Finovate came back strong this morning, with excellent keynotes and a solid round of fintech demos.

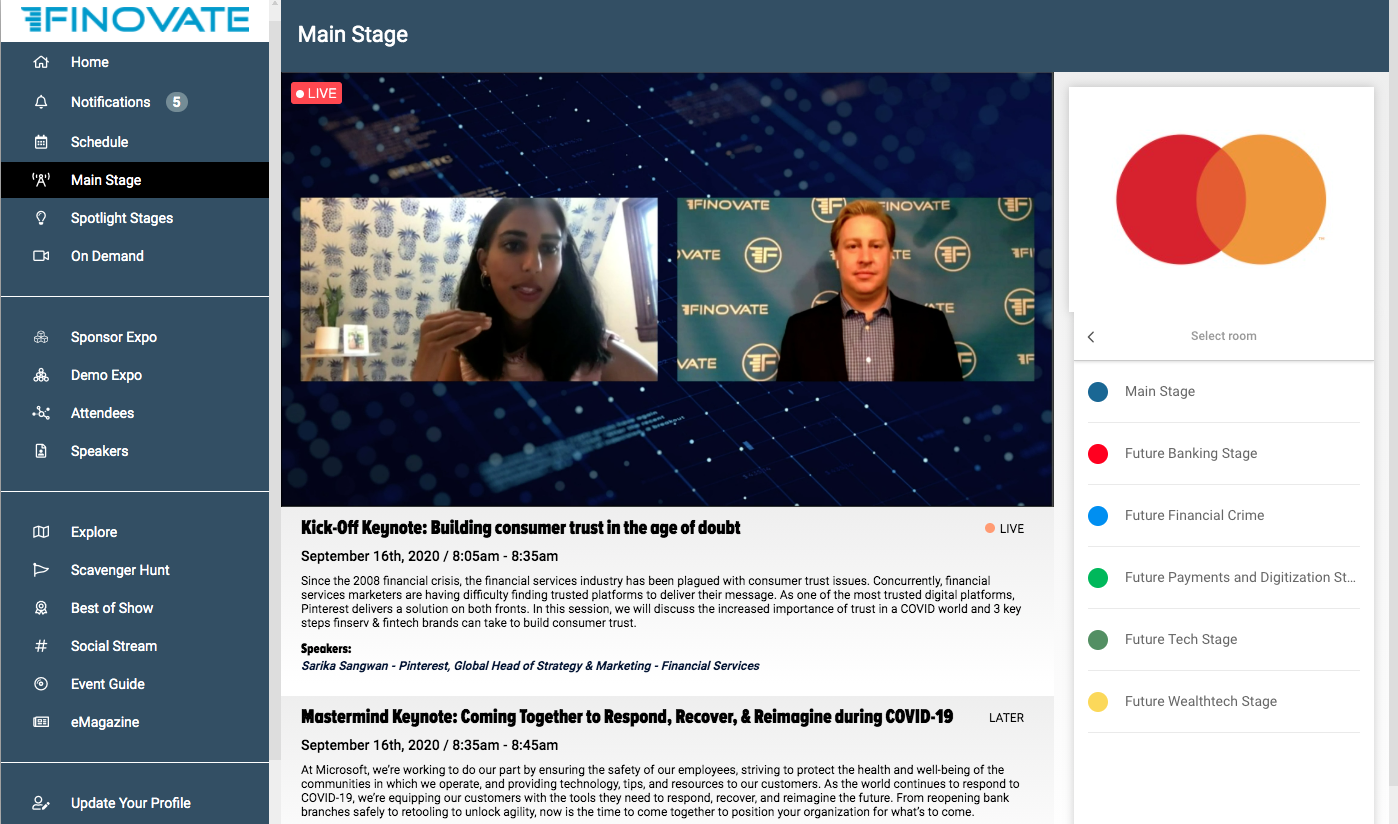

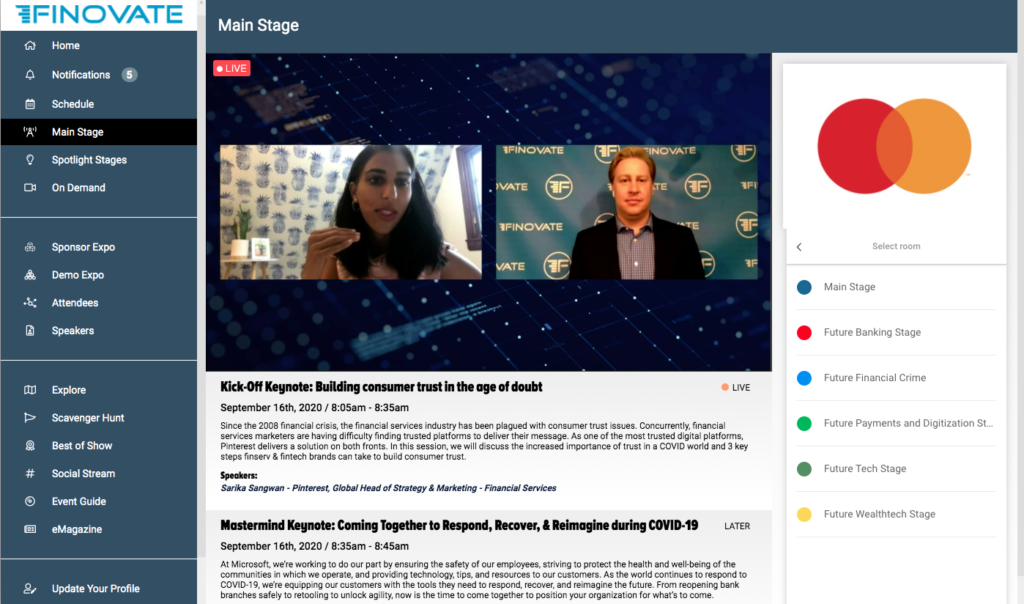

Sarika Sangwan, Global Head of Strategy and Marketing- Financial Services at Pinterest kicked things off with her keynote on building consumer trust in the age of doubt. She illustrated that the best way to build trust is with intentionality and purpose. Sangwan encouraged banks to put the customer first and allow that to drive every decision they make.

The next keynote of the morning featured Tom Feher, Banking Industry Executive of U.S. Financial Services at Microsoft, who spoke on coming together to respond, recover, and reimagine during COVID-19. Feher showcased a range of solutions to help firms return to in-person operations in the midst of the pandemic. He pointed out that low code and no code solutions can not only help organizations respond to issues faster, but also reduce costs.

Today’s final keynote speaker was Paul Rohan, Head of Business Strategy- Finance at Google Cloud on how open banking is 21st century branch banking. Rohan’s discussion combined technology, sociology, and history to consider how banks can change their belief systems (as well as their computer systems) to move into a more open approach that embraces third parties.

Following this was the last set of demos:

- Authoriti showcased the Authoriti Network that helps create new ways of preventing identity theft, fraud, and misuse of data.

- Cirrus Secure demoed its cloud-based collaboration hub that impacts a lender’s bottom-line by creating efficiency in place of document chaos.

- KioWare presented its touchless kiosk environment that enables kiosks to be converted to touchless operation without expensive new hardware.

- Cinchy showed off its real-time Data Collaboration Platform that helps financial service providers solve data integration, data access, data governance, and solutions-delivery challenges.

- Lenderfit demoed how it helps lenders close more commercial loans faster.

- Glia showcased its digital customer service platform that connects financial institutions to their customers using chat, voice, video, cobrowsing and AI.

- Illuma Labs demoed passive voice authentication for call centers to help banks elevate the user experience, enhance security against fraudsters, and improve operational efficiency.

- Envestnet |Yodlee presented its data aggregation and analytics platform that provides innovation and insights for financial service providers.

- Microsoft showcased tools to help firms protect their workforce during each phase of the return to the workplace — and beyond.

- Horizn demoed how it helps financial institutions dramatically accelerate digital adoption with customers and employees.

Wrapping up today’s show were the Mastercard Priceless Pitches, three-minute pitches from Mastercard’s Start Path participants, including:

- Previse showed how it leverages AI to power B2B payments and make B2B commerce more efficient.

- Doconomy presented how it helps consumers calculate the carbon footprint of every transaction they make and offset and reduce their carbon footprint.

- Enveil showed how it protects data-in-use to enable secure and private data sharing, search, and analytics.

- vCita presented how it powers small business by offering them tools to manage their money, time, and clients to grow their business.

Tomorrow we’ll kick off our discussion days with another conversation at our interactive networking session, Meet at the Cafe. Afterwards we’ll feature insightful keynote presentations and breakout panels. Stay tuned!