Introduction

|

Table 1 Strategic Imperatives for Small Business Success

Source: Online Banking Report, 5/04

|

The purpose of this report is to help financial institutions use online delivery to increase sales, profits, and market share in the small business market. Although, much of the report is applicable to large and small businesses, our main focus is on the smallest segment, the self-employed and so-called microbusiness, businesses with less than $1 million in annual sales. For the sake of clarity, we’ll use the term “small business” throughout this report.

We’ll look at the market through the eyes of a financial institution product manager, the background of both authors. Hundreds of ideas and tactics are presented, some with more emphasis than others. All support five key strategic imperatives for approaching this market (see Table 1 above).

While small businesses have lagged consumers in adopting online banking, recent research by

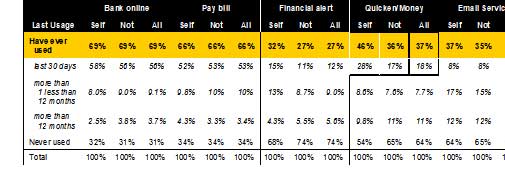

James Van Dyke’s Javelin Strategy & Research http://www.javelinstrategy.com/ shows that the gap has been eliminated. Javelin’s April 2004 study shows that 56% of all online households used online banking during the past 30 days, compared to 58% of households where the primary financial manager is self-employed (a good proxy of microbusiness ownership). About the only significant difference in behavior was in the usage of Quicken or Money software, where 28% of business owners used it during the past 30 days compared to 17% of non-self-employed (see Table 2 below). Small business owners also tended to visit the branch more often, especially for deposits with 80% having made a branch deposit in the past 30 days compared to 66% of all online households.

Table 2

Online Banking Usage: Self-Employed Online Households vs. All Online Households

Source: Javelin Strategy, May 2004 survey of 2,196 U.S. online households fielded April 2004; screened to be primary household financial manager

SELF = self-employed only (n = 163); NOT = all others (n = 2033); ALL = entire sample (N = 2196)

Major strategic imperatives

1. Identify small business owners within your consumer

base and market

Since it’s time-consuming and expensive to attract small

businesses from your competitors, your first priority is to mine your own

consumer base for them. Customer surveys, website usage, and deposit

activity are good indicators of small business ownership.

2. Facilitate contact with a human at the bank

To maximize your share of wallet, it’s essential that each

business owner have a human point of contact at the bank. And it needs to be

someone high enough in the organization that they are not turning over every

nine months, one of the biggest complaints small businesses have about their

banking relationships. To maximize efficiency, this human interaction should

be supported with online tools such as email and instant messaging.

3. Begin a credit relationship

More often that not, small businesses use lending

relationships to determine who they consider to be their primary financial

institution. If you are serious about growing your small business share, you

must be aggressive in granting credit to small business owners. And it

needn’t be a commercial loan. More often it will be a consumer product,

especially tied to home equity. The business owner doesn’t care how you

classify the credit internally, they care that you are lending cash to grow

their business.

4. Bank the personal business of the business owner

Some small business owners insist on banking their personal

business at a different bank,

either because of personal relationships or privacy/security fears of mixing

personal and business accounts.

5. Provide value-added services for a fee

After decades of being beaten up by consumers over every fee

on the schedule, financial institutions are wary of charging fees to their

retail-like small business customers. But, despite what they may say in a

focus group, once they have established an account, small businesses are

loathe moving and are relatively insensitive to pricing. If a business owner

values their time at $100 per hour and it takes 10 to 15 hours to switch

accounts, that’s a $1000 to $1500 soft-dollar cost to moving. However,

startup businesses are another matter. When shopping for their initial

banking relationship, a new business could be swayed by a couple dollars per

month. That’s why Barclays’ strategy of offering new businesses a

host of initial free banking and professional consultations is so brilliant.

Unique attributes of the small business segment

· Small businesses crave stability in their financial relationships;

they want to deal with a company they are sure will be there in the future. More

importantly, they want a relationship with a real human who knows their

business and won’t let anything fall through the cracks during management or

business upheaval. What they look for in a provider is expertise, a long track

record, fair pricing, and easy-to-use reliable products.

· Their sourcing of transactional banking services does not provide

competitive advantage to businesses large or small. It’s a relatively minor

infrastructure expense. However, credit services can make or break a business,

so that’s often the key to the relationship.

· Online banking, while gaining in importance, is a relatively low

priority for most business customers who care more about the relationship with

their loan/biz banking officer, branch convenience, credit lines, loans,

rates/fees, and customer service.

· It’s vitally important for most microbusinesses to connect with a

human during the initial sales process – someone the business owner believes

will have a positive impact on credit decisions.

In fact, business owners may value the bond with their banking officer

more than the relationship with the bank.

· Businesses don’t have the time or inclination to adjust their

systems and procedures for relatively marginal convenience improvements. That’s

why, until recently, they’ve lagged consumers in online banking adoption. But,

once started they will often become fiercely loyal online banking customers.

· Given the combined value of their personal and business financial

services expenditures, and the owners’ optimistic perception of future growth in

both, small businesses want to be treated like the important customers they are.

Implications

· Smaller businesses have long been dismissed as lacking sufficient

revenue potential to justify the labor required to serve them; however, that

assumption is dead wrong. The combined net interest margin from business and

personal financial products is $35 billion per year with good prospects for

growth

· The smaller the business, the better the opportunity. Larger small

businesses already have established banking relationships and are on the radar

screen of every big-bank officer in the area. Each of those wins will be

hard-fought and expensive. The better opportunities are in the nearly invisible

microbusiness category, especially among self-employed professionals and

businesses in formation. However, non-banks such as Intuit, First Data,

and PayPal have made in-roads in certain product categories and will

attempt to leverage those relationships to up-sell other services.

· Credit integration, overall financial counseling, and positive

representation to the inevitable loan committee are a must. Clients often have

good knowledge of the availability and prices of available capital options. Home

equity secured lending, with underwriting flexible enough to accommodate the

self-employed, is especially important when serving microbusinesses

· Epayment companies such as PayPal, iPay

http://www.ipaymybills.com/ , and

Fidesic) that enable microbusinesses to easily accept credit

cards and ACH payments, can be an effective means of finding new customers.