As a payments platform, WePay conducts business in a battlefield of daily security concerns.

As a payments platform, WePay conducts business in a battlefield of daily security concerns.

Founded in 2009, WePay offers online marketplaces, crowdfunding platforms, and small businesses two main products:

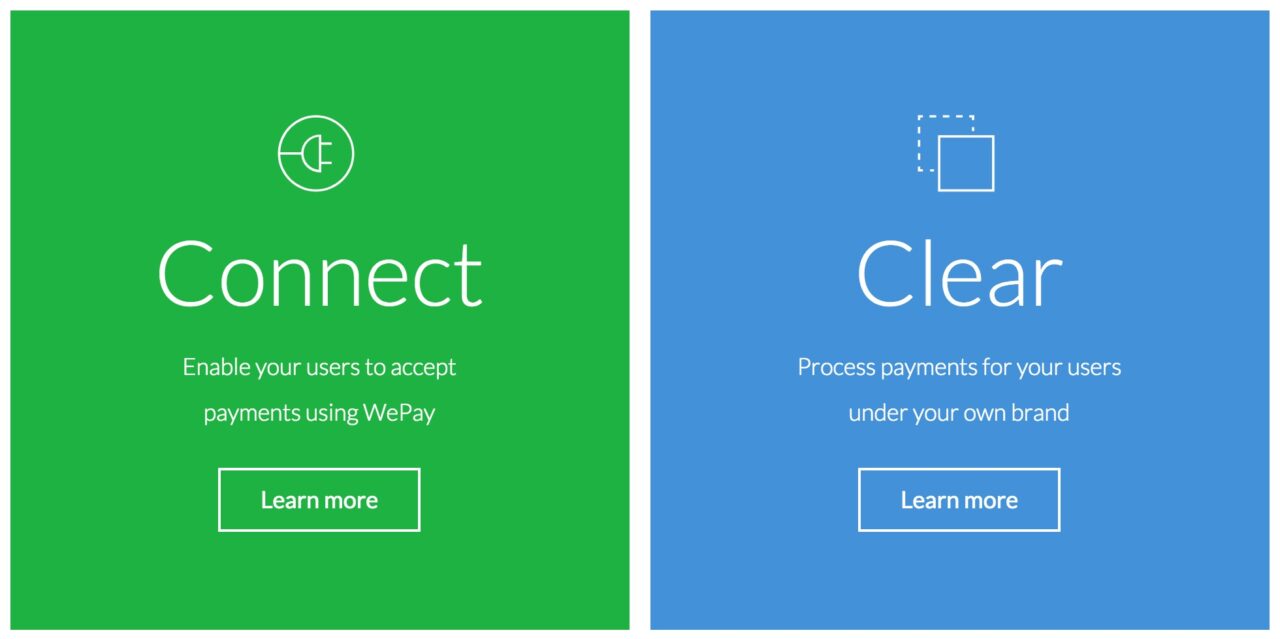

1) A white-labeled payments processing platform, Clear

2) A merchant account platform, Connect

We recently caught up with John Canfield, VP of risk for WePay, to chat about how he combats fraud. As it turns out, the company is doing some pretty creative things, including using machine learning, to win the war against fraudsters.

Finovate: WePay’s payment APIs are built for online marketplaces, ecommerce sites, and crowdfunding platforms. What are the top-three ways in which these types of companies benefit from WePay’s payment APIs?

Finovate: WePay’s payment APIs are built for online marketplaces, ecommerce sites, and crowdfunding platforms. What are the top-three ways in which these types of companies benefit from WePay’s payment APIs?

Canfield: We’re all witnessing enormous growth in “platform” commerce, as an ever-increasing number of players facilitate exchanges between buyers and sellers. It’s an exciting trend, which is why companies like Uber, Etsy, and Airbnb garner headlines just about daily. What rarely gets mentioned in the coverage is just how complicated platform payments can be, given myriad operational, regulatory, and risk-prevention requirements.

WePay focuses on helping platforms with their payments. The company provides payments services with flexibility and user-experience control that platforms seek. It also provides regulatory and fraud risk protection. And of note, WePay helps customers get to market with their configured payments solutions at greater speed and far less cost, upfront and ongoing, than if the platforms were to build their payments and related risk internally.

Finovate: How long does it take the average developer to integrate WePay’s APIs?

Canfield: WePay’s Payment API can be integrated in days. That said, the greatest value we deliver comes in the form of more deeply integrated, configured payments and payments risk experiences, which include extensive use of WePay’s Risk API.

Platforms choose this route because incorporating our Risk API enables them to seamlessly feed their data into WePay’s risk tools, ultimately leading to better, more customized risk experiences for the customers on their platforms. Such robust solutions, which are the result of close collaboration from solution engineering to planning to implementation to ongoing support, can take a few months to fully deploy.

Finovate: How is WePay using machine learning to combat fraud?

Canfield: Combating fraud requires extensive risk management, and a cornerstone of risk management is using data to inform controls and decisions. So as you’d expect, we look at a lot of data in a lot of ways.

Machine learning helps us use more data to learn and adapt faster. We feed large amounts of data into machine learning—including data from non traditional sources like social networks and our customers’ data as passed over to our own Risk API—to ensure we’re constantly getting smarter. We’ve also structured our systems so that we can deploy new learning immediately.

For more detail on how we’re using machine learning, I’d direct people to our recent blog article on the topic: http://blog.wepay.com/how-were-using-machine-learning-to-fight-shell-selling/

Finovate: What other techniques does WePay use to fight fraud?

Canfield: We believe the key to fighting fraud is not to do one thing well, but to do a bunch of things well. Beyond using extensive data, as I mentioned earlier, we apply a lot of process to guide how we assess risks and when we complement technology and systems with people conducting risk analytics and investigations. And we bring to bear tools to help our people do their risk assessment work.

This human touch is important because a highly trained person with the right mindset can sometimes spot new patterns, new behaviors, and anomalies before the machines do. It’s also important because, at the end of the day, we’re a business serving people and we sometimes need to work directly with them on matters of risk—and this is not something a rule or machine can do, at least not yet.

John Canfield demoed WePay’s Veda Risk API at FinovateSpring 2014

Finovate: Who are your main competitors and how does WePay differentiate itself?

Canfield: WePay has a number of strong competitors, each doing good things to help people get paid. On one end of the spectrum, newer technology players including Stripe and Braintree offer code that platform developers can easily plug in to start handling payments quickly. With this ease often comes limited flexibility and control around an end user’s payment experience, and little if any risk protection.

On the other end of the spectrum, larger and more traditional players, including Wells Fargo Merchant Services and Vantiv, can help platforms take a lot more control by becoming payments facilitators. Yet with the added control, the platforms must also take on varying degrees of heavy operational and risk management burdens.

We believe WePay provides the best of both worlds, applying a plug-and-play approach with ability for platforms to control their user experiences, while taking on the operational, regulatory and fraud-prevention burdens for them.

Finovate: In general, what’s next for WePay?

Canfield: We’re at a major inflection point. We’ve grown a lot by serving growing platforms well. This is how we’ve delivered a 123% increase in revenue in Q1 this year compared to Q1 last year, and ushered a 159% increase in users getting paid through our platform customers.

Yet we need to do more, better. We recently announced a $40 million financing round, with the belief we should invest more to deliver more.

Next you’ll see us accelerating growth by supporting platforms in new geographies where they operate. You’ll also see us putting energy towards more innovation, including more risk-protection innovation, and new features and functions customers seek. And we will ensure high quality and reliability as we scale. To do all of this, our CEO has publicly spoken of us significantly growing our team, so a crowded office or additional office may also be in our future.

WePay debuted its Veda Risk API at FinovateSpring 2014 in San Jose. The Palo Alto-based company has raised more than $74 million in funding since it was founded in 2009.

Are you building new financial technology? Be sure to register now for the only event exclusively for fintech developers, FinDEVr 2015, 6/7 Oct in San Francisco.