While all lenders have ways to determine the creditworthiness of borrowers, not all have an efficient and effective process to do so. CRIF’s technology helps lenders maintain growth and agility while managing risk.

While all lenders have ways to determine the creditworthiness of borrowers, not all have an efficient and effective process to do so. CRIF’s technology helps lenders maintain growth and agility while managing risk.

CRIF is a global company focused on credit management, credit reporting, scoring, loan decisioning, and loan processing. Its modular solutions integrate with banks’ existing infrastructure.

Stats on CRIF Lending Solutions:

- 1700 employees

- Based in Bologna, Italy

- FY 2013 revenue: $405M

- Customers in 50 countries

- Credit-bureau solutions in 17 countries

- Works with 3,100 FIs worldwide

- CRIF has acquired a number of international providers. Its 2014 acquisitions include:

- Recom (Debt Collection Services) in Turkey

- OFWI Teledata (credit and business data provider) in Switzerland

- Majority stake in High Mark Credit Information Services in India

- Dun & Bradstreet UAE in Dubai

OpenSky’s story

OpenSky is a business line of Capital Bank, N.A., a Washington, D.C.-based private bank with more than $600 million under management. It approached CRIF for help updating a system received as part of an acquisition. The system is for online card applications and management of the OpenSky Secured VISA Credit Card. The existing system required a complicated, manual process for verifying applicants’ identity and gathering security deposits.

OpenSky’s goals for updating the process included:

- Multichannel solution that automated workflow and risk management

- Improved applicant-approval rates

- Improved integration with internal and external systems

- Increased booking rates

- Decreased funding time

In September 2014, OpenSky implemented two of CRIF’s product solutions:

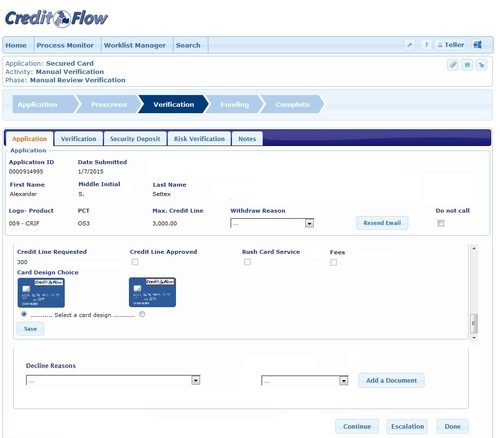

1) CreditFlow

CreditFlow is a consumer-facing credit-application process management system. Once the consumer triggers an activity, the system directs the task to specific employees and processes. The consistency ensures regulatory compliance.

The built-in loan-processing technology creates electronic documents with e-signature capability that improve the customer experience.

2) StrategyOne

StrategyOne is a loan-decision solution that automates decision-making. It integrates with the lender’s systems such as product catalogue and CRM to identify the optimal balance of approval, referral, and rejection rates for borrowers of different risk categories.

The result is easier KPI decisioning, as well as a visual decision tree to help risk managers view and adjust loan-acceptance rates.

The result

The solution integrates with OpenSky’s website as well as its third-party applications. OpenSky automates communication with cardholders about overpayment, withdrawals and security deposit returns.

The system furnishes its management team with data from the application process to facilitate compliance checks. Additionally, it generates real-time reports to monitor daily staff activities and pipelines.

It has increased credit card application volume, with 80% booked the same day.

“The OpenSky-secured credit-card site went live February 12, 2015, and we are already seeing tremendous success in the flow of applications,” said Nick Bryan, president of OpenSky. “CRIF was a great partner to work with and helped us put in place the right solutions from both a business and a customer experience perspective.”

International use

CRIF was introduced in Europe where it helped lenders adapt to multiple countries’ lending regulations. It now serves more than 3,100 financial institutions across the globe with flexible solutions that help lenders stay compliant with changing regulations.

2015 outlook

In the United States, CRIF sees automotive lending at a record high. And they expect an increase in riskier loans that are not always backed by the necessary capital reserves.

Outside the U.S., CRIF sees opportunity in optimizing lending and compliance readiness. It expects banks will begin searching for more efficient processes in their credit and lending operations.

CRIF demonstrated its Credit Framework at FinovateEurope 2014.