Last week I received new credit cards from US Bank and Capital One, both containing microchips to support EMV terminals, the global standard finally rolling out in the United States over the next few years. Given the world’s obsession with tech, it’s a good time for issuers to toot their own horns a bit.

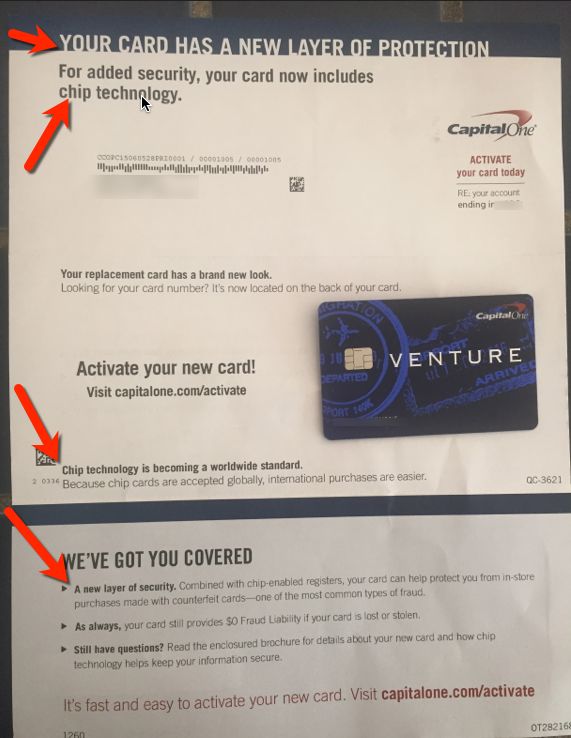

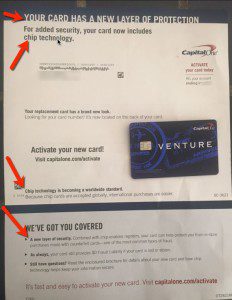

The Capital One card mailer did a good job doing just that. The entire mailing package was built to highligh the changes. The copywriting was excellent and there were multiple avenues for interested consumers to read more about the new technology. In addition to the expected copy on the front of the card mailer (Fig 1 below), there was an FAQ on the back (Fig 2 below), and a brochure included in the package (not pictured). Capital One built an explainer page on its website, but unlike US Bank (below), the URL is buried in FAQs on the back of the mailer.

Fig 1: Capital One EMV card and mailer Fig 2: Capital One EMV card mailer back

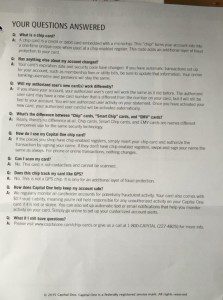

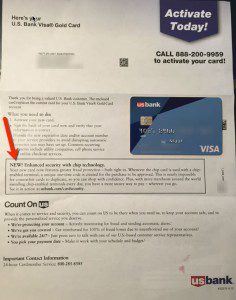

US Bank, on the other hand, took a less-comprehensive approach with the mailer, but delivered much more on its website. The bank shoehorned an EMV explanation box onto the usual card mailer (Fig 3 below), and referred questions to an excellent explainer page on its website (Fig 4). Website visitors receive thorough explanations, how-to graphics, and a short video showing how to insert a chip card in a reader.

And the bank’s explanation of the new technology was a little verbose. It read:

NEW! Enhanced security with chip technology.

Your new card now features greater fraud protection—built right in. Whenever the chip card is used with a chip-enabled terminal, a unique one-time code is created for the purchase to be approved. This is nearly impossible for counterfeit cards to duplicate, so you can shop with confidence. Plus, with more merchants around the world installing chip-enabled terminals every day, you have a more secure way to pay—wherever you go.

See it in action at usbank.com/cardsecurity

That all could have been covered with one or two bullet points (for example, see Fig 1).

Fig 3: US Bank EMV card and mailer Fig 4: US Bank EMV card website explainer (link)

Recommended consumer messaging

Here’s what issuers should explain to their customers:

- Your new card now contains a computer chip to help combat fraud

- When you visit a retailer with new chip-reader technology, you may need to insert the chip-end of the card into the reader instead of swiping. Most likely the clerk will show you how to do it, but if you would like to see it now, watch a one-minute video at mybank.com/using-new-chip-card. If the retailer still has older equipment, just swipe your card as usual.

- There are no changes as to how you use our card online or through your mobile phone.

- No matter what technology the retailer is using, when using a US Bank card, you are always protected by our 100% fraud guarantee.

- If you have questions, please email us at [email protected], visit mybank.com/chipcard, or call 1-800-mybanks

————

Notes:

- Click on any of the above images for a more detailed view.

- Nowhere does either bank mention whether it’s a debit card or credit card. For customers with both that should be clarified.

- Capital One moved the account number to the back, making for a very clean look. It’s also much easier to read when you manually input the card number into a website.

- I know it’s a pain from a support standpoint and probably has a horrible ROI, but I would sure appreciate an email address to ask specific questions. I have a “gold card” for a reason, an easy way to interact with customer service seems like a reasonable expectation.

- I recently received a new card from Simple, and surprisingly, it is not chip-enabled. That sure doesn’t fit with its high-tech positioning.

- Why is my US Bank “Visa Gold Card” now in 50 shades of blue (Fig 3, top left)? I like the new design, but seems like a name change is in order.