The RedCloud 1 Platform by RedCloud Technologies is a transaction engine and processing platform. By leveraging RedCloud 1, financial service providers can offer regulated digital financial services such as domestic payments, remittances, mobile wallets, lending, savings, and insurance.

The RedCloud 1 solution, which can be co-branded or white-labeled, can act as an end-to-end transaction platform or simply form a new front-end interface to existing backend processes. It is designed to help effectively deal with regulatory constraints.

Front-facing platform

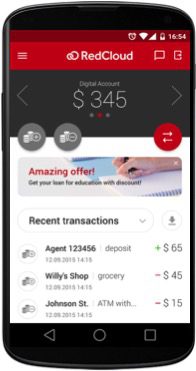

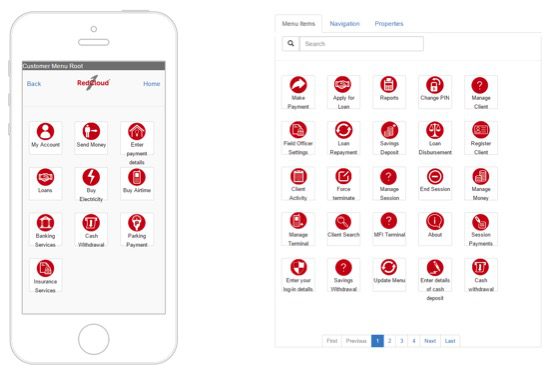

The RedCloud 1 platform offers a simple, omnichannel user experience. For example, when using its remittance capabilities to send money internationally, consumers log in with a unique identifier (for example, email address, phone number, or Twitter account), then enter the amount and their PIN. RedCloud processes all transaction types, including cross-border payments and remittances, in real time with no settlement delay.

Behind the scenes

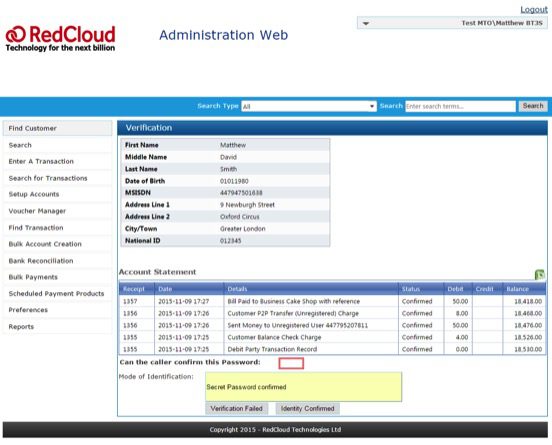

The RedCloud administration view offers multiple tools, such as a transaction-search capability and a CRM module, that enable service providers to manage the platform.

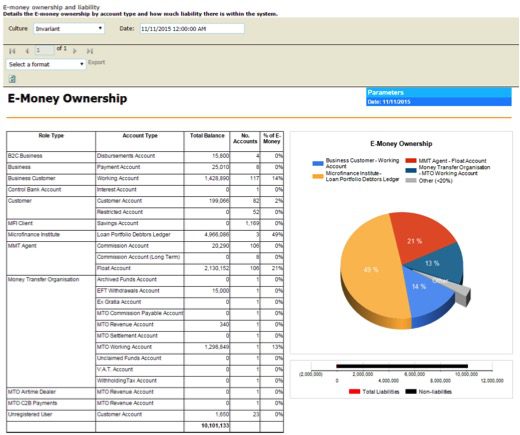

The analytics suite offers a real-time bank reconciliation view that shows both sides of all transactions. Preconfigured insights are not only useful to service providers, but also to agents and merchant clients, who can use transaction data to drive business strategy.

The company’s configuration tool has a drag-and-drop WYSIWYG interface which enables non-technical employees to bring new products to market with no need for IT involvement.

What’s next

RedCloud is contracting with several organizations across Africa and Asia.

RedCloud founder, Justin Floyd and product manager, Matthew Smith, demoed RedCloud 1 at FinovateFall 2015:

http://finovate.wistia.com/medias/ec4vzxoet0?embedType=api&videoFoam=true&videoWidth=800