On Sept. 19, Key Bank <key.com> announced a new fee-based identity theft and credit bureau monitoring program powered by Vertrue’s Privacy Matters service. It’s the first major U.S. bank to market a comprehensive service through its website. Most major card issuers have been selling similar services via statement insert and direct mail for years.

On Sept. 19, Key Bank <key.com> announced a new fee-based identity theft and credit bureau monitoring program powered by Vertrue’s Privacy Matters service. It’s the first major U.S. bank to market a comprehensive service through its website. Most major card issuers have been selling similar services via statement insert and direct mail for years.

Price: $14.95/mo ($180/yr) for a couple or $9.95/month ($120/yr) for a single

Key’s presents the benefits in four groups:

1. Prevention

- Firewall, anti-virus and anti-spyware software

- Free personal document shredder

2. Detection

-

24-hour credit monitoring

-

Weekly email fraud alerts credit bureau changes occur

-

Three-bureau credit report

3. Protection

-

Emergency funds transferred to your credit card if the account is frozen or your card is stolen, with approved credit

-

$25,000 of insurance against losses

4. Restoration

-

Professional investigator to help restore your identity and credit record

-

Credit card registration

Analysis

I believe the area of credit bureau monitoring and fraud prevention are ripe for long-term profits and growth (see Online Banking Report 83/84). However, Key Bank’s offering is too expensive and not well explained, especially with respect to who provides the listed benefits.

First, the price. This is a service you want your customers to use, both for their protection and yours. You can and should sell it for a profit, but don’t get carried away. In our view, it should be priced less than $10/mo for a couple and no more than $7 or $8/month for a single.

Second, you need to be completely upfront and transparent about who is offering and administering the service, especially one that deals with sensitive issues such as identity theft and credit records. And there needs to detailed explanations available for all features and benefits.

Second, you need to be completely upfront and transparent about who is offering and administering the service, especially one that deals with sensitive issues such as identity theft and credit records. And there needs to detailed explanations available for all features and benefits.

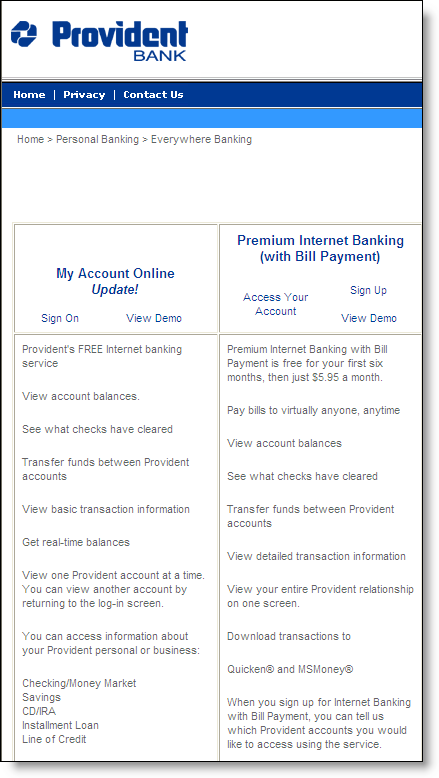

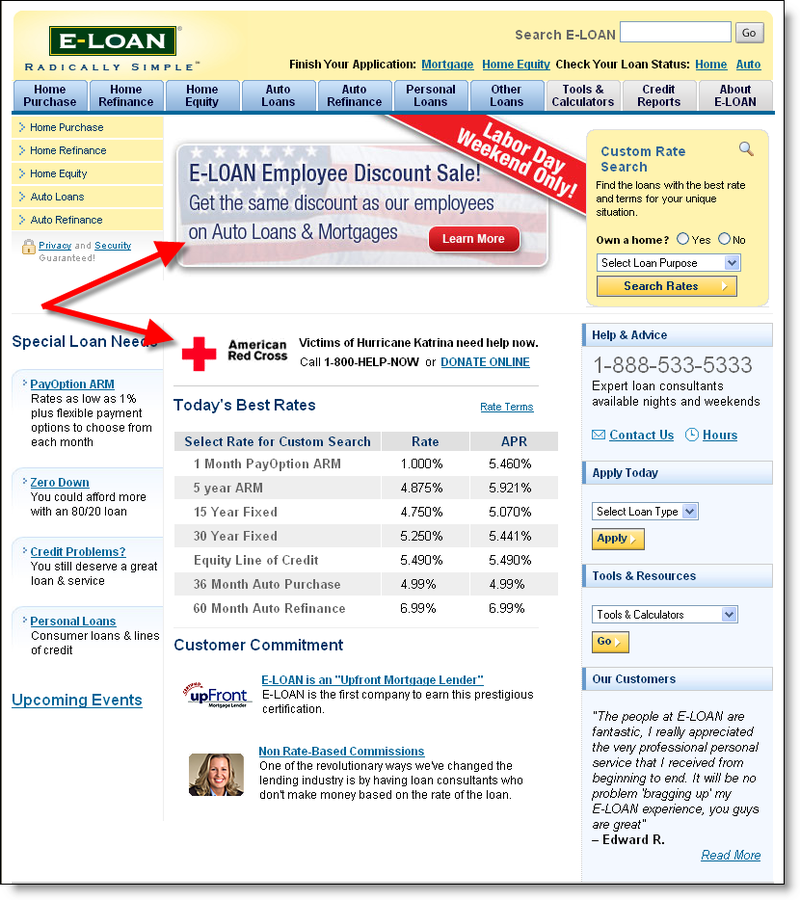

Key Bank and its partner’s implementation leave a lot to be desired on both these fronts. The benefits are not well explained on Key’s website (click on inset for a closeup). This is a new offering for many and there will be many questions, especially at $180/yr. For example, prospective customers are going to want to know:

- How often will I receive a 3-bureau credit report?

- How do you add cash to a frozen credit card and why is it "subject to credit approval"?

- What types of expenses are reimbursed with the $25,000 insurance policy?

Even more damaging to the bank’s credibility is the lack of disclosure that the service is being administered and delivered by an outside company. Even though savvy users may suspect they are signing on with a third party the name of the entity Privacy Matters, is so generic, it’s difficult to know for sure if that’s another company or a service mark of Key Bank. The signup form does NOT explicitly say one way or the other (click on signup form, left).

Even more damaging to the bank’s credibility is the lack of disclosure that the service is being administered and delivered by an outside company. Even though savvy users may suspect they are signing on with a third party the name of the entity Privacy Matters, is so generic, it’s difficult to know for sure if that’s another company or a service mark of Key Bank. The signup form does NOT explicitly say one way or the other (click on signup form, left).

Even more problematic is that Privacy Matters is not really a company at all. Even though it’s the only name used on the signup form (see inset), Terms and Conditions, and Contact Us pages, it’s a service mark of Adaptive Marketing LLC, which according to the privacy policy pop-up, is wholly-owned subsidiary of Coverdell & Company. What’s not said anywhere is that Coverdell & Company itself is a wholly-owned subsidiary of Vertrue <vertrue.com> which until recently was known as MemberWorks.

Put yourself in the customer’s shoes. Wouldn’t you wonder why the benefits aren’t clearly defined? Why the ownership of the service is so vague? Why I would trust a service mark of an entity owned by another entity owned by a company that just changed its name, none of which I’ve ever heard of. And really, why is Key Bank making this offer to me in the first place?

Grades:

Product features and benefits: A

Pricing: C-

Website implementation: D

–JB