LiquidLandscape offers banks a risk-visualization workspace. The startup’s LiquidLandscape Notebook is a collaborative space where banking executives view and interact with data on a map and communicate with each other about the correlations.

Company facts:

- Barclays tech-accelerator alum

- 3 employees

- Headquartered in San Francisco

- Founded 2013

All financial services firms must communicate about data, but it is not always easy to understand how the data-points relate, or what potential issues the correlations may indicate. LiquidLandscape helps solve this issue of scattered data.

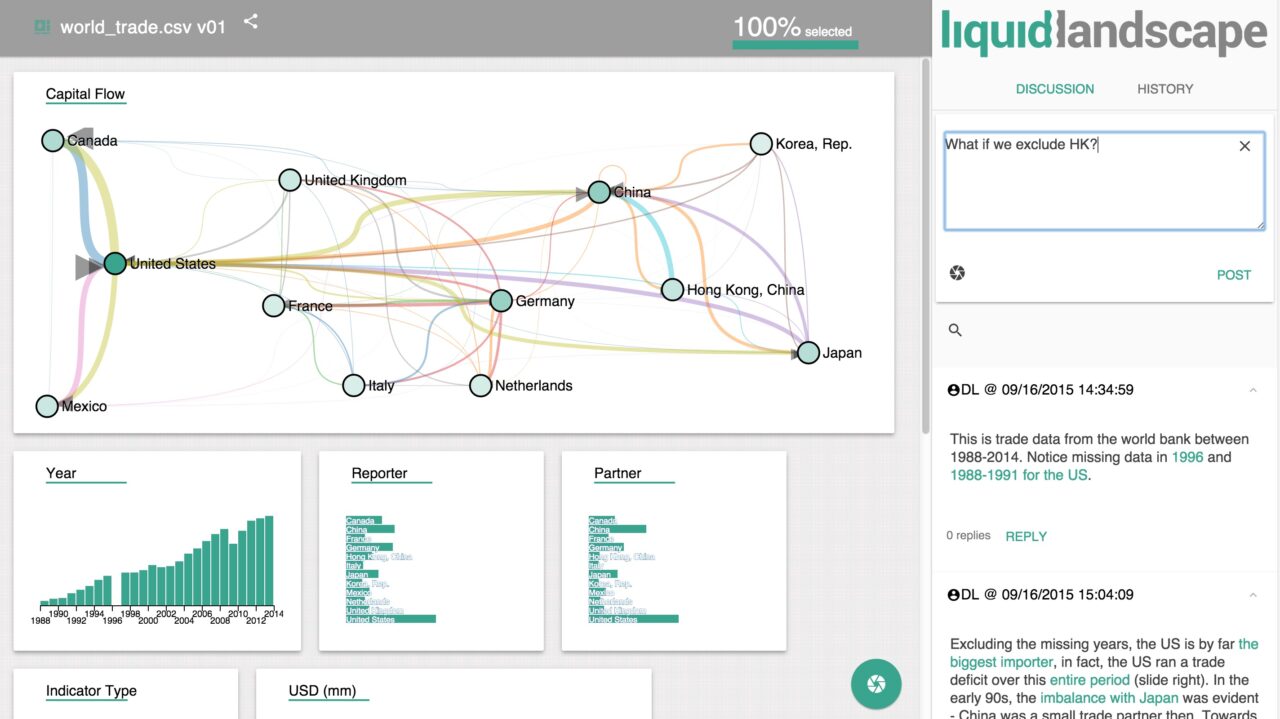

CEO Margit Zwemer describes the product as instant replay for financial services’ data that creates a “tube map” to show data-bottlenecks. The LiquidLandscape dashboard can map the data in an intelligible way, making it easy for employees to zoom in, at any level, to help answer the questions:

- What is the problem?

- What data indicate the issue?

- What decision was made?

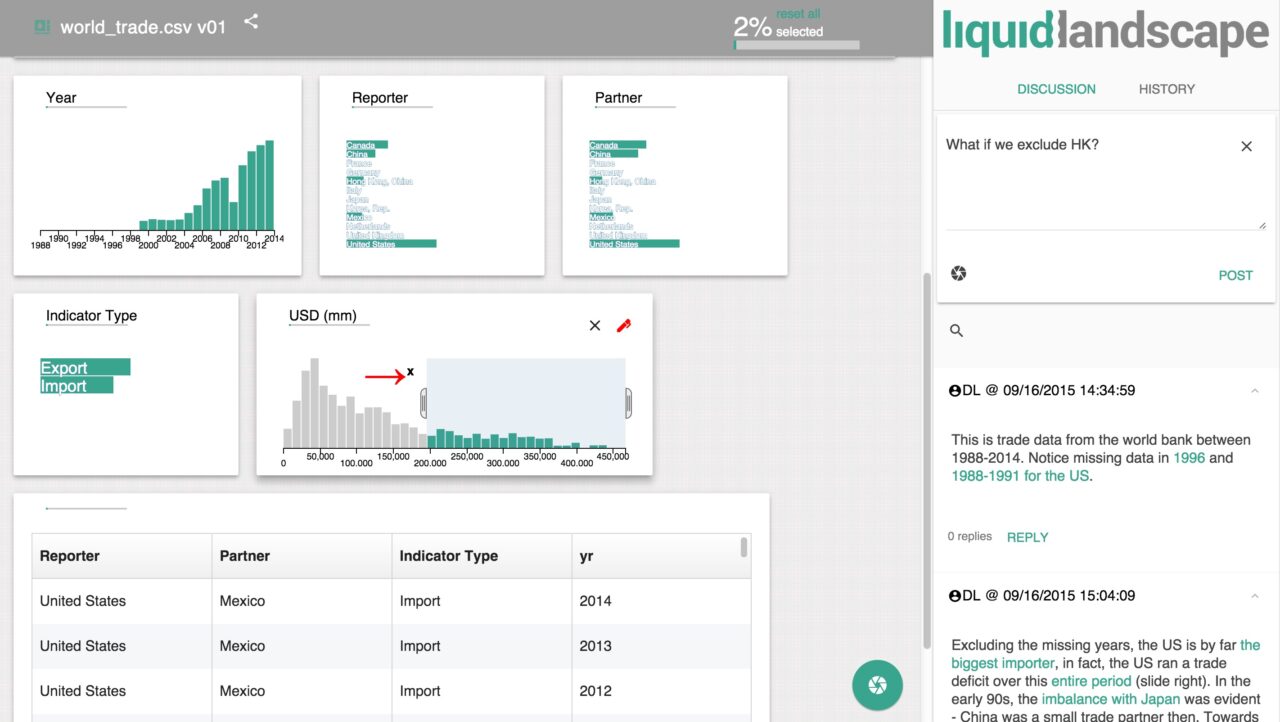

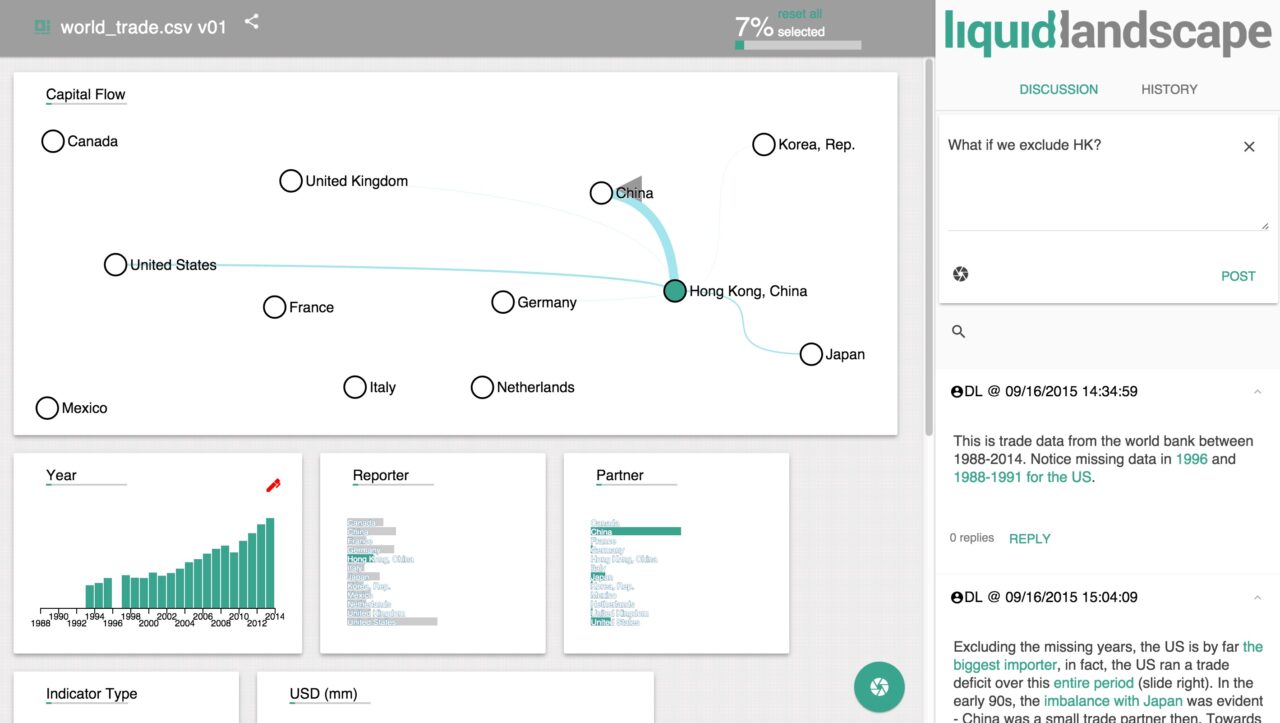

In the screenshots below, the user is examining capital flow among major countries.

After the user selects their desired specifications, type, and ranges, LiquidLandscape maps the data. In the screenshot below, the user has drilled down to examine Hong Kong’s trades with China, Japan, and the United States.

The platform also facilitates communication. Rather than require employees to email data back and forth, LiquidLandscape creates efficiency by enabling users to comment within the platform on specific data-points.

The screenshot below shows the discussion log on the right panel that creates a history of the chat-log around data. All comments are tied to the data, and users can respond to comments, making it easy to keep communication threads organized.

It is easiest to understand the power of LiquidLandscape’s platform through examples. Using various types of big data, the dashboard helps analyze:

- Fund flows between ETFs

- Risk-limit breaches between individual traders and the risk department’s requirements

- Connections between different parts of an organization

- Mortgage applications completed online vs. in-app

- Audit trails for compliance

- Consumer credit qualification

LiquidLandscape is secure and fully compliant. And while there are essentially no limits on what its engine can help visualize, the startup is currently focused on helping financial services companies understand and mitigate risk. LiquidLandscape does, however, have future plans to broaden its focus in the upcoming years.

What’s next?

This fall, LiquidLandscape launched in beta. The company is in the middle of fundraising and plans to grow its three-person team.

Here is the LiquidLandscape team debuting at FinovateFall 2015:

http://finovate.wistia.com/medias/2lffbvq11o?embedType=api&videoFoam=true&videoWidth=800