A look at the companies demoing at FinovateFall in New York on September 11 and 12. Register today and save your spot.

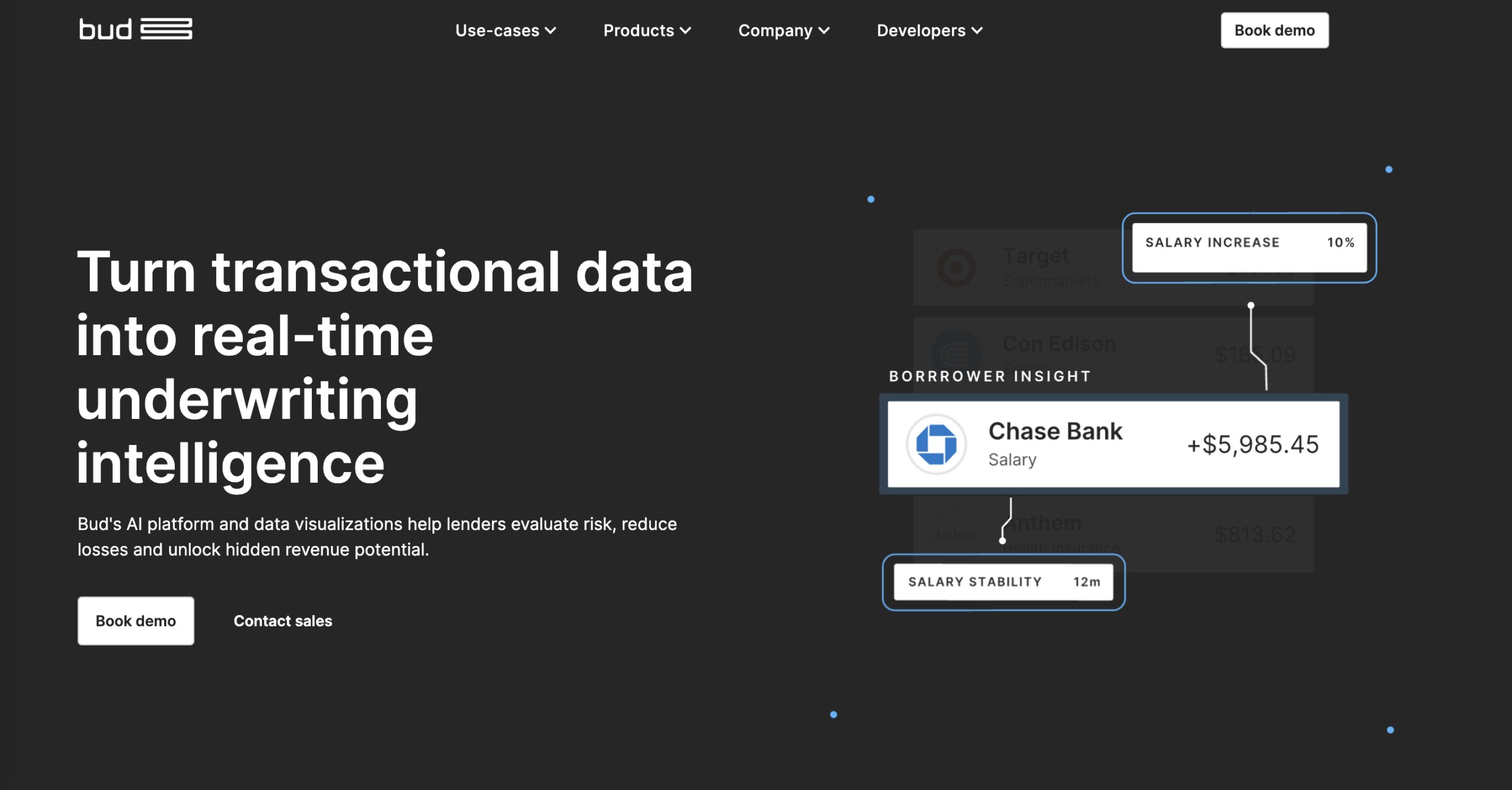

Bud makes financial decisions simple by turning transactional data into rich customer insights. It enables lenders to get an accurate picture of a borrower’s income, expenditure and credit in realtime.

Features

- Hyper-personalized insights fueled by generative AI

- Strategic, smart segment growth unleashed

- Efficient decision-making grounded in realtime data

Why it’s great

Supercharge personalization, deposits and growth with generative AI for financial services.

Presenter

Edward Masaveckas, CEO & Founder

Maslaveckas is CEO and Co-Founder at data intelligence fintech Bud Financial (Bud). Under his leadership, Bud has grown to some 120 people and secured more than $100M in investment.

LinkedIn