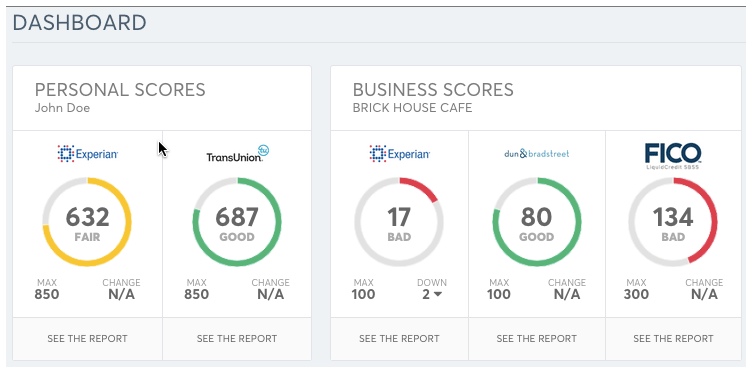

Nav dashboard monitors both personal and business credit

We are huge fans of strategic investing by financial institutions, especially in lower dollar amounts, what we call strategic seed investing. It’s the ultimate win-win in business. NewCo gets capital, credibility and adult supervision on the board. OldCo gets inside access to experiment after experiment in its core market without risk of sullying its billion-dollar brand. That’s why we’ve seen a dramatic rise in venture investing by large financial institutions in the past 18 to 24 months.

The best place to find new strategic investments? Our quarterly Finovate events around the globe (of course). But to help you narrow down the possibilities from our 857 alums, we try to highlight promising areas here from time to time.

Today, we look at risk-evaluation services targeted to small- and mid-sized businesses (SMB), also known as business credit scores.

Given the massive businesses built on the back of consumer credit scoring—Experian, Equifax, TransUnion, Credit Karma, Intersections, and all the mid-size credit score retailers—it comes as no surprise that these same players, along with a few startups, are targeting SMBs.

We’ve seen a number of alt-credit-score plays at Finovate (Aire, EFL, xxxxx) but only one was focused exclusively on small-business credit scoring:

Cortera: The company appeared at Finovate in May 2010 (FS10 video). Ten months later, it landed $50 million in private equity funding for a total of $60.7 million raised. Earlier this year, the company picked up an additional round of growth debt, but the amount was not disclosed. Two strategic FI investors were involved in its 2008 $8 million Series A: CIBC and Fidelity.

Cortera: The company appeared at Finovate in May 2010 (FS10 video). Ten months later, it landed $50 million in private equity funding for a total of $60.7 million raised. Earlier this year, the company picked up an additional round of growth debt, but the amount was not disclosed. Two strategic FI investors were involved in its 2008 $8 million Series A: CIBC and Fidelity.

The big three

- Dun & Bradstreet: The company that created the industry sells reports from $60 to $150 each or $188 annually per company tracked.

- Experian provides a number of business credit evaluation reports in the $40 to $50 price range each or on subscription basis for $150 annually (per company followed).

- Equifax provides similar information for $100+ per report, or $20 per month per company tracked.

The new startup: Nav

Since Cortera does not appear to be in fundraising mode, and the big three are all major companies, banks should look at newer players. One that seems promising, and is currently raising $12 million (at a $65 million valuation), is Nav (formerly Creditera).

Since Cortera does not appear to be in fundraising mode, and the big three are all major companies, banks should look at newer players. One that seems promising, and is currently raising $12 million (at a $65 million valuation), is Nav (formerly Creditera).

Nav is geared to SMB owners for monitoring their own company. It is not currently offering services for evaluation of other companies, the bread-and-butter of D&B and others. Nav’s service combines personal and business credit scores, essential for small-to-medium businesses, for $30 to $50/mo. It’s a single source to get reports across five sources—D&B, Experian, Equifax, Transunion, and FICO. The company also offers a freemium option, with free access to summary data from two sources free of charge and obligation (with no credit card required).

Nav also runs a commercial lending marketplace where owners can look for business credit cards, loans and other financing from Nav-affiliated lenders.

San Mateo, California-based Nav was founded in 2012 and raised a $6.5-million Series A led by Kleiner Perkins in Nov 2014. The company was founded by Levi King, who previously co-founded alt-lender and 2011 Finovate alum Lendio.

Investing in the business risk-evaluation space

Why banks should be interested in the space:

- Business owners seeking their company’s credit report may be in the market for financing

- Business (and personal) credit reports is a potentially lucrative, fee-based business

- Business credit score monitoring is a valuable entry-level service to begin a banking/credit relationship, especially if owners are drawn to the site multiple times each year

- Understanding of the needs of small businesses will help any FI looking to grow its small-biz services

- The freemium model could be a great value-add for business checking accounts

- The free service could be a good draw to the bank’s website