May is Asian-American and Pacific Islander Heritage month. And with FinovateSpring less than a week away, we wanted to take a moment to celebrate the Asian-American fintech innovators who will be demonstrating their latest technologies on the Finovate stage live in San Francisco, California on May 21 through 23.

Tickets for FinovateSpring are still available. Visit our registration page today and save your spot. We look forward to seeing you in San Francisco!

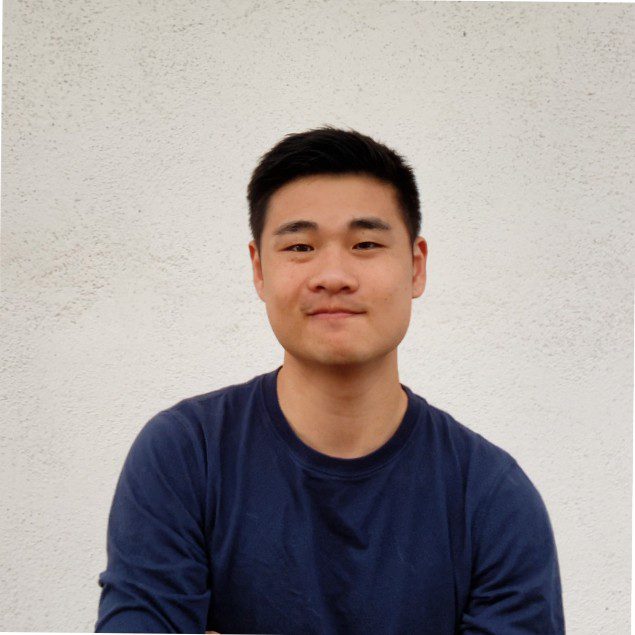

Mang-Git Ng

CEO and Co-Founder, Anvil – Document SDK

A former engineer at Dialpad, Dropbox, and Flexport, Ng is CEO and Co-Founder of Anvil. He is also a graduate of the University of Michigan and an alum of the Y Combinator Startup School Online.

Headquartered in San Francisco, California, Anvil was founded in 2018.

Saujin Yi

Founder and CEO, LiquidTrust

With experience in angel investments at 79 Studios, as a venture partner at Resolute, and a former I-banker at Chanin & CSFB, Saujin Yi is founder and CEO of LiquidTrust. Yi is a graduate of MIT and earned her MBA from UCLA Anderson, where she is a lecturer.

LiquidTrust was founded in 2019. The company is headquartered in Los Angeles, California.

Chit-Kwan Lin

CEO, Revelata

A Venture Partner at JAZZ, Lin seeks to make everyone become “bionic” when it comes to investment research and analysis. Founder and CEO of Revelata, Lin is a graduate of Harvard University, earning his A.B. in Biochemical Sciences, as well as his S.M. and Ph.D. in Computer Science, at the institution.

Headquartered in Palo Alto, California, Revelata was founded in 2020.

Gary Chao

Co-Founder and COO, Tennis Finance

Former Head of Operations for Juno Finance and Ownit, Chao is Co-Founder and Chief Operating Officer with Tennis Finance. Chao earned a B.A. in Economics and Psychology at University of California, Los Angeles.

San Francisco, California-based Tennis Finance was founded in 2022.