Blippy has been one of the more controversial financial entrants in the past few years. Observers have called it the “end of privacy as we know it,” a way to take “oversharing to a dizzying new level,” and a “great tool for phishers.” And those are just the people who like it.

Blippy has been one of the more controversial financial entrants in the past few years. Observers have called it the “end of privacy as we know it,” a way to take “oversharing to a dizzying new level,” and a “great tool for phishers.” And those are just the people who like it.

Blippy, a kind of Twitter meets Yodlee service, allows users to stream their purchase activity to the startup’s website. Users can choose to publish data from credit and debit cards, bank accounts, and/or directly from purchase activity at ecommerce-partners sites (see list below). It’s the ecommerce transaction stream that provides the richest data describing the actual product purchased or rented rather than just a dollar total.

For example, here’s an entry from @Julia who’s connected her Amazon account directly to Blippy (note 1) As you can see the Amazon purchases are shown in detail and one of the items, a giraffe teether, has elicited a question/comment from a friend (highlighting ours):

In comparison, credit card transactions list only the merchant name and not what was purchased. However, Blippy allows users to annotate their transactions to add that detail, as you can see in the following entry.

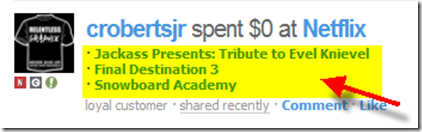

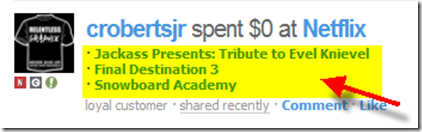

One of the most common ways Blippy is used is to stream media consumption via iTunes and Netflix. Here are the three Netflix movies on their way to @crobertsjr:

The Palo Alto-based startup received a $1.6 million angel round in January 2010 from Ron Conway, Jason Calacanis, Twitter’s Evan Williams, Sequoia Capital, Charles River Ventures, and others.

How it works

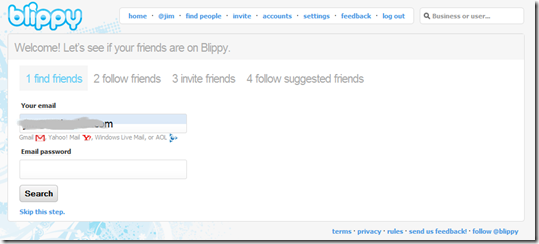

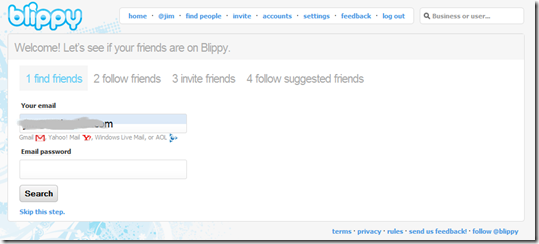

I got my first taste of Blippy after it opened to the public on Jan. 14. It’s simple to get started, calling for just an email address, screenname and password. You also have the option of finding friends using your email address book or choosing from a list of 13 suggested people including Blippy founder Philip Kaplan (@PUD) and interstar Jason Calacanis (@jason).

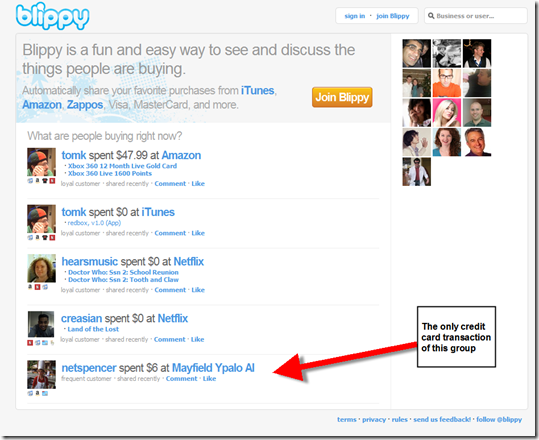

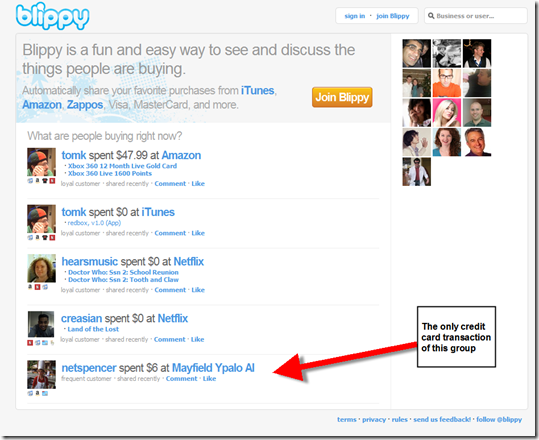

But you don’t even need to register for Blippy to see it in action. There’s a live stream on the homepage that anyone can watch (see screenshot below). If Blippy follows the Twitter/Facebook model, they will soon have an API available that will let outside developers tap the data stream.

Usage stats

- Number of beta users: More than 5,000 who streamed $4.5 million worth of transactions

- Most-streamed merchant: Netflix with 54,000 entries

- Most prolific spender (that I ran across): Foo Bar (@foo), who does not identify himself other than CEO at a gaming startup, has linked his business credit card and streamed more than 350 purchases worth more than $300,000 (he’s a big online advertiser at Google, MySpace, Facebook).

- Most-followed user: Leo Laporte (@leolaporte), from the Premiere Radio Network, with more than 2,600 followers

Features/benefits

Data sharing within workgroups:

- Ability to share financial transactions within a family, a workgroup, or small business. It would be a great way for financial gatekeepers, e.g., the bookkeeper, CFO, or even board members/investors to keep tabs on company spending (see @foo above).

- Ability to annotate expense streams. Users can add short descriptions to expense items so their followers can see the specifics.

- Ability to discuss/comment on expense items. For example, CFO can ask “why did our Google AdWords expense spike yesterday?” and anyone in the group can comment back with an answer or speculation. We use Yammer in our company for this type of back and forth.

Product research/social networking:

- Ability to find other customers of the same store

- Ability to discuss product or media purchases with friends or strangers

- Ability to post positive/negative info about purchases (yours or others)

- Ability to find previous purchasers of a product you are considering (currently not supported through search)

- Ability to compare how much people paid for a certain item (not currently supported through search)

Personal financial management:

- Ability to annotate expenses for future reporting (e.g., marking taxable items)

- Store transactions free for as long as Blippy keeps the servers running

- Ability to search own transactions

Financial institution opportunities

1. Card companies and banks should create similar sharing functionality for alerts; especially for small business clients. While public posting of purchase data may never have mass appeal, there are many private uses for real-time transaction data.

2. PFM’s should be building this functionality now to get out in front of Mint/Intuit who could simply acquire Blippy and incorporate real-time data flow within weeks.

3. Once the Blippy API becomes available, banks should tap it to allow their customers to use it directly from within online banking.

Analysis

Whether Blippy lives on as a standalone service is difficult to predict. It depends on whether these capabilities are incorporated into other social networks, particularly, Facebook (note 2) and Twitter. And how fast card issuers move to make real-time transaction info easily available to their own customers.

But regardless of where the company nets out, Blippy should be credited with pioneering real-time financial transaction flow, something every financial institution and ecommerce company will support in the coming years. As a result, we are awarding Blippy an OBR Best of the Web award, our first of 2010 and just the third in the past 14 months (note 3, previous winners).

But regardless of where the company nets out, Blippy should be credited with pioneering real-time financial transaction flow, something every financial institution and ecommerce company will support in the coming years. As a result, we are awarding Blippy an OBR Best of the Web award, our first of 2010 and just the third in the past 14 months (note 3, previous winners).

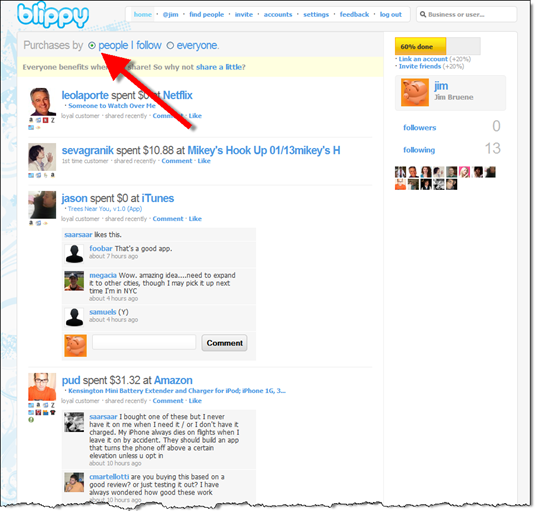

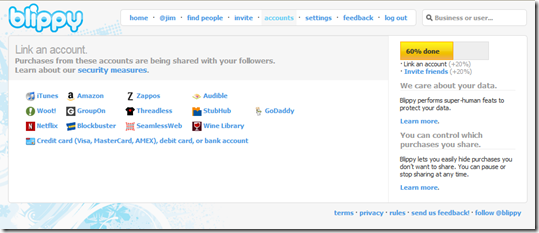

Blippy Homepage (14 Jan. 2010 7 PM Pacific)

Optional sign-in to Gmail, Yahoo or AOL to locate friends on Blippy

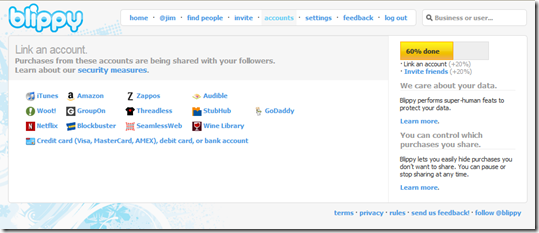

Purchases/activity at these merchants can be automatically tracked

Note: 13 ecommerce merchants currently participate (Amazon, Apple iTunes, Audible, Blockbuster, GoDaddy, GroupOn, Netflix, SeamlessWeb, Stubhub, Threadless, Wine Library, Woot, Zappos)

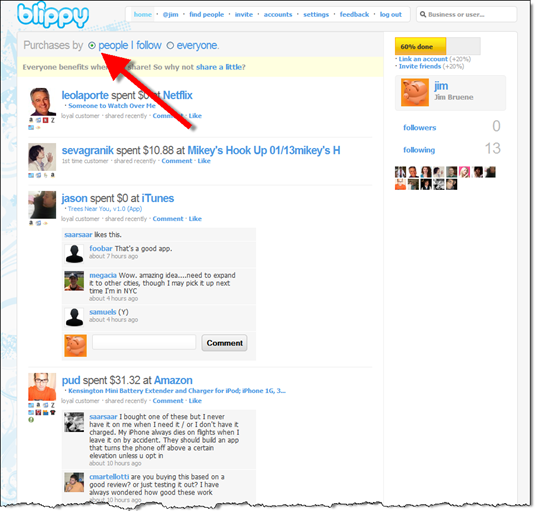

The Blippy real-time transaction stream

Note: You can choose to watch all activity or just that of the people you are following

Notes:

1. If she hadn’t given Blippy her Amazon login info and linked only her credit card, there would be no product detail. It would just show as $80.95 spent at Amazon.

2. Blippy is similar to Facebook’s ill-fated Beacon service launched in Nov. 2007. The service was quickly toned down, then eventually dismantled, due to the privacy brouhaha that ensued. Blippy is very different because its users are signing up specifically to share purchase info.

3. OBR Best of the Web awards, from Online Banking Report, are given periodically to companies that pioneer new online and mobile banking features. It is not an endorsement of the company or product, just recognition for what we believe is an important development. Blippy is the 76th recipient since we began awarding it in 1997. There were just two winners in 2009.

One of the most important trends in the online/mobile world is the so-called real-time Web. Here’s how Wikipedia defines it:

One of the most important trends in the online/mobile world is the so-called real-time Web. Here’s how Wikipedia defines it: