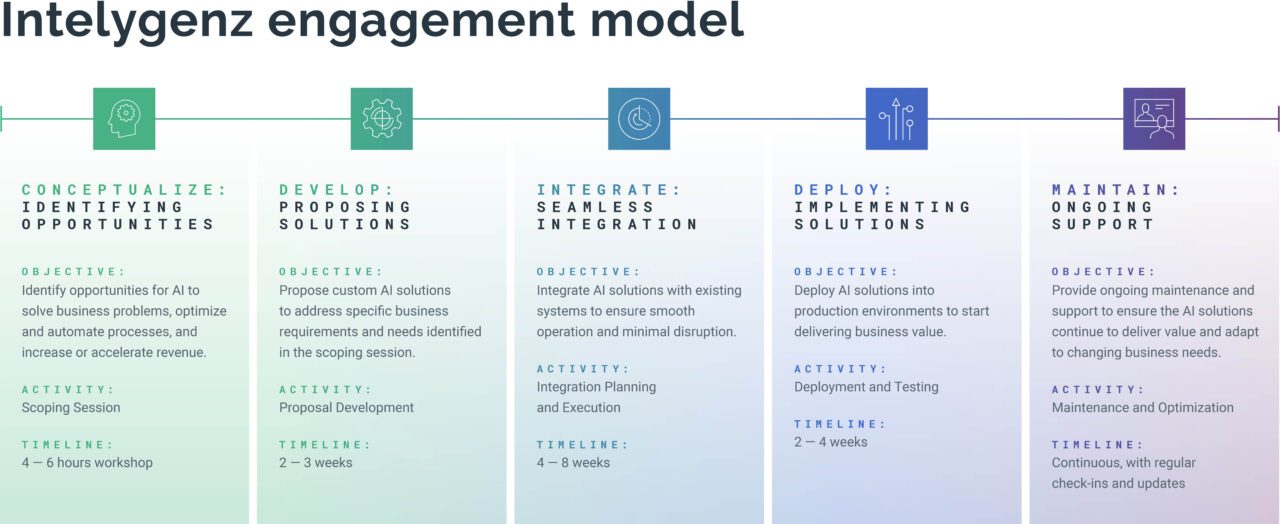

Intelygenz’s “Day Zero Promise” embodies this approach. Our methodology begins with a rigorous scoping session to align AI projects with strategic business outcomes from the very beginning. This is followed by:

- Agile Development: An iterative approach that allows for continuous refinement and adaptation of AI solutions to evolving business needs.

- Seamless Integration: Close collaboration with internal IT and business teams ensures that AI solutions integrate smoothly with existing systems and workflows.

- Accelerated Deployment: Fast-tracking the time to value by deploying AI solutions in a matter of weeks, not months or years.

By maintaining a relentless focus on delivering measurable ROI, Intelygenz helps financial institutions avoid the common pitfalls of AI implementation and ensures that AI initiatives contribute directly to business growth.

4. Focus on flexibility and cost-efficiency

For many financial institutions, one of the barriers to AI adoption is the perceived cost and complexity. However, AI does not have to be prohibitively expensive or rigid. Intelygenz positions itself as a more flexible and cost-efficient alternative to top-tier AI companies. We deliver high-quality AI solutions without the overhead and rigidity often associated with larger providers, making us an ideal partner for organizations looking to innovate while managing costs.

5. A collaborative approach to AI success

AI projects are not just technical endeavors; they are fundamentally business transformations. A collaborative approach between the AI partner and the organization is crucial for success. At Intelygenz, we engage closely with our clients throughout the entire process, ensuring that every AI solution is not only technically robust but also aligned with the organization’s strategic goals. This partnership approach has led to real-world success stories where financial institutions have transformed AI from a buzzword into a business-critical capability.

Learn More at FinovateFall

For financial services leaders looking to leverage AI effectively, the path to success involves a thoughtful strategy that prioritizes business value over technology for technology’s sake. At FinovateFall, Chris Brown, President of Intelygenz USA, will delve deeper into these themes during his keynote session, ‘Beyond the Hype: Delivering Real Business Value with AI in Financial Services’. Attendees will learn how to identify the right business challenges, evaluate strategic options for AI deployment, and implement solutions that drive tangible ROI.

Join us on day two of FinovateFall to gain actionable insights and see how Intelygenz’s expert consultancy and implementation services can help your institution harness the true potential of AI.