Remember the magic you felt when you first saw your credit card transactions automatically categorized on Mint? Did your heart drop when you realized it only tracked merchants, not products? A granular view of purchases at the product level is known as level 3 data, and it’s valuable for both banks and consumers.

Shoeboxed has been providing level 3 data since launching in 2007. Its platform stores customers’ paper receipts, automatically aggregates their email receipts, and offers multiple services to help users track their finances and make better purchasing decisions.

At FinovateSpring 2015, Shoeboxed launched a packaged offering for banks to provide their customers. By better understanding the exact products consumers are purchasing, banks can serve their customers in a more tailored way.

Company facts:

- Based in Durham, North Carolina

- Founded in 2007

- User base of one million

User experience

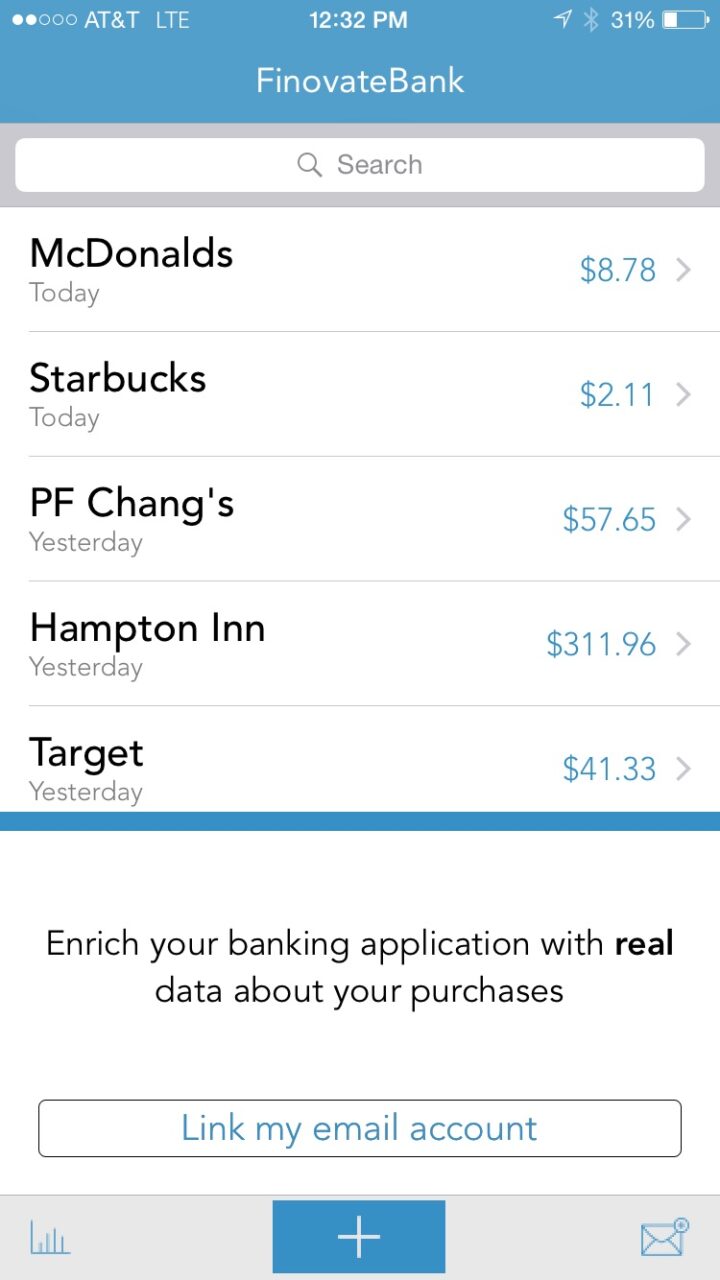

Bank clients deliver Shoeboxed seamlessly within their mobile app. At first, Shoeboxed displays the list of the customer’s transactions as they normally would see them (see screenshot below).

For a richer view of their transactions, customers take two steps:

1) Link email account to automatically sync email receipts such as airline tickets or Amazon purchases.

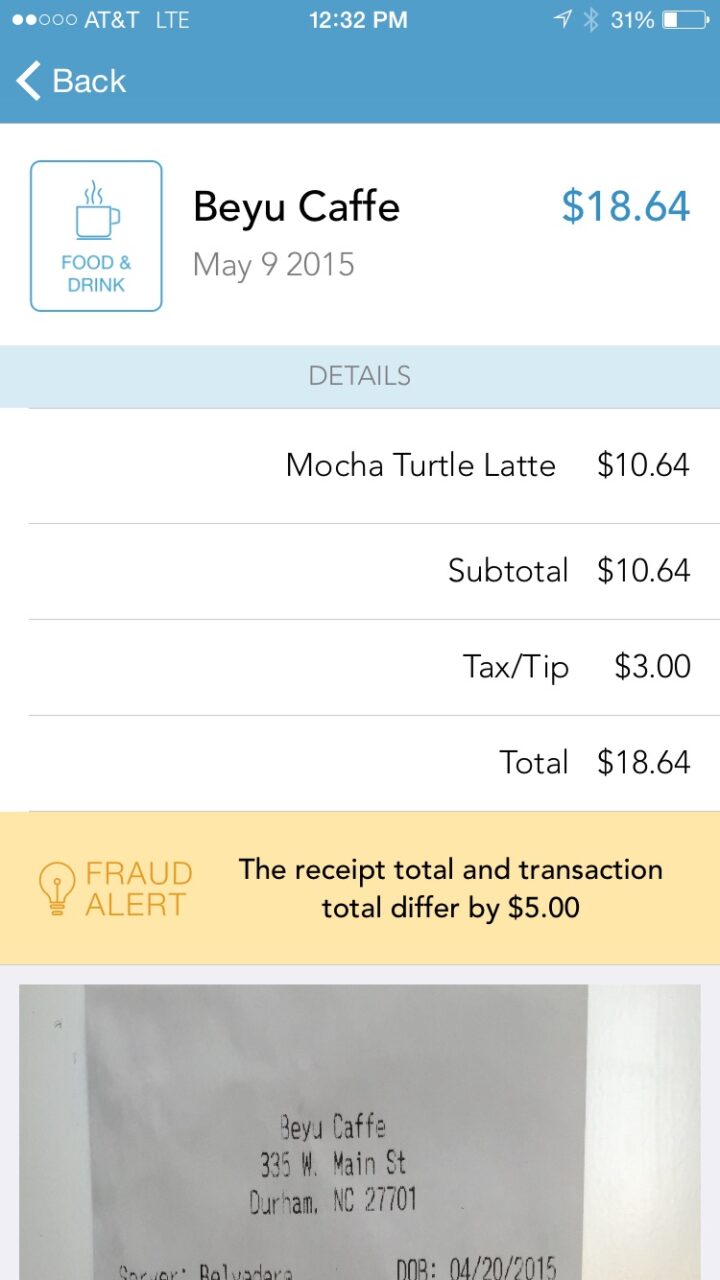

After syncing to email, Shoeboxed aggregates email receipts, matches them with the credit card transaction, and provides details about each purchase. To see more information about a transaction, the app supplies a copy of the original receipt, an itemized list of purchases, and the category of the transaction, all within the banking app.

2) Upload photos of paper receipts

For paper receipts, users take pictures from within the mobile banking app. In the background, Shoeboxed automatically matches the SKU of items on the receipts to the corresponding transactions.

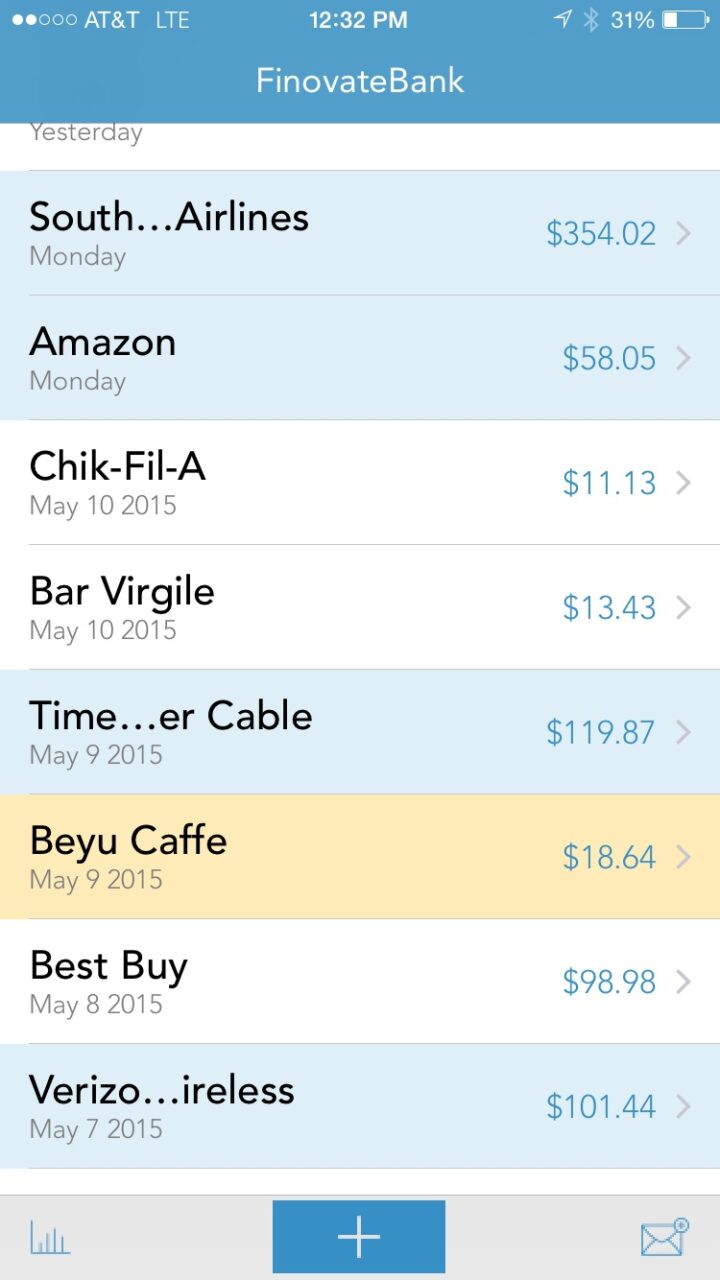

Fraud alerts

In potential fraud cases, where the amount listed on the receipt differs from the amount of the final transaction, Shoeboxed highlights the purchase in yellow to alert the user.

In this case, the posted transaction amount for Beyu Caffe exceeds the amount on the receipt by $5. Here, an employee may have changed the tip after the customer signed the receipt.

Other Shoeboxed benefits include:

1) Price drop alerts

2) Product recall alerts

3) Product return reminders

For banks

Shoeboxed believes that receipt-capture will soon become a standard, must-have banking feature, similar to mobile remote deposit. The company is currently targeting the top 20 U.S. banks, helping them customize the product to their specific needs through an SDK that can be integrated in as fast as two to three months. It also offers a guided, turnkey solution.

Shoeboxed’s white-labeled solution enables banks to offer their customers a granular view of what they’re purchasing. Banks can leverage this level 3 data to enhance their advertising, rewards, and create more tailored offerings to end-customers.

Shoeboxed also offers the service directly to consumers and small businesses. Check out the company’s launch video of its Receipt Capture for Banks at FinovateSpring 2015.