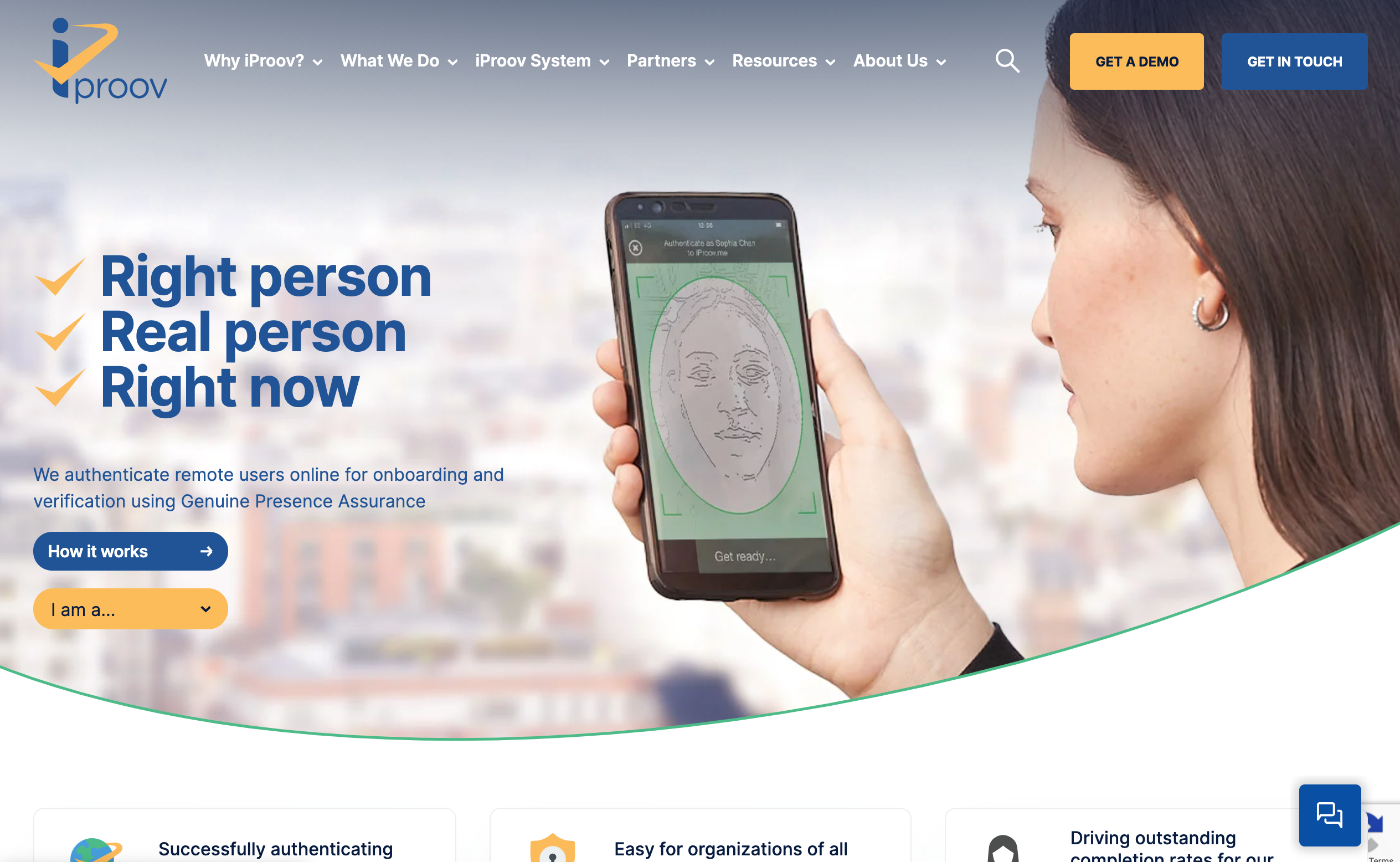

iProov’s Flexible Authentication provides banks with a single biometric solution for high and low risk profile transactions throughout the customer journey to protect from fraud.

Features

- Banks protect against fraud

- Banks maximize cost-effectiveness by only paying for appropriate security

- Users enjoy optimized experience with the right reassurance for any transaction

Why it’s great

Flexible Authentication replaces the need for financial institutions to choose between high or low security biometric authentication for their customers with its adaptable user experience.

Presenter

Andrew Bud, CEO & Founder

Andrew Bud, CBE FREng, is a serial entrepreneur who has built innovative global businesses in the mobile and biometrics sectors and founded iProov in 2011.

LinkedIn