Xsolla is taking its expertise in providing billing services for gaming platforms into the world of payments and commerce. At FinovateEurope 2015, Xsolla demonstrated its white-label, customizable billing platform for financial institutions. Aiman Seksembaeva, Xsolla’s manager of business development, said, “We believe our solution has been perfected and molded by millions of daily transactions that can actually help reinvent e-commerce.”

The stats:

- Founded in 2006

- Headquartered in Sherman Oaks, California

- Maintains workforce of 170

- Alexander Agapitov is CEO

The story

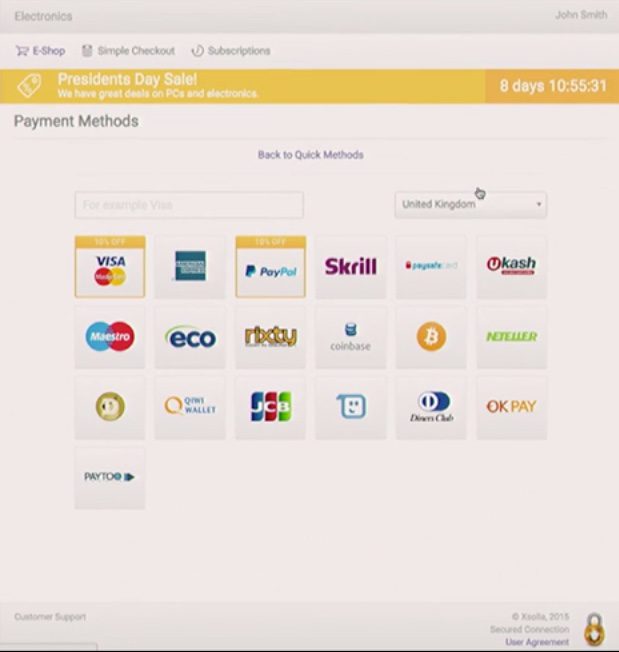

Xsolla’s payment-gateway comes with advanced analytics and reporting tools, as well as advanced antifraud and chargeback management. The technology can be used by online merchants looking to make it easier for consumers to make transactions in the manner and currency of their choice. Xsolla believes this flexibility is critical, pointing out that enabling consumers to transact in local currencies increases engagement which can lead to higher revenues for both small businesses and their bank partners.

Users choose a country and coverage, or have them selected automatically. Some advanced users of the platform may transact in one set of currencies, yet want payouts in an entirely different set of currencies. Seksembaeva points out that this kind of functionality within larger payment gateways has been available for years, and now with Xsolla, these options are available to small and medium-sized merchants as well.

Banks and clients alike have access to the platform’s analytic and reporting dashboard, a 24/7 analytics suite that helps merchants monitor and manage the “flow and health of their business.” Users can see all transactions made on the platform, the volume of sales, taxes if applicable, payout amounts and types, and review fees, courtesy of detailed reports on each payment method.

The bank workspace, Semsekbaeva points out, is not just a “big-data analytics solution capable of producing customized reports” but a resource that allows FIs to communicate directly with clients. It can be used for cross-selling; marketing credit lines for SMEs; as well as handling complex offers from merchants and other vendors.

The future

Xsolla has been busy making friends in the weeks and months since its Finovate debut in London in February. The company announced partnerships with Ubisoft and CipSoft in April, following a string of successful deals from late 2014. Teaming up with other platforms in the spring has led to sales increases of more than 30% and significant gains in conversion rates from PayPal, credit cards, and other payment methods.

Above: Xsolla Business Development Manager Aiman Seksembaeva presented at FinovateEurope 2015.

The key will be convincing FIs that Xsolla, which already has a strong presence in the world of online gaming, is making a real commitment to helping banks provide a range of options for their small business clients looking for variety in payment options.

“We’ve been experiencing a lot of demand from businesses for a solution like ours,” Seksembaeva said of the company technology. “But we truly believe this is not Xsolla’s place to be. This is a bank’s business.”