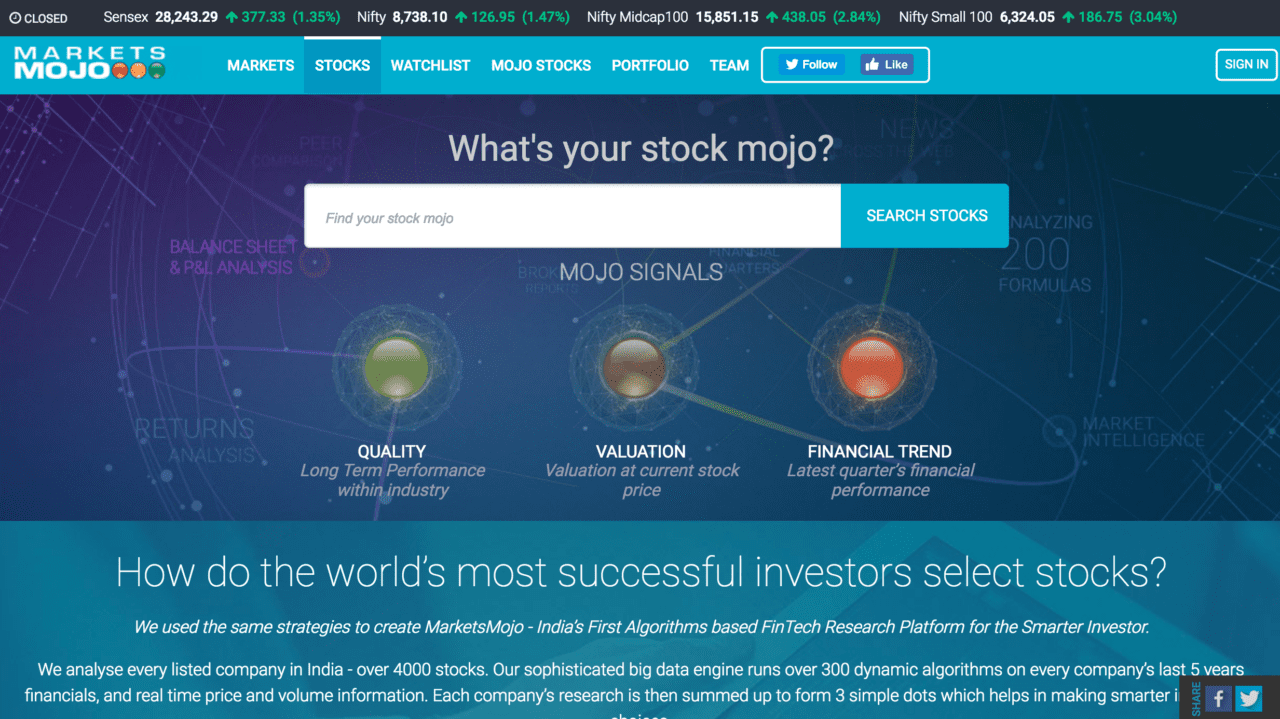

A look at the companies demoing live at FinovateAsia on 8 Nov 2016 in Hong Kong. Pick up your tickets today and save your spot.

WeInvest’s end-to-end robo-advisery platform on mobile and web is backed by a robust middle-to-back-office platform, global investment strategies and execution, and custody with Pershing, BNY Mellon.

Features:

- AUM-based fee structure. Pay as you scale.

- Mutiple asset classes, currencies, brokers and custodians supported

- Investment strategies App Store to gain access to the best global strategies

Why it’s great

Asia’s first platform-as-a-service robo-adviser can help you launch your version in three months with an investment of less than US$150,000.

Presenters

Bhaskar Prabhakara, CEO

Prabhakara has over 14 years’ consulting experience with various banks, brokerages and asset-management firms across India, Middle East, United States, and London. He graduated from IIT Madras and has an MBA from IIM, Ahmedabad.

LinkedIn

Aananth Solaiyappan, CTO

Solaiyappan is changing wealth management and investing through technology in Asia with a passion for design-led innovation and the transformative power of fintech in Asia. He formerly worked for Stanchart, Amazon, Oracle, and Sequoia.

LinkedIn

Ned Phillips, Founder & CEO

Ned Phillips, Founder & CEO Valentin previously worked as an investment adviser in wealth management with ANZ and ABN AMRO Private Bank. In Europe, he was involved in the development of risk-management banking systems at Natixis.

Valentin previously worked as an investment adviser in wealth management with ANZ and ABN AMRO Private Bank. In Europe, he was involved in the development of risk-management banking systems at Natixis.

Presenter: Sri Srinivasan, Product Leader

Presenter: Sri Srinivasan, Product Leader

Presenters

Presenters Bhaskar Prabhakara, Founder and CEO at WeInvest

Bhaskar Prabhakara, Founder and CEO at WeInvest

Presenter

Presenter