InvoiceSharing is as straightforward – and unsexy – as it sounds. But beneath this eponymous exterior lies a company dedicated to using technology to help companies and financial institutions unlock major savings and efficiencies.

While there are early adopters of technology in the enterprise, there still are plenty of companies and organizations that still rely on outdated business operations, including antiquated invoicing systems. InvoiceSharing helps these companies overcome the hurdles to better business operations by offering a solution that is free, cloud-based, and open.

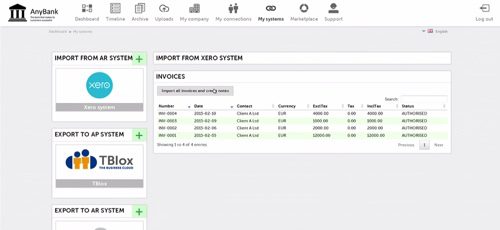

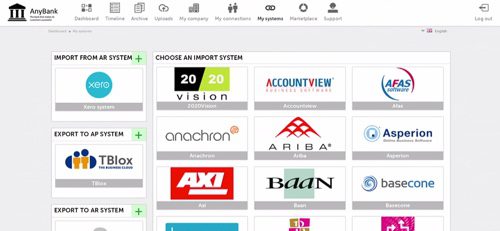

With InvoiceSharing, companies connect their accounting systems to the platform, and use it to send invoices electronically. For its Finovate debut, InvoiceSharing introduced a branded version of the platform and highlighted the technology’s ability to work with a wide variety of accounting and electronic invoicing systems. Users send and receive invoices through their own accounting systems – “we speak all languages” says InvoiceSharing CEO Jeroen Volk – InvoiceSharing does all the translation. And by connecting with the systems of major suppliers, the platform makes it easier for newer companies and startups to build relationships with the companies that will be critical to their growth.

The Stats

- Founded in 2013

- Jeroen Volk is CEO

- Headquartered in The Netherlands, with offices in London and New York

- Raised more than $1.5 million in funding

- Named to Forbes “The World’s Next 10 Big Fintech Stars” list (2014), and the Fintech 50 (2015)

- Won Deloitte’s Most Disruptive Innovator Award (2014, and Red Herring’s Top 100 Europe Award (2014)

- Participated in Startupbootcamp London (2014)

The Story

InvoiceSharing is a “connect the dots” technology that plays middleman between accounting systems, electronic invoicing systems and suppliers. InvoiceSharing is not an electronic invoicing system itself. But it has everything to do with making it easier for companies to communicate faster and ultimately cheaper when it comes to requesting and receiving payment.

The platform’s eagerness to play well with others is important. The great diversity of systems has created an opportunity for InvoiceSharing to make sure that those working with one system will be able to seamlessly communicate with another. And by seamlessly, InvoiceSharing means not just being able to send invoices electronically, but to have incoming invoices come through your accounting system as well. Volk said that this is one of the stumbling blocks for companies – “why SMEs won’t work with you” – that can result in using alternatives that are more expensive and potentially less reliable than electronic invoicing.

Setting up the platform is straightforward. Users connect their accounting system, select their electronic invoicing system (there are many on the platform), and select their suppliers. This last point is a source of pride of the company, emphasizing its ability to onboard what it calls the “long tail” suppliers due to the openness of its platform. Suppliers can specific exactly how and what information is required and displayed and, again, InvoiceSharing takes care of the translation as this data is communicated back through the company’s system.

“Connecting all those systems, platforms, but also interfacing with all those platforms and networks is exactly the hassle we do that you don’t have to do as a company,” Volk said from the Finovate stage in February. “And as a result it is easy to work together.”

The Future

InvoiceSharing’s platform is offered for free. The company makes its revenues from premium products it provides its companies such solutions that automate the invoicing process or reporting tools. InvoiceSharing has also been active on the investment front, having raised € 2 million, and has earned accolades on both sides of the Atlantic, being named to The Fintech 50 in London in January, and winning the Most Disruptive Innovator 2014 Award from Deloitte back in October.

The future of the platform is already clear. InvoiceSharing is looking to empower banks and financial institutions to capture and combine invoice data with payment and other system data. This could give FIs the ability to better serve their business clients with more customized products, including better credit terms on financing. InvoiceSharing is working with one bank partner currently on developing this white label option, and looking to partner with others.

“Nobody is doing electronic invoicing for fun. But you can do great things with electronic invoices,” said Volk. “You can help companies cut costs and improve cash flow.” If InvoiceSharing’s current plan to leveraging invoice data into real customer insights proves popular, helping companies improve cash flow and cut costs may be just the beginning.