No one said it was easy being a startup, especially a “Web 2.0 lender” in the middle of major credit turmoil. Lending Club, which had to shut down the retail lending portion of its service in April, is preparing to put the second P back into its P2P loan service (see note 1).

No one said it was easy being a startup, especially a “Web 2.0 lender” in the middle of major credit turmoil. Lending Club, which had to shut down the retail lending portion of its service in April, is preparing to put the second P back into its P2P loan service (see note 1).

A big part of that process is filing with the SEC so the company can sell retail securities backed by its loans. For lenders, it won’t be much of a change. The securities will be backed by the individual loans, just as if it were a standard loan. And at least initially, the securities cannot be resold. However, in the filing, Lending Club says it is planning on creating a secondary market for the securities through its platform.

Lending Club posted an update on its website announcing the filing.

Lending Club discloses $500,000 monthly burn rate

Luckily for the company’s followers, and competitors, the S-1 filed Friday (20 June) sheds light on what would usually be known only to its investors and creditors, the privately held company’s inner finances. The company disclosed that during the fiscal year ending March 31, 2008, it experienced:

- negative cash flow of $6 million

- total net loss of $7 million on revenues of $450,000; the revenue total includes $200,000 in interest on deposit balances

Lending Club itself is a significant lender on the platform

Another interesting disclosure: More than half the loans originated through the Lending Club platform have been funded by the company and its creditors/investors, even before it had to stop taking new retail loan commitments April 7. That’s an interesting dynamic for a so-called person-to-person lender. Because Lending Club sets the market clearing rates, its funding did not compete directly with the retail lenders, i.e., Lending Club stepped in to help fund deals that retail lenders had not fully funded. However, had the company not put so much money into the system, borrower rates could have floated higher, potentially increasing lender yields (note 2).

As of June 10, 2008, only $6.4 million of the loans made through the platform have been to “retail lenders.” Later in the S1, Lending Club discloses that it has funded $7 million of the $15 million loaned through the platform as of March 31, and then $1.6 million of the $3 million loaned after March 31. That leaves Lending Club holding $8.6 million of the $18 million loaned through the platform.

The lending was financed primarily through loans from Silicon Valley Bank ($3 mil), Gold Hill Venture Lending ($5 mil). Also, through March 31, company insiders and investors had lent about $0.5 million.

Other stats from the S-1

Other numbers (as of 31 March, 2008, unless indicated otherwise):

- $1.8 million spent on marketing, of which $270,000 was advertising

- $1.8 million spent on engineering

- 23 full-time employees

- Average loan amount per borrower is $9,100

- Number of loans = 1,669 worth $15.2 million (through 10 June 2008)

- 150,000 website visitors in March

- Average amount lent per loan per lender = $75

- 50% of loan volume has been through LendingMatch that automates the process

- $8.9 million had been outstanding for more than 45 days and had been subject to at least one billing cycle; of that amount, 98.3% was current, 0.88% was 15- 30 days late and 0.87% was more than 30 days delinquent. No loans had gone into default which is 120+ days delinquent

- On p. 48 is a detailed table of home ownership. job tenure, annual gross income and debt-to-income ratio by Lending Club credit grade

Loan purpose:

- 50% refinancing high-interest credit card debt

- 35% financing one-time events such as weddings, home improvements or medical

- 15% small business financing

Notes:

1. For more info on person-to-person lending see our Online Banking Report #148/149

2. I say POTENTIALLY increased yields. That would depend on whether the borrowers accepted loans at higher rates. And higher rates would lead to lower volumes, so even though interest margins would be higher, there could be substantially fewer deals. And that also increases the risk of adverse selection with only higher-risk borrowers accepting the higher rates.

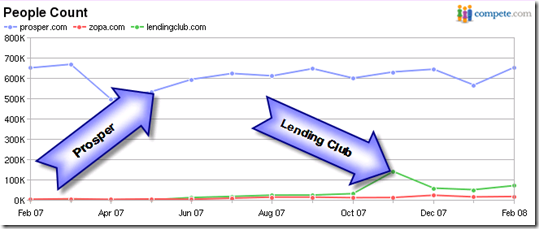

While Prosper still had twice the overall loan volume of Lending Club in Q1 ($21 vs. $10 million), Lending Club is closing the gap in the prime/near-prime market (FICO 640+) originating two-thirds the volume of Prosper in March ($4 vs. $6 million). But if you take into account Lending Club's more stringent debt-to-income requirements (max 30%), the newcomer actually surpassed Prosper in these lower-risk loans ($4.1 vs. $3.7 million in March).

While Prosper still had twice the overall loan volume of Lending Club in Q1 ($21 vs. $10 million), Lending Club is closing the gap in the prime/near-prime market (FICO 640+) originating two-thirds the volume of Prosper in March ($4 vs. $6 million). But if you take into account Lending Club's more stringent debt-to-income requirements (max 30%), the newcomer actually surpassed Prosper in these lower-risk loans ($4.1 vs. $3.7 million in March).