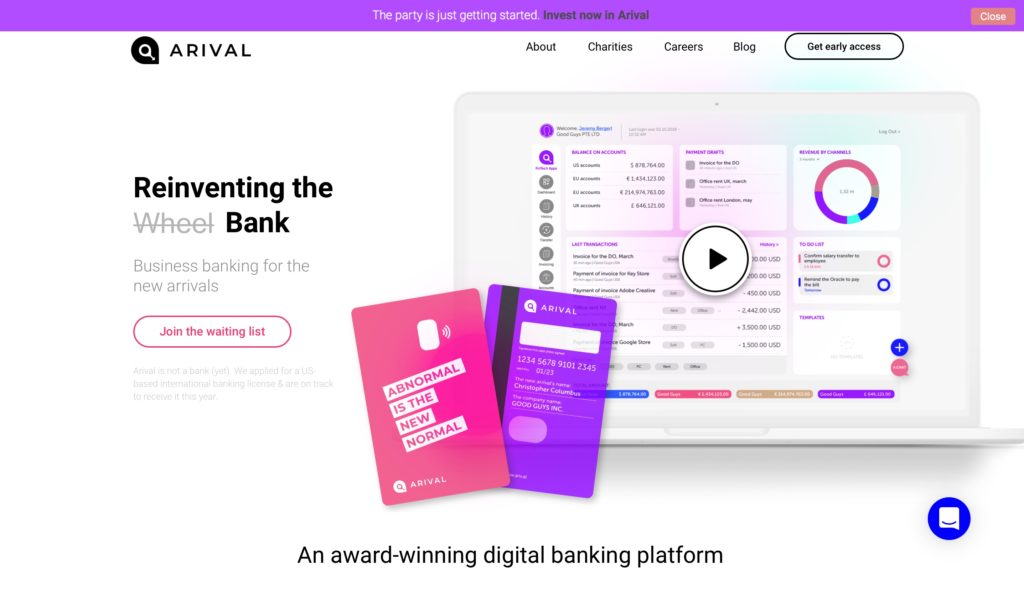

FinovateAsia 2018 Best of Show winner Arival Bank announced this week that it raised $2.3 million (£1.87 million) in a pre-Series A, equity crowdfunding campaign. The Singapore-based fintech bank for businesses and entrepreneurs soared past its fundraising target of $864,500 (£700,000), and now boasts a pre-money valuation of more than $14.8 million (£12 million).

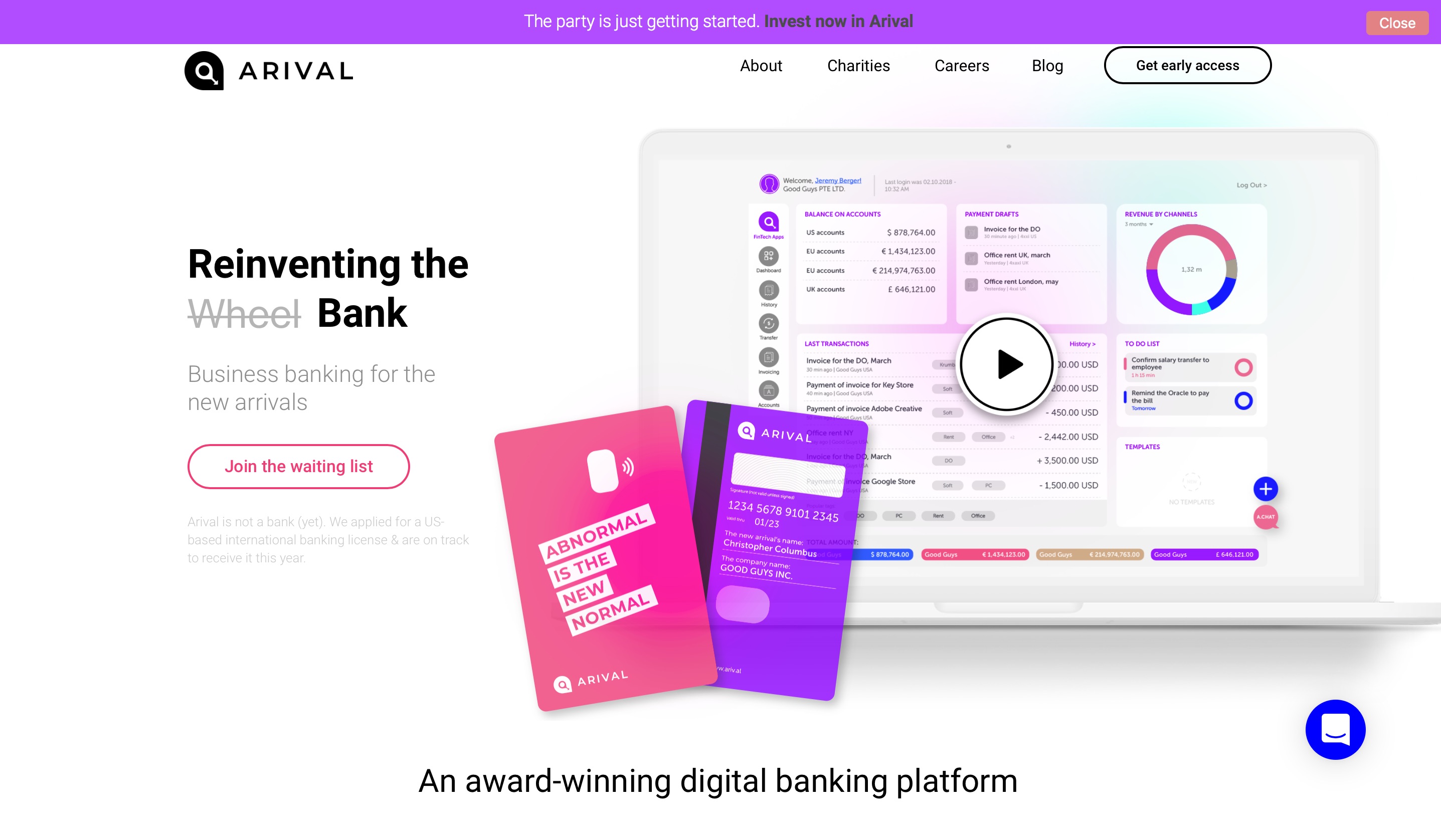

“We’re not a neobank or challenger bank,” the company noted in its crowdfunding pitch. “We think of ourselves as the first fintech bank. We’ll exist as a licensed bank, (with) forward-thinking compliance (as) our secret sauce, and we plan to bundle some of the world’s hottest fintech products inside one banking platform.”

The fundraising follows the company’s $1 million seed round from April of last year. The new capital will help support licensing, product development, and effectively going live. The company is targeting a series A early in 2020 to capitalize the bank in the U.S., as well as to expand operations globally.

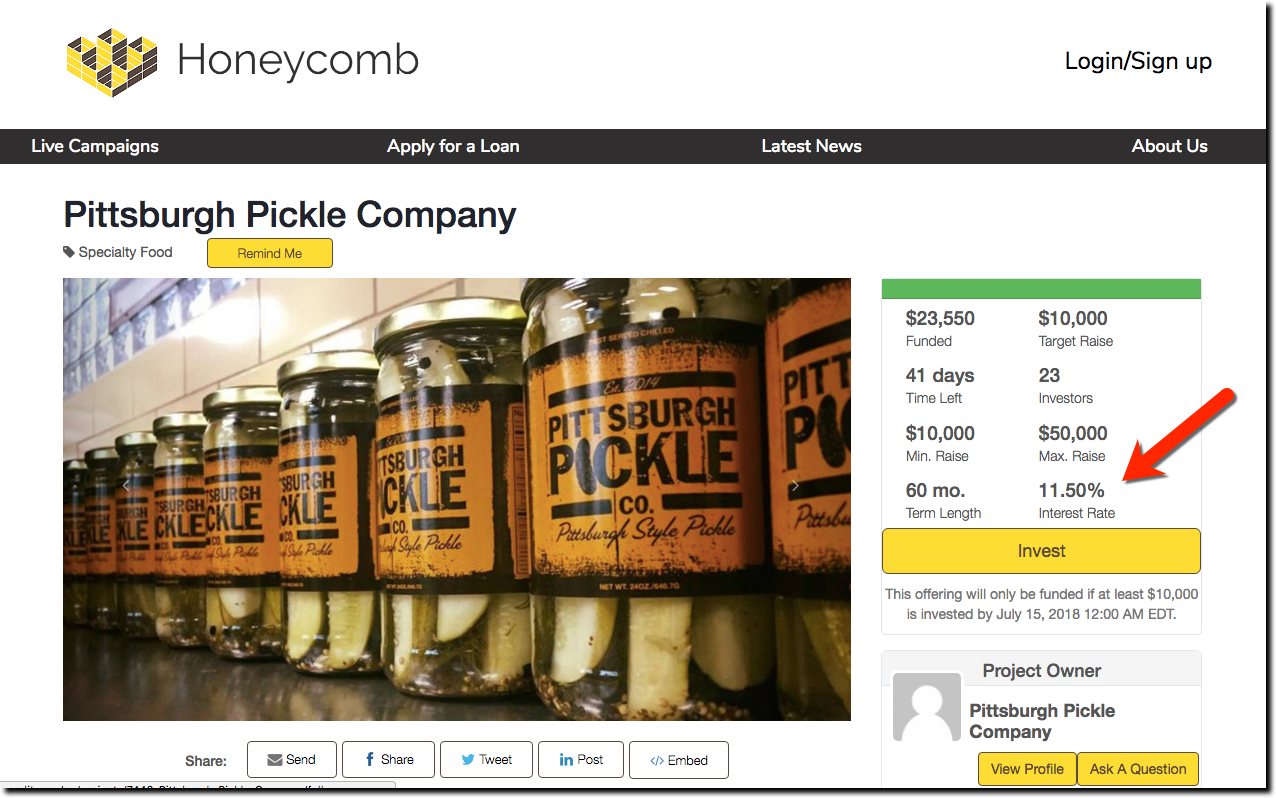

The campaign also marks the first time a digital bank has conducted an equity crowdfunding raise in the U.S. Seedinvest, an SEC-licensed broker dealer platform based in New York, spearheaded the fundraising with Crowdcube (the largest platform in the U.K.) in the role of joint partner.

“This is atypical for a digital banking startup, especially in the U.S.,” Arival Bank COO Jeremy Berger explained. “However, this was something we presented to the local regulators as we enter one of the most sophisticated banking markets in the world. Other digital banks in Europe have had real success with similar raises as it opens the opportunity to build camaraderie with future customers.”

Currently, Arival Bank has more than 1,000 requests from individuals and entities interested in opening accounts with the firm as it seeks to provide an alternative for “abnormal clients” traditional banks and even some digital banks do not serve. The firm’s main target focus currently are crypto- and blockchain-related businesses – who are chronically underbanked – as well as tech startups, and freelancers. The company, which applied for a U.S.-based international banking license last year, is betting that providing SMEs with access to innovative third party financial products and services – as well as “kick-ass customer service” and a unified banking interface – will go a long way toward supporting the next generation of businesses.

At FinovateAsia 2018 in Hong Kong, Arival Bank demonstrated ArivalOS, a digital banking platform, powered by open APIs, that features integrated third party fintech solutions designed specifically for SMEs. ArivalOS offers bank accounts, money transfers, debit cards, mPOS and factoring, and SME loans. The company also offers A.ID, a “virtual compliance manager” that provides a full-stack compliance solution that covers KYC, onboarding, AML and transaction monitoring.

Arival Bank was founded in 2017 by Jeremy Berger (COO), Igor Pesin (CFO) and Vladislav Solodkiy (CEO) – also known as the team behind Life.SREDA venture capital. Berger was recognized by Forbes this year in its 30 Under 30 list of the world’s top young finance professionals. Pesin is one of the top-ranked fintech influencers in Southeast Asia according to Lattice80, and is author of the annual fintech report, Money of the Future. Solodkiy is author of the book, The First Fintech Bank’s Arrival, now in its second edition, that inspired the very idea for Arival.

Berger will be one of the featured speakers later this month at FinovateFall in New York, joining a panel discussion titled Digital Challengers vs Incumbents: Who Will Emerge Victorious? For more information on how to catch his presentation, visit our FinovateFall page.