In mid-August, Facebook, the popular social networking site aimed at college students, alums, and now a few select corporations has released a simple personal finance application. The original name was FaceBank (see screenshot at bottom of article), but recently it was renamed MoochSpot (click on screenshot below for closeup).

In mid-August, Facebook, the popular social networking site aimed at college students, alums, and now a few select corporations has released a simple personal finance application. The original name was FaceBank (see screenshot at bottom of article), but recently it was renamed MoochSpot (click on screenshot below for closeup).

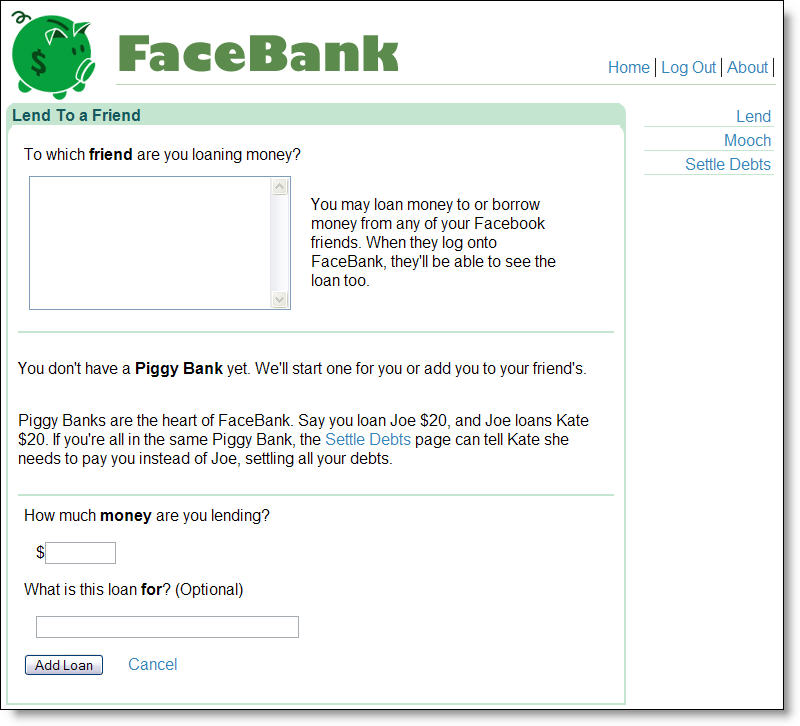

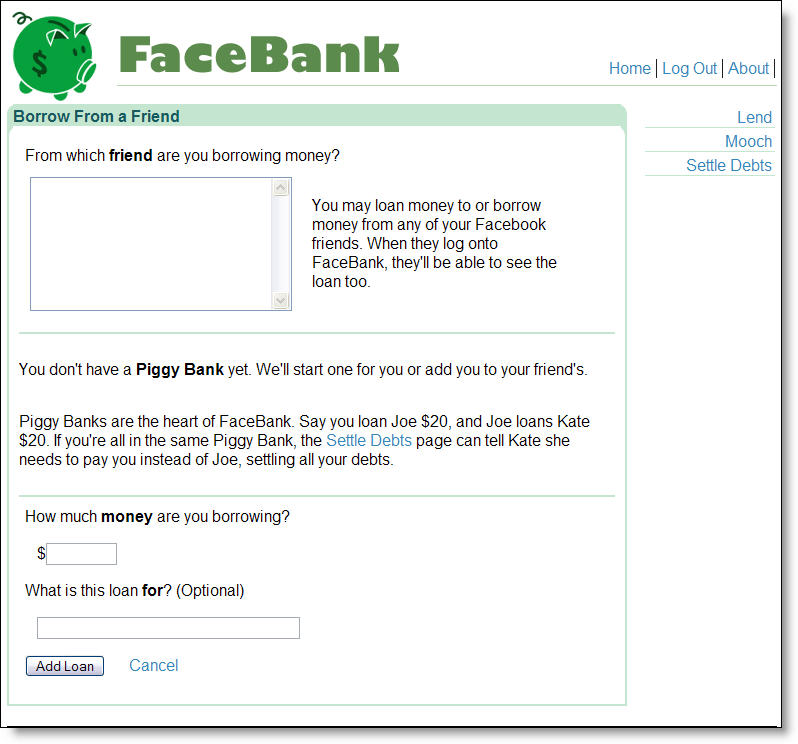

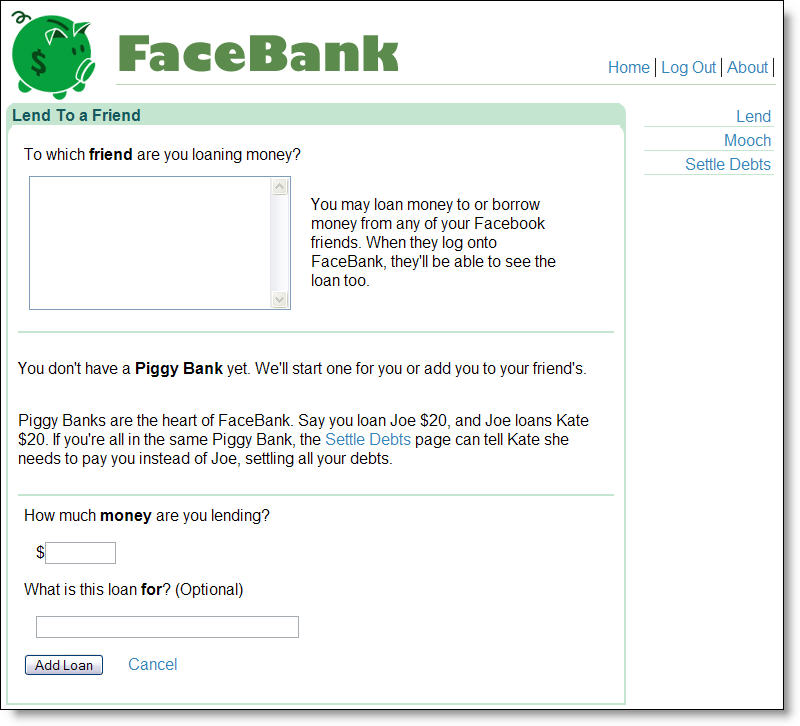

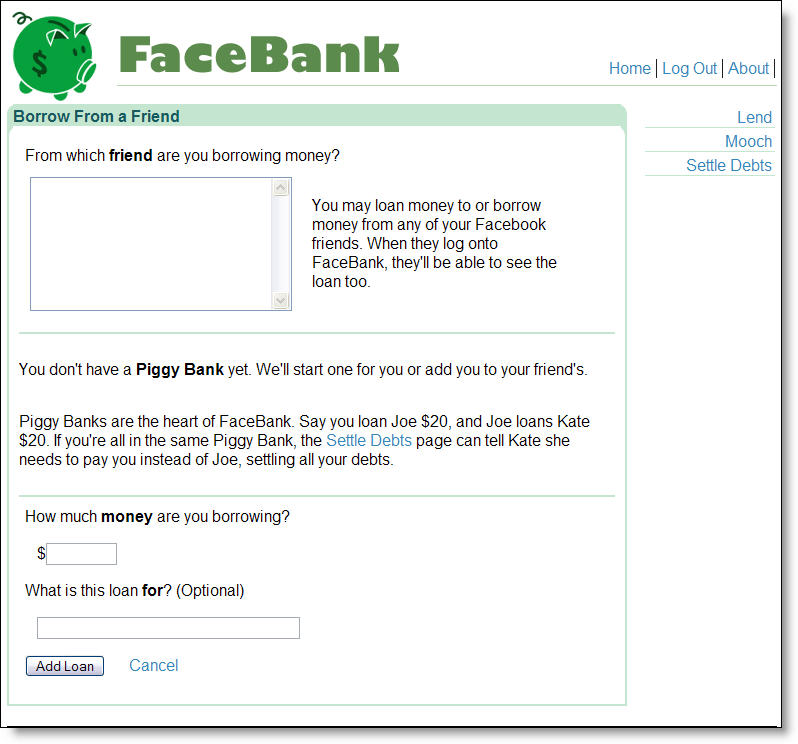

MoochSpot allows Facebook users to loan (i.e., spot), borrow (mooch), and settle debts with other Facebook users. At this point there is no payment capabilities, so the money must change hands through other methods.

Here's how it works:

- Create a "piggy bank" to track the funds

- Select a Facebook friend from the list that automatically shows in the MoochSpot list (note, in our screenshot below, we don't have any predesignated friends, so the list is empty)

- Enter the amount of the loan

- (Optional) Enter a reason for the loan

Analysis

MoochSpot was developed, not because of huge user demand to track personal debts, but to showcase the type of application that can be built by outside developers using the recently released Facebook APIs. MoochSpot is highlighted on the Facebook developer's page <developers.facebook.com>.

BillMonk, the self-proclaimed "social money" site which allows debts to be split and tracked via website or mobile phone (see NB Apr 30), is the first financial services provider to jump on the bandwagon and create Facebook integration (in inset, see Facebook login in lower-right of BillMonk's homepage). We tried on several computers to get it to work and were unable to get past the Facebook login. We'll check back in a few days to see if they have the bugs worked out.

BillMonk, the self-proclaimed "social money" site which allows debts to be split and tracked via website or mobile phone (see NB Apr 30), is the first financial services provider to jump on the bandwagon and create Facebook integration (in inset, see Facebook login in lower-right of BillMonk's homepage). We tried on several computers to get it to work and were unable to get past the Facebook login. We'll check back in a few days to see if they have the bugs worked out.

Financial institutions looking to create online banking sites that click with college students should pay close attention to BillMonk and MoochSpot. It would be relatively simple for a bank to use the Facebook API to develop even more powerful payment applications that combine the loan-tracking benefits of MoochSpot with actual epayment capabilities to move money back and forth among friends. While it wouldn't do anything that Paypal doesn't do today, the integration within online banking is important.

But the biggest reason to integrate with Facebook, MySpace, or any other 20-something social network is because it positions yourself as a bank or CU that understands the younger generation. And make sure you have genuine 20-somethings designing the marketing and writing the blog copy.

Appendix:

Below is the original FaceBank application prior to changing the name to MoochSpot:

Two potentially disruptive startups, Prosper, the leader in U.S. P2P lending and Wesabe, the first-mover in social personal finance, both announced new funding rounds today:

Two potentially disruptive startups, Prosper, the leader in U.S. P2P lending and Wesabe, the first-mover in social personal finance, both announced new funding rounds today: