Chris Larsen, who helped invent financial e-commerce by creating E-Loan <eloan.com> in 1997, is back on the scene mere months after selling the company to Popular Inc. last summer for $300 million. His new company, Prosper.com, first discussed here on Feb. 6, is built around the idea of creating communities of people who lend to and borrow from each other. The idea, he says, isn’t too far away from Jimmy Stewart’s savings and loan in Frank Capra’s film, It’s a Wonderful Life, where ordinary people lent to each other and made them all more prosperous.

Chris Larsen, who helped invent financial e-commerce by creating E-Loan <eloan.com> in 1997, is back on the scene mere months after selling the company to Popular Inc. last summer for $300 million. His new company, Prosper.com, first discussed here on Feb. 6, is built around the idea of creating communities of people who lend to and borrow from each other. The idea, he says, isn’t too far away from Jimmy Stewart’s savings and loan in Frank Capra’s film, It’s a Wonderful Life, where ordinary people lent to each other and made them all more prosperous.

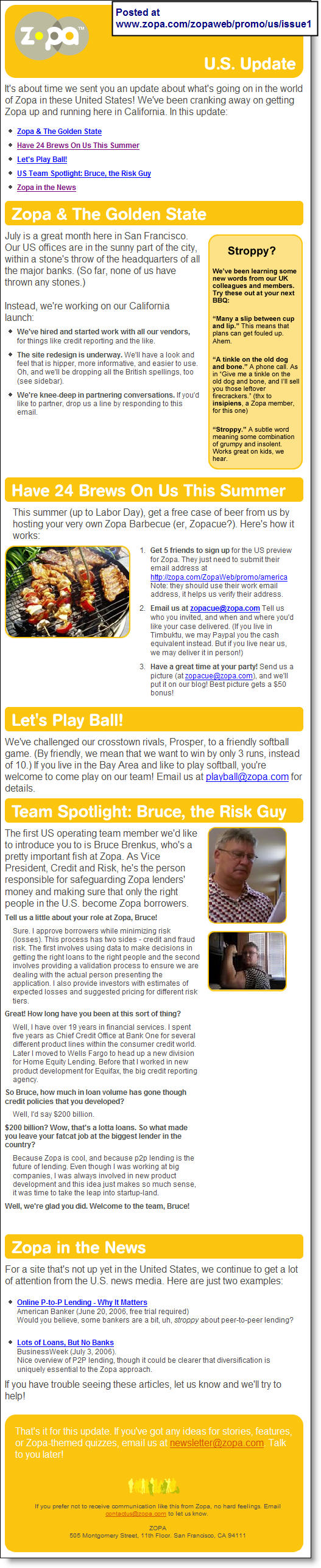

The business premise is comparable to the model of Zopa, the UK-based, person-to-person lending site that opened last summer (see NB Nov. 22) with funding from Benchmark's European unit. But while Larsen concedes the similarity, he says he had the idea first. “This is something Bob [Kagle] and I talked about long before the Zopa guys had come to Benchmark [Europe] —since 2003, in fact,” he says.

Robert Kagle is a Benchmark Capital partner who provided much of the original financing for E-Loan, and who served as an E-Loan director. The Prosper idea attracted them, adds Larsen, because while the E-Loan idea worked relatively well—it originated and sold $26.7 billion in mortgages between 1997 and June 2005—it wasn’t really what they’d wanted to do, which was more along the lines of Prosper.

Larsen says, “[At E-loan] we were beholden to the capital markets, rather than being able to create a whole new marketplace that’s supported just by people. This is more of a pure model, an opportunity to start from a clean sheet of paper and design something from the ground up.” Plus, he adds, the public that could support a Prosper didn’t exist in 1997. “You couldn’t do [Prosper] back then. PayPal very much blazed a trail, and you really couldn’t do this until they had come along.”

The company

Prosper is funded by venture capital funds that include Accel Partners, Benchmark Capital, Fidelity Ventures, and the Omidyar Network. Prosper opened with something of a bang the week of Feb. 6, getting plenty of high-profile press in the mainstream media, and, according to Larsen, attracting more than $750,000 to its loan pools in the first week of business. And the first week’s business seems promising: As of Feb. 24, 301 loans were up for auction, up from 168 a week earlier. Loan sizes range from $1,000 to $25,000.

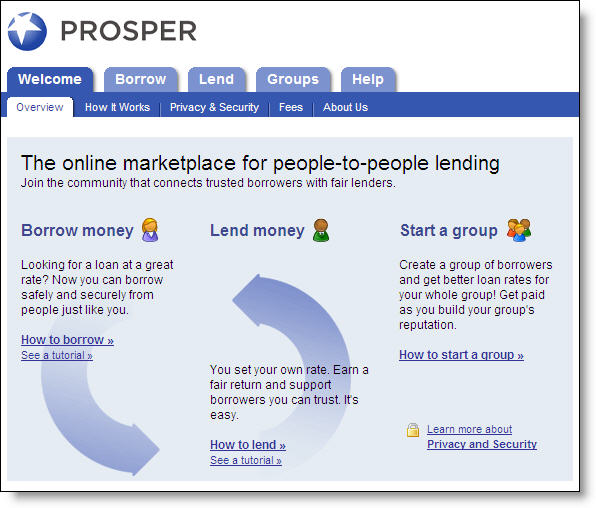

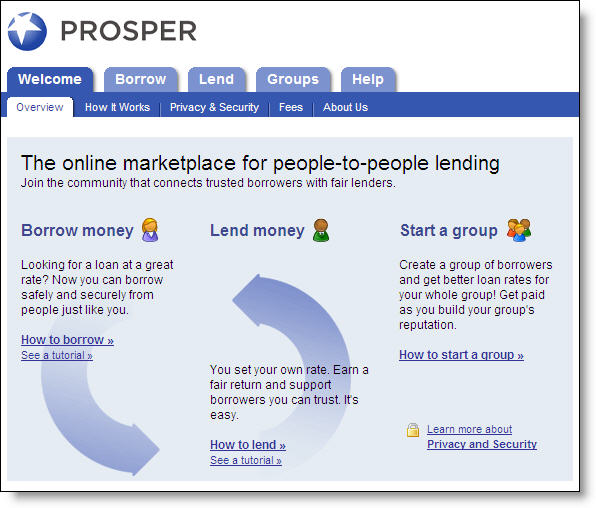

How it works

Prospective borrowers are first given a credit rating by Prosper after being vetted by credit score, a fraud check, and income. The borrower then lists the reason for their loan, uploads pictures if desired, and selects a starting interest rate, essentially the highest rate they would accept.

Individual lenders, who go through their own authentication process before being allowed to participate, can bid for as little as $50 of any particular loan, specifying the minimum rate they will accept. Prosper charges the borrower a 1 percent loan-origination fee and levies a 0.50 percent annual servicing fee to the lender on the outstanding balance.

Analysis

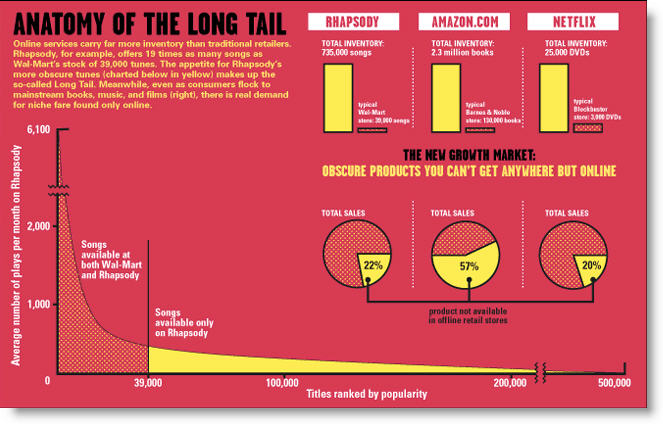

One of the problems faced by the venture is adverse selection, the tendency for loan applications to be dominated by those most in need of credit and least likely to repay. If poor credit risks overrun the venture, higher quality applicants, and the investors looking for them, will desert both Prosper and Zopa.

Another question is whether lenders will feel adequately compensated for their risks. Larsen says he wants his lenders to “capture the 10 percent spreads between short-term money and credit card deposits,” and compares the expected returns at Prosper to the AA corporate credit market, which currently gives investors a 7 percent return, or 6.5 percent after defaults. Zopa says it has provided lenders a 7 percent average return with no defaults in the seven months it’s been open for business, but this is not a period statistically significant enough to predict future performance.

On the other hand, much of business is betting on horses, and on jockeys, and Larsen has proven himself adept at both picking horses and riding them. It may be that the time is right for a business built more along the lines of Jimmy Stewart’s small town savings and loan, and less along the lines of a modern bank's unyielding underwriting algorithms. (Contact: Prosper.com, Chris Larsen, 415-362-7272)

—AR

Previous articles:

— Prosper Feb. 6

— Zopa Nov. 22

Person-to-person lender, Prosper, announced its first annual user meeting next February in San Francisco. Registration is a refundable $25 and includes an all-day session with dinner on Monday, Feb. 12, and a half-day on Tuesday, Feb. 13.

Person-to-person lender, Prosper, announced its first annual user meeting next February in San Francisco. Registration is a refundable $25 and includes an all-day session with dinner on Monday, Feb. 12, and a half-day on Tuesday, Feb. 13.