If you are looking for a single article that summarizes the current state of mobile banking, check out Karen Epper Hoffman's feature article, Mobile Banking: Where's the Business Case in this month's BAI Strategies. Karen is one of the most important writers in the financial services press, with a rich industry background, and I always enjoy speaking with her and reading her work.

The business case is indeed elusive: Unfortunately, Ms. Hoffman is not able to answer the question raised in the headline. But it's not her fault. It's simply too early to know how the mobile banking business case will shake out. With just a few hundred thousand users out of 200 million U.S. adults, even finding someone who's used mobile banking is difficult, much less figuring out if they'll do expedited payments on the phone or decrease their costly chats with your service rep.

There are literally hundreds of factors that will determine whether mobile becomes a standalone profit center or is just one more cost center. Many of those factors won't be known until well into the next decade. In fact, we are likely headed towards a convergence of phone, laptop, and entertainment device, that will make the question moot.

But it matters little: Banks have no choice in the mobile matter. Whether or not the business case is made with straightforward fees (e.g., signature debit) or with a bunch of impossible-to-measure intangibles (e.g., online banking), banks WILL support mobile access, just like they support telephone and online today.

But HOW they support it during the next five years is a matter of great debate and fortunately our upcoming FINOVATE conference (note 1) includes mFoundry the company behind the most high-profile launch to date, Citi Mobile, and MShift, the company that supports more than 80% of all the live U.S. mobile banking programs.

mFoundry

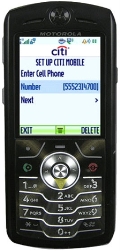

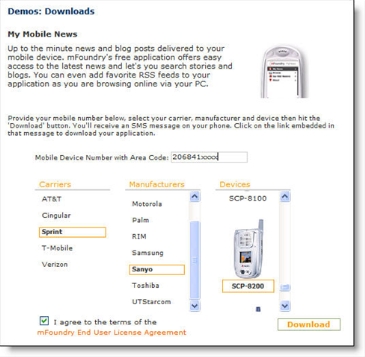

Even after all the hype of the past 12 months, the fact remains that only one bank, and one vendor, have launched a fully downloadable, custom mobile banking app: Citi Mobile powered by Sausalito, Cal-based mFoundry (see previous coverage here). And with a reference account like Citibank, mFoundry is on everyone's short list for 2008/2009 deployments of downloadable mobile banking & payments apps. I've had a chance talk to CEO Drew Sievers several times this year, the last time at the Mobile eCommerce Summit in June, and I look forward to seeing the latest from his pioneering company at FINOVATE.

Even after all the hype of the past 12 months, the fact remains that only one bank, and one vendor, have launched a fully downloadable, custom mobile banking app: Citi Mobile powered by Sausalito, Cal-based mFoundry (see previous coverage here). And with a reference account like Citibank, mFoundry is on everyone's short list for 2008/2009 deployments of downloadable mobile banking & payments apps. I've had a chance talk to CEO Drew Sievers several times this year, the last time at the Mobile eCommerce Summit in June, and I look forward to seeing the latest from his pioneering company at FINOVATE.

MShift

While Citibank may have the highest profile launch to date, the vast majority of financial institutions offering mobile banking, 90% or so, use the platform of San Jose, Cal-based MShift. After meeting CEO Awele Ndili in May at a Metavante user conference, we wrote about his amazing hold on the smaller end of the market and listed the 32 clients they had live as of mid-May (here). There have been several launches since then including one of our favorite credit unions, Tech CU, also located in San Jose (news release here). The thing I remember most from my first meeting with Dr. Ndili is how he manages to run simultaneous live demos from 3 or 4 different handsets at time, including a check image on a tiny flip phone screen. It will be interesting to see if he tries to perform that trick on the FINOVATE stage.

While Citibank may have the highest profile launch to date, the vast majority of financial institutions offering mobile banking, 90% or so, use the platform of San Jose, Cal-based MShift. After meeting CEO Awele Ndili in May at a Metavante user conference, we wrote about his amazing hold on the smaller end of the market and listed the 32 clients they had live as of mid-May (here). There have been several launches since then including one of our favorite credit unions, Tech CU, also located in San Jose (news release here). The thing I remember most from my first meeting with Dr. Ndili is how he manages to run simultaneous live demos from 3 or 4 different handsets at time, including a check image on a tiny flip phone screen. It will be interesting to see if he tries to perform that trick on the FINOVATE stage.

Note:

1. FINOVATE 2007: DEMOing the Future of Finance includes 7-minute demos from five key mobile players: mFoundry, MShift, ClairMail, Firethorn, and Monitise Americas (see previous coverage here). While the auditorium seating is sold out, we have a few remaining seats available in a 40-seat overflow room down the hall. That room features a great view of the live audio-video feed of the demos. To register, visit the FINOVATE site and click register in the upper-right corner.