The concept behind LockByMobile is simple: use mobile devices to give cardholders an added level of security against credit and ATM card breaches. For Smart e-Money, the company behind LockByMobile, the strategy was to leverage and deploy the award-winning technology it had already patented and deployed in another context.

“What if you could be one step ahead of fraud?” said Smart e-Money VP of Innovation Angelito Villanueva from the Finovate stage in February. “What if you could add a hard lock that only your customers could lock and unlock, just with a swipe of their finger using their smart phone?”

“Wish it could be done? Well, this solution already exists, and we call it LockByMobile.”

LockByMobile stats:

- Founded in 2000

- Headquartered in Manila, Philippines

- Operates as a subsidiary of Smart Communications

- Serves more than 72 million subscribers

- Has more than 200 employees

The story

The key technology that makes LockByMobile work has been around since 2007 when it was first developed by Smart e-Money as a security tool for its prepaid wallets. The technology won an award in 2009 for “Best Mobile Security Feature” at GSMA in Barcelona, Spain, but it is the enhancement and deployment of the technology as a way to make cardholders more secure that brought the company to London for FinovateEurope 2015.

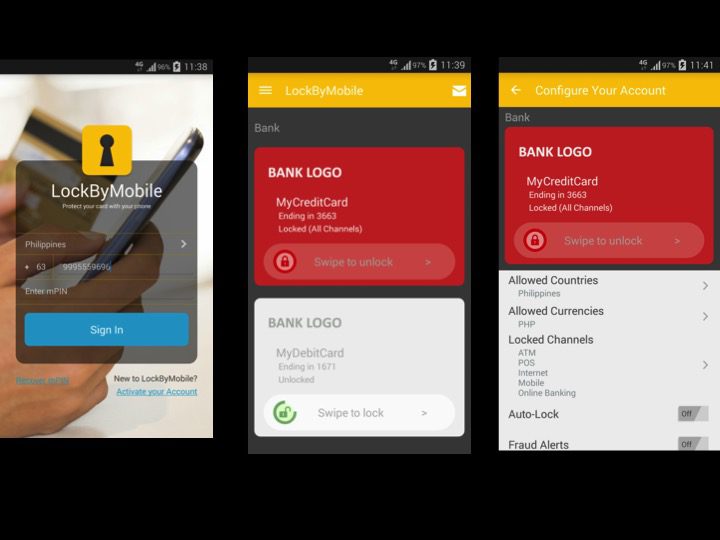

To get started with LockByMobile, users download the app, register, and then sign in with their mobile number and a PIN. Users will be able to see their various card accounts on file with the participating issuing banks. Locking and unlocking cards is as easy as a swipe of a finger, and a bright-red highlighting makes it easy for users to see at a glance which of their cards are locked and which are not.

If a transaction is attempted on a locked card, the cardholder will get an SMS notification to their mobile device. And real-time functionality means that even in the case of an accidental locking, there is no friction or inconvenience when it comes to unlocking the card on the spot.

There are a variety of ways LockByMobile is helpful to cardholders. Consumers who lose their cards or have their cards stolen can use the mobile app to lock their cards to prevent use. But LockByMobile points out, even though cards are only used once or twice a day on average, “your card is potentially exposed to fraud all the time.” In other words, even with your card “safely” in your pocket or purse, locking the card using LockByMobile’s technology provides valuable anti-fraud protection.

In addition, the platform’s spending controls can be used to manage supplemental cards given to children or be used by caregivers helping seniors avoid financial exploitation. LockByMobile allows transactions to be limited by channel, amount, location, type of merchant, and type of currency.

The future

LockByMobile caught the attention of more than one observer at FinovateEurope 2015. Let’s Talk Payments praised the company as an added layer of security for ATM and credit-card users. Data monitor’s profile of LockByMobile’s Finovate debut led to a 4 out of 5 rating, including high marks for being a potentially “game-changing” opportunity for banks.

Going forward, the company plans to launch LockByMobile in “several financial institutions across different countries” in 2015, as well as build relationships with a number of potential partners.

“We are constantly improving our offer and enhancing the platform with new functionalities,” said Villanueva from the Finovate stage. Added Guillaume Danielou: “We are currently developing a version for Corporate Cards where the business owner can control the limits and usage for his employees’ business cards, as well as benefiting from the Lock/Unlock feature to protect the cards against fraud.”

Watch LockByMobile’s live demo at FinovateEurope 2015.